Vodafone 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24 Vodafone Group Plc Annual Report 2009

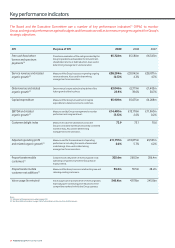

The Board and the Executive Committee use a number of key performance indicators(1) (‘KPIs’) to monitor

Group and regional performance against budgets and forecasts as well as to measure progress against the Group’s

strategic objectives.

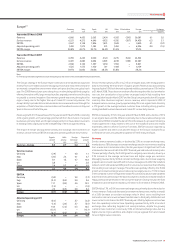

Key performance indicators

KPI Purpose of KPI 2009 2008 2007

Free cash flow before

licence and spectrum

payments(2)

Provides an evaluation of the cash generated by the

Group’s operations and available for reinvestment,

shareholder returns or debt reduction. Also used in

determining management’s remuneration.

£5,722m £5,580m £6,343m

Service revenue and related

organic growth(2)

Measure of the Group’s success in growing ongoing

revenue streams. Also used in determining

management’s remuneration.

£38,294m

(0.3)%

£33,042m

4.3%

£28,871m

4.7%

Data revenue and related

organic growth(2)

Data revenue is expected to be a key driver of the

future growth of the business.

£3,046m

25.9%

£2,119m

39.0%

£1,405m

30.7%

Capital expenditure Measure of the Group’s investment in capital

expenditure to deliver services to customers.

£5,909m £5,075m £4,208m

EBITDA and related

organic growth(2)

Measure used by Group management to monitor

performance at a segment level.

£14,490m

(3.5)%

£13,178m

2.6%

£11,960m

0.2%

Customer delight index Measure of customer satisfaction across the

Group’s controlled markets and its jointly controlled

market in Italy. Also used in determining

management’s remuneration.

72.9 73.1 70.6

Adjusted operating profit

and related organic growth(2)

Measure used for the assessment of operating

performance, including the results of associated

undertakings. Also used in determining

management’s remuneration.

£11,757m

2.0%

£10,075m

5.7%

£9,531m

4.2%

Proportionate mobile

customers(1)

Customers are a key driver of revenue growth in all

operating companies in which the Group has an

equity interest.

302.6m 260.5m 206.4m

Proportionate mobile

customer net additions(1)

Measure of the Group’s success at attracting new and

retaining existing customers.

33.6m 39.5m 28.2m

Voice usage (in minutes) Voice usage is an important driver of revenue growth,

especially given continuing price reductions in the

competitive markets in which the Group operates.

548.4bn 427.9bn 245.0bn

Notes:

(1) Definition of the key terms is provided on page 143.

(2) See ‘Non-GAAP information’ on page 138 for further details on the use of non-GAAP measures.