Vodafone 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104 Vodafone Group Plc Annual Report 2009

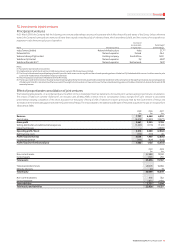

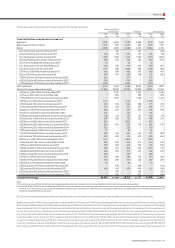

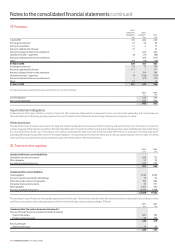

25. Borrowings

Carrying value and fair value information

2009 2008

Short term Long term Short term Long term

borrowings borrowings Total borrowings borrowings Total

£m £m £m £m £m £m

Financial liabilities measured at amortised cost:

Bank loans 893 5,159 6,052 806 2,669 3,475

Bank overdrafts 32 − 32 47 – 47

Redeemable preference shares – 1,453 1,453 – 985 985

Commercial paper 2,659 − 2,659 1,443 − 1,443

Bonds 515 8,064 8,579 1,125 4,439 5,564

Other liabilities(1) 1,015 4,122 5,137 306 3,005 3,311

Bonds in fair value hedge relationships 4,510 12,951 17,461 805 11,564 12,369

9,624 31,749 41,373 4,532 22,662 27,194

Note:

(1) At 31 March 2009, amount includes £691 million (2008: £nil) in relation to collateral support agreements.

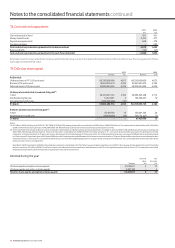

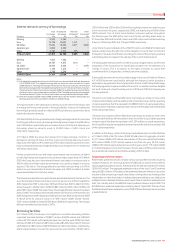

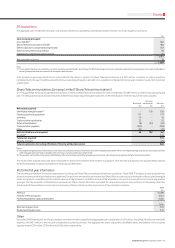

The fair value and carrying value of the Group’s short term borrowings is as follows:

Sterling equivalent

nominal value Fair value Carrying value

2009 2008 2009 2008 2009 2008

£m £m £m £m £m £m

Financial liabilities measured at amortised cost 5,131 3,731 5,108 3,715 5,114 3,727

Bonds in fair value hedge relationships: 4,320 802 4,397 800 4,510 805

4.25% euro 1,859 million bonds due May 2009 1,720 − 1,722 − 1,780 −

4.75% euro 859 million bond due May 2009 794 − 798 − 831 −

7.75% US dollar 2,582 million bond due February 2010 1,806 − 1,877 − 1,899 −

5.5% euro 400 million bond due July 2008 − 37 − 37 − 39

6.25% sterling 400 million bond due July 2008 − 400 − 400 − 397

6.65% US dollar 500 million bond due May 2008 − 126 − 126 − 130

4.0% euro 300 million bond due January 2009 − 239 − 237 − 239

Short term borrowings 9,451 4,533 9,505 4,515 9,624 4,532

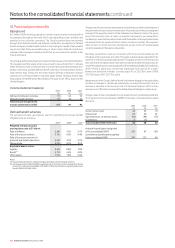

Notes to the consolidated nancial statements continued