Vodafone 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance

Vodafone Group Plc Annual Report 2009 33

Europe(1)

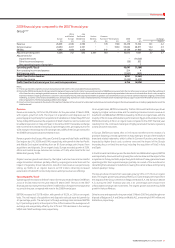

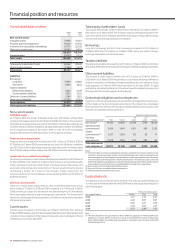

Germany Italy Spain UK Other Eliminations Europe % change

£m £m £m £m £m £m £m £ Organic

Year ended 31 March 2008

Revenue 6,866 4,435 5,063 5,424 4,583 (290) 26,081 6.1 2 .0

Service revenue 6,551 4,273 4,646 4,952 4,295 (287) 24,430 6 .3 2.1

EBITDA 2,667 2,158 1,806 1,431 1,628 – 9,690 3.1 (0 .1)

Adjusted operating profit 1,490 1,573 1,282 431 1,430 – 6,206 0.8 (1.5)

EBITDA margin 38.8% 48.7% 35.7% 26.4% 35.5% 37.2%

Year ended 31 March 2007

Revenue 6,790 4,245 4,500 5,124 4,275 (342) 24,592

Service revenue 6,481 4,083 4,062 4,681 4,018 (338) 22,987

EBITDA 2,696 2,149 1,567 1,459 1,530 – 9,401

Adjusted operating profit 1,525 1,575 1,100 511 1,448 – 6,159

EBITDA margin 39.7% 50.6% 34.8% 28.5% 35.8% 38.2%

Note:

(1) The Group revised its segment structure during the year. See note 3 to the consolidated financial statements.

The Group’s strategy in the Europe region continued to drive additional usage and

revenue from core mobile voice and messaging services and reduce the cost base in

an intensely competitive environment where unit price declines are typical each

year. The 2008 financial year saw a strong focus on stimulating additional usage by

offering innovative tariffs, larger minute bundles, targeted promotions and focusing

on prepaid to contract migration. Data revenue growth was strong throughout the

region, mainly due to the higher take up of mobile PC connectivity devices. The

Group’s ability to provide total communications services was enhanced through the

acquisition of Tele2’s fixed line communication and broadband services in Italy and

Spain in the second half of the year.

Revenue growth of 6.1% was achieved for the year ended 31 March 2008, comprising

2.0% organic growth, a 0.7 percentage point benefit from the inclusion of acquired

businesses, primarily Tele2, and 3.4 percentage points from favourable movements

in exchange rates, largely due to the strengthening of the euro against sterling.

The impact of merger and acquisition activity and exchange rate movements on

revenue, service revenue, EBITDA and adjusted operating profit are shown below:

Organic M&A Foreign Reported

growth activity exchange growth

% pps pps %

Revenue – Europe 2.0 0.7 3.4 6.1

Service revenue

Germany (2.9) – 4.0 1.1

Italy (2.0) 2.6 4.1 4.7

Spain 8.1 1.6 4.7 14.4

UK 5.8 – – 5.8

Other 2.4 0.3 4.2 6.9

Europe 2.1 0.8 3.4 6.3

EBITDA

Germany (5.0) – 3.9 (1.1)

Italy (3.2) (0.2) 3.8 0.4

Spain 11.1 (0.4) 4.6 15.3

UK (1.9) – – (1.9)

Other 2.9 (0.3) 3.8 6.4

Europe (0.1) (0.2) 3.4 3.1

Adjusted operating profit

Germany (6.0) – 3.7 (2.3)

Italy (1.4) (2.4) 3.7 (0.1)

Spain 14.4 (2.2) 4.3 16.5

UK (15.7) – – (15.7)

Other (4.2) (0.5) 3.5 (1.2)

Europe (1.5) (1.1) 3.4 0.8

Service revenue grew by 6.3%, or by 2.1% on an organic basis, with strong growth in

data revenue being the main driver of organic growth. Revenue was also positively

impacted by the 9.3% rise in the total registered mobile customer base to 110.6 million

at 31 March 2008. These factors more than offset the negative effects of termination

rate cuts, the cancellation of top up fees