Vodafone 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 Vodafone Group Plc Annual Report 2009

25. Borrowings continued

obligations comprising its physical assets and certain share pledges of the shares under VEL. The terms and conditions of the security arrangements mean that should

members of the VEL Group not meet all of their loan payment and performance obligations, the lenders may sell the pledged shares and/or assets to recover their losses,

with any remaining sales proceeds being returned to the VEL Group. Six of the eight legal entities within the VEL Group provide cross guarantees to the lenders.

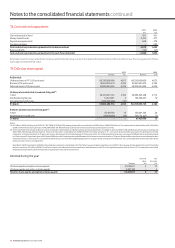

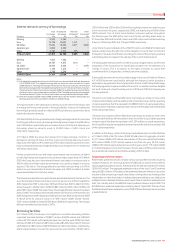

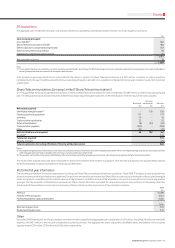

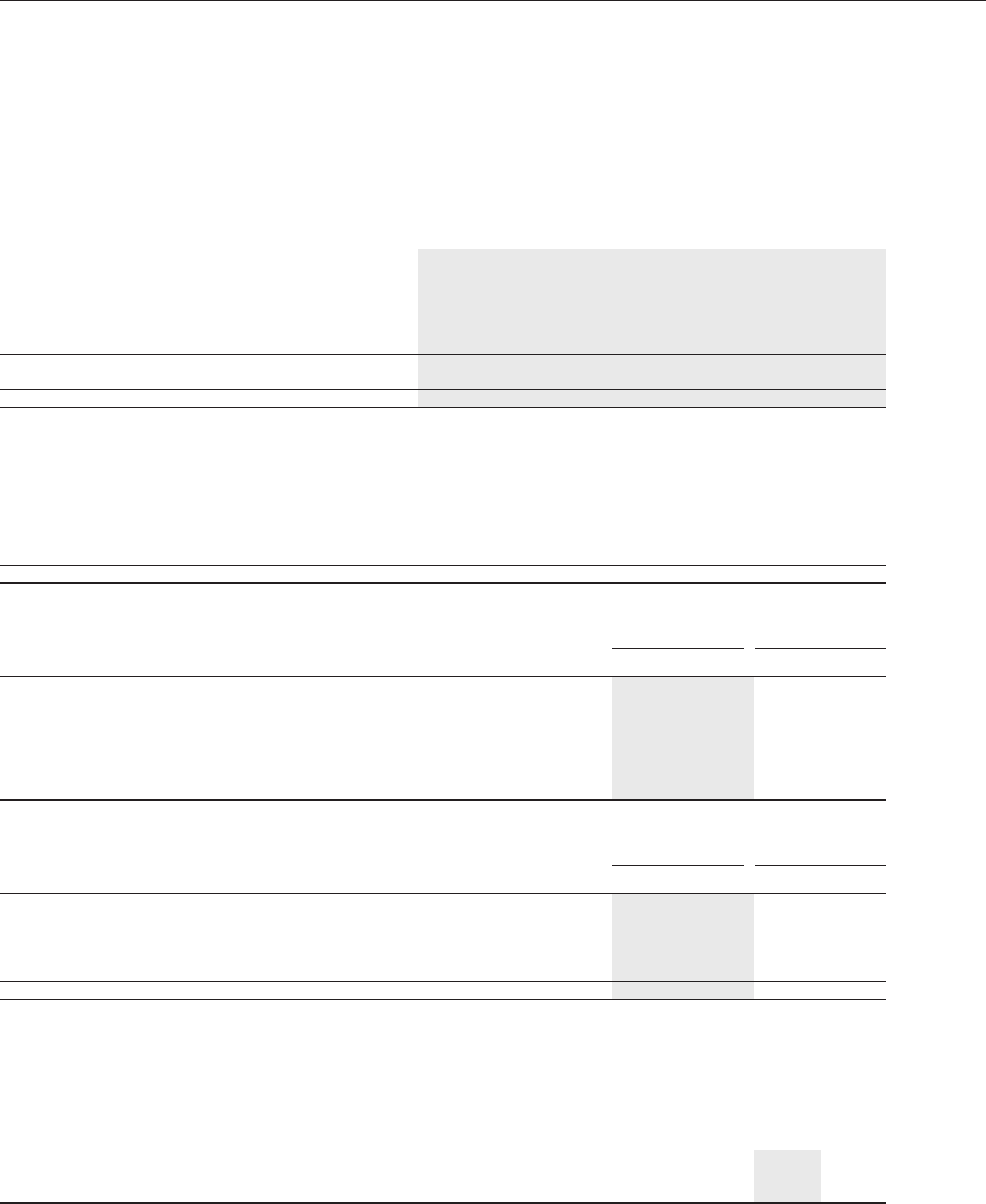

Maturity of borrowings

The maturity profile of the anticipated future cash flows including interest in relation to the Group’s non-derivative financial liabilities on an undiscounted basis, which,

