Vodafone 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Governance

Vodafone Group Plc Annual Report 2009 51

In December 2008, Governance Metrics International, a global corporate

governance ratings agency, ranked the Company amongst the top UK companies,

with an overall global corporate governance rating of ten, the highest score

assigned and achieved by only 1% of the 4,196 companies rated.

In the Company’s profile report by Institutional Shareholder Services Inc. (‘ISS’),

dated 1 May 2009, the Company’s governance practices outperformed 98.6%

of the companies in the ISS developed universe (excluding US), 98.2% of

companies in the telecommunications sector group and 98.1% of the companies

in the UK.

Compliance with the Combined Code

The Company’s ordinary shares are listed in the UK on the London Stock Exchange.

In accordance with the Listing Rules of the UK Listing Authority, the Company

confirms that throughout the year ended 31 March 2009 and at the date of this

document, it was compliant with the provisions of, and applied the principles of,

Section 1 of the 2006 FRC Combined Code on Corporate Governance (the “Combined

Code”). The following section, together with the “Directors’ remuneration” section

on pages 57 to 67, provides details of how the Company applies the principles and

complies with the provisions of the Combined Code.

Board organisation and structure

The role of the Board

The Board is responsible for the overall conduct of the Group’s business and has the

powers, authorities and duties vested in it by and pursuant to the relevant laws of

England and Wales and the articles of association. The Board:

has final responsibility for the management, direction and performance of the •

Group and its businesses;

is required to exercise objective judgement on all corporate matters independent •

from executive management;

is accountable to shareholders for the proper conduct of the business; and •

is responsible for ensuring the effectiveness of and reporting on the Group’s •

system of corporate governance.

The Board has a formal schedule of matters reserved to it for its decision and

these include:

Group strategy;•

major capital projects, acquisitions or divestments;•

annual budget and operating plan;•

Group financial structure, including tax and treasury;•

annual and half-year financial results and shareholder communications;•

system of internal control and risk management; and•

senior management structure, responsibilities and succession plans.•

The schedule is reviewed periodically. It was last formally reviewed by the

Nominations and Governance Committee in March 2009, at which time it was

determined that no amendments were required.

Other specific responsibilities are delegated to Board committees which operate

within clearly defined terms of reference. Details of the responsibilities delegated to

the Board committees are given on pages 53 and 54.

Board meetings

The Board meets at least eight times a year and the meetings are structured to allow

open discussion. All directors participate in discussing the strategy, trading and financial

performance and risk management of the Company. All substantive agenda items have

comprehensive briefing papers, which are circulated one week before the meeting.

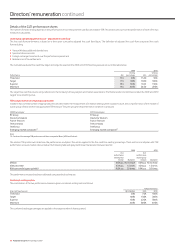

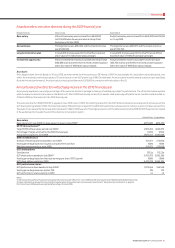

The following table shows the number of years directors have been on the Board at

31 March 2009 and their attendance at scheduled Board meetings they were eligible

to attend during the 2009 financial year:

Years Meetings

on Board attended

Sir John Bond 4 9/9

John Buchanan 6 7/9

Vittorio Colao 2 9/9

Andy Halford 3 9/9

Alan Jebson 2 9/9

Nick Land 2 8/9

Anne Lauvergeon 3 8/9

Simon Murray 2 8/9

Luc Vandevelde 5 9/9

Anthony Watson 3 9/9

Philip Yea 3 8/9

Arun Sarin (until 29 July 2008) – 3/3

Dr Michael Boskin (until 29 July 2008) – 3/3

Professor Jürgen Schrempp (until 29 July 2008) – 2/3

In addition to regular Board meetings, there are a number of other meetings to deal

with specific matters. Directors unable to attend a Board meeting because of another

engagement are nevertheless provided with all the papers and information relevant

for such meetings and are able to discuss issues arising in the meeting with the

Chairman or the Chief Executive.

Division of responsibilities

The roles of the Chairman and Chief Executive are separate and there is a division of

responsibilities that is clearly established, set out in writing and agreed by the Board

to ensure that no one person has unfettered powers of decision. The Chairman is

responsible for the operation, leadership and governance of the Board, ensuring its

effectiveness and setting its agenda. The Chief Executive is responsible for the

management of the Group’s business and the implementation of Board strategy

and policy.

Board balance and independence

The Company’s Board consists of 14 directors, 11 of whom served throughout the

2009 financial year. At 31 March 2009, in addition to the Chairman, Sir John Bond,

there were two executive directors and eight non-executive directors. Samuel Jonah

was appointed as an additional non-executive director with effect from 1 April 2009

and Michel Combes and Steve Pusey as additional executive directors with effect from

1 June 2009.

The Deputy Chairman, John Buchanan, is the nominated senior independent director

and his role includes being available for approach or representation by directors or

significant shareholders who may feel inhibited by raising issues with the Chairman.

He is also responsible for conducting an annual review of the performance of the

Chairman and, in the event it should be necessary, convening a meeting of the non-

executive directors.

The Company considers all of its present non-executive directors to be fully

independent. The Board is aware of the other commitments of its directors and is

satisfied that these do not conflict with their duties as directors of the Company.

There are no cross-directorships or significant links between directors serving on

the Board through involvement in other companies or bodies. For the purpose of

The Board of the Company is committed to high standards of corporate governance, which it considers are critical

to business integrity and to maintaining investors’ trust in the Company. The Group expects all its directors and

employees to act with honesty, integrity and fairness. The Group will strive to act in accordance with the laws and

customs of the countries in which it operates; adopt proper standards of business practice and procedure; operate

with integrity; and observe and respect the culture of every country in which it does business.

Corporate governance