Vodafone 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance

Vodafone Group Plc Annual Report 2009 37

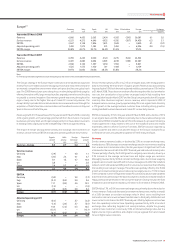

2010 nancial year

Adjusted

operating Free

profit cash flow(1)

£bn £bn

2009 performance 11.8 5.7(1)

2010 outlook(2)(3) 11.0 to 11.8 6.0 to 6.5

Notes:

(1) Excludes spectrum and licence payments but includes payments in respect of long standing tax

issues. The amount for the 2009 financial year is stated after £0.3 billion of tax payments,

including associated interest, in respect of a number of long standing tax issues.

(2) Includes assumptions of average foreign exchange rates for the 2010 financial year of

approximately £1:€1.12 (2009: 1.20) and £1:US$1.50 (2009: 1.72). A substantial majority of the

Group’s adjusted operating profit and free cash flow is denominated in currencies other than

sterling, the Group’s reporting currency. A 1% change in the euro to sterling exchange rate would

impact adjusted operating profit by approximately £70 million.

(3) The outlook does not include the impact of reorganisation costs arising from the Alltel

acquisition by Verizon Wireless but includes the impact of the Group’s acquisition of a further

15.0% stake in Vodacom and the consolidation of that entity from 18 May 2009.

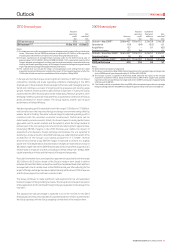

In Europe and Central Europe, recent significant declines in GDP and continued

competitive intensity will make operating conditions challenging in the 2010

financial year. In these markets, the Group expects that voice and messaging revenue

trends will continue as a result of ongoing pricing pressures and slowing usage

growth. However, further growth in data revenue is expected. In Turkey, the Group

expects that the 2010 financial year will be challenging. Revenue growth in other

emerging markets, in particular India and Africa, is expected to continue as the Group

drives penetration in these markets. The Group expects another year of good

performance at Verizon Wireless.

Adjusted operating profit is expected to be in the range £11.0 billion to £11.8 billion,

with benefits from the improved foreign exchange environment being offset by

weaker trends in trading. The wider outlook range for adjusted operating profit is

consistent with the uncertain economic environment. Performance will be

determined by actual economic trends, the Group’s speed in closing performance

gaps which exist in certain markets and the extent to which the Group decides to

reinvest part of its cost savings into total communications growth opportunities.

Underlying EBITDA margins in the 2010 financial year, before the impact of

acquisitions and disposals, foreign exchange and business mix, are expected to

decline by a similar amount to the 2009 financial year, reflecting the benefit of the

acceleration of the Group’s cost savings programme in a weaker revenue

environment. Overall Group EBITDA margin is expected to decline at a slightly

slower rate. Total depreciation and amortisation charges are expected to be around

£8.5 billion, higher than in the 2009 financial year as the result of the acquisition of a

further stake in Vodacom and the consolidation of that entity from 18 May 2009,

capital expenditure in India and the impact of foreign exchange rates.

Free cash flow before licence and spectrum payments is expected to be in the range

£6.0 billion to £6.5 billion, ahead of the Group’s medium term target to deliver

between £5.0 and £6.0 billion annual free cash flow. Capitalised fixed asset additions

are expected to be at a similar level to the 2009 financial year after adjusting for the

impact of foreign exchange. European capital intensity will be around 10% of revenue

and the Group expects to continue to invest in India.

The Group continues to make significant cash payments for tax and associated

interest in respect of long standing tax issues. The Group does not expect resolution

of the application of UK Controlled Foreign Company legislation to the Group in the

near term.

The adjusted tax rate percentage is expected to be in the mid 20s for the 2010

financial year, driven by reducing rates of corporate taxation in certain countries where

the Group operates, with the Group targeting a similar level in the medium term.

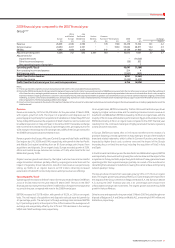

2009 nancial year

Adjusted Capitalised

operating fixed asset Free

Revenue profit additions cash flow(1)

£bn £bn £bn £bn

Outlook – May 2008(2) 39.8 to 40.7 11.0 to 11.5 5.3 to 5.8 5.1 to 5.6

Operational (1.0) (0.4) (0.2) 0.1

Acquisitions 0.2 – 0.1 (0.1)

Foreign exchange 0.3 0.4 – 0.1

Outlook – November 2008(3) 38.8 to 39.7 11.0 to 11.5 5.2 to 5.7 5.2 to 5.7

Foreign exchange 1.8 0.5 0.3 0.3

Outlook – February 2009(4) 40.6 to 41.5 11.5 to 12.0 5.5 to 6.0 5.5 to 6.0

2009 performance 41.0 11.8 5.9 5.7

Notes:

(1) Before licence and spectrum payments.

(2) The Group’s outlook from May 2008 reflected expectations for average foreign exchange rates

for the 2009 financial year of approximately £1:€1.30 and £1:US$1.96.

(3) The Group’s outlook, as updated in November 2008, reflected the impact of the Group’s

acquisition of stakes in Ghana, Qatar and Poland and by SFR of Neuf Cegetel and updated

expectations for average foreign exchange rates for the 2009 financial year of approximately

£1:€1.26 and £1:US$1.80.

(4) The Group’s outlook, as updated in February 2009, reflected updated expectations for average

foreign exchange rates for the 2009 financial year of approximately £1:€1.20 and £1:US$1.72.

Outlook