therefore, differs from both the carrying value and fair value, is as follows:

Redeemable Loans in fair

Bank preference Commercial Other value hedge

loans shares Paper Bonds liabilities relationships Total

£m £m £m £m £m £m £m

Within one year 950 127 2,670 787 1,053 5,222 10,809

In one to two years 2,361 97 – 283 3,663 1,808 8,212

In two to three years 665 59 – 2,105 25 1,443 4,297

In three to four years 525 59 – 269 314 1,589 2,756

In four to five years 1,345 59 – 1,064 252 2,118 4,838

In more than five years 342 1,517 – 7,360 71 8,928 18,218

6,188 1,918 2,670 11,868 5,378 21,108 49,130

Effect of discount/financing rates (136) (465) (11) (3,289) (209) (3,647) (7,757)

31 March 2009 6,052 1,453 2,659 8,579 5,169 17,461 41,373

Within one year 838 43 1,457 1,368 343 1,443 5,492

In one to two years 369 104 – 464 122 4,168 5,227

In two to three years 1,490 77 – 214 2,744 398 4,923

In three to four years 346 43 – 1,671 12 1,016 3,088

In four to five years 142 43 – 139 234 1,082 1,640

In more than five years 423 1,132 – 2,990 163 9,459 14,167

3,608 1,442 1,457 6,846 3,618 17,566 34,537

Effect of discount/financing rates (133) (457) (14) (1,282) (260) (5,197) (7,343)

31 March 2008 3,475 985 1,443 5,564 3,358 12,369 27,194

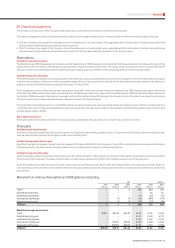

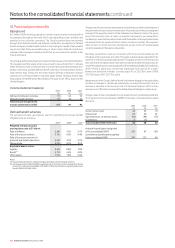

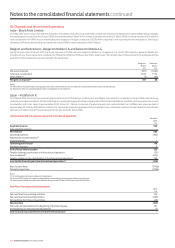

The maturity profile of the Group’s financial derivatives (which include interest rate and foreign exchange swaps), using undiscounted cash flows, is as follows:

2009 2008

Payable Receivable Payable Receivable

£m £m £m £m

Within one year 9,003 9,231 14,931 14,749

In one to two years 592 668 433 644

In two to three years 739 609 378 441

In three to four years 765 603 399 430

In four to five years 743 577 380 406

In more than five years 7,062 5,129 3,662 4,637

18,904 16,817 20,183 21,307

The currency split of the Group’s foreign exchange derivatives, all of which mature in less than one year, is as follows:

2009 2008

Payable Receivable Payable Receivable

£m £m £m £m

Sterling − 6,039 2,126 8,262

Euro 5,595 13 10,111 –

US dollar 2,527 1,127 2,076 4,992

Japanese yen 214 20 27 15

Other 81 1,285 42 797

8,417 8,484 14,382 14,066

Payables and receivables are stated separately in the table above as settlement is on a gross basis. The £67 million net receivable (2008: £316 million net payable)

in relation to foreign exchange financial instruments in the table above is split £37 million (2008: £358 million) within trade and other payables and £104 million

(2008: £42 million) within trade and other receivables.

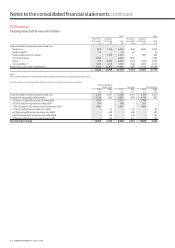

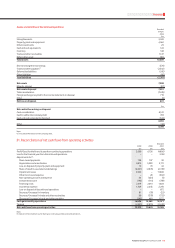

The present value of minimum lease payments under finance lease arrangements under which the Group has leased certain of its equipment is analysed as follows:

2009 2008

£m £m

Within one year 10 9

In two to five years 42 37

In more than five years 18 24

Notes to the consolidated nancial statements continued