Vodafone 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

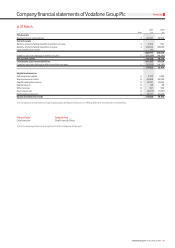

Financials

Vodafone Group Plc Annual Report 2009 123

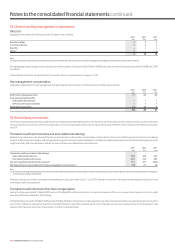

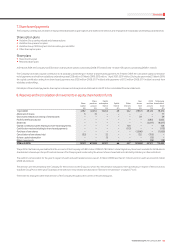

Fair value hedges

The Company’s policy is to use derivative instruments (primarily interest rate swaps) to convert a proportion of its fixed rate debt to floating rates in order to hedge the interest

rate risk arising, principally, from capital market borrowings.

The Company designates these as fair value hedges of interest rate risk with changes in fair value of the hedging instrument recognised in the profit and loss account for the

period together with the changes in the fair value of the hedged item due to the hedged risk, to the extent the hedge is effective. The ineffective portion is recognised

immediately in the profit and loss account.

Share-based payments

The Group operates a number of equity settled share-based compensation plans for the employees of subsidiary undertakings using the Company’s equity instruments. The

fair value of the compensation given in respect of these share-based compensation plans is recognised as a capital contribution to the Company’s subsidiary undertakings

over the vesting period. The capital contribution is reduced by any payments received from subsidiary undertakings in respect of these share-based payments.

Dividends paid and received

Dividends paid and received are included in the Company financial statements in the period in which the related dividends are actually paid or received or, in respect of the

Company’s final dividend for the year, approved by shareholders.

Pensions

The Company is the sponsoring employer of the Vodafone Group pension scheme, a defined benefit pension scheme. The Company is unable to identify its share of the

underlying assets and liabilities of the Vodafone Group pension scheme on a consistent and reasonable basis. Therefore, the Company has applied the guidance within FRS

17 to account for defined benefit schemes as if they were defined contribution schemes and recognise only the contribution payable each year. The Company had no

contributions payable for the years ended 31 March 2009 and 31 March 2008.

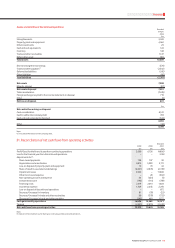

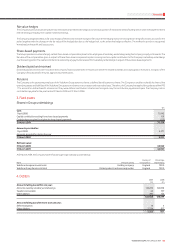

3. Fixed assets

Shares in Group undertakings

£m

Cost:

1 April 2008 70,193

Capital contributions arising from share-based payments 128

Contributions received in relation to share-based payments (113)

31 March 2009 70,208

Amounts provided for:

1 April 2008 5,271

Amounts provided for during the year –

31 March 2009 5,271

Net book value:

31 March 2008 64,922

31 March 2009 64,937

At 31 March 2009, the Company had the following principal subsidiary undertakings:

Countr y of Percentage

Name Principal activity incorporation shareholding

Vodafone European Investments Holding company England 100.0

Vodafone Group Services Limited Global products and services provider England 100.0

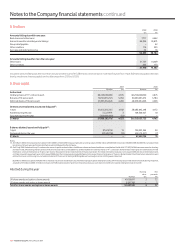

4. Debtors

2009 2008

£m £m

Amounts falling due within one year:

Amounts owed by subsidiary undertakings 126,010 125,838

Taxation recoverable 44 137

Other debtors 280 124

126,334 126,099

Amounts falling due after more than one year:

Deferred taxation 18 4

Other debtors 2,334 817

2,352 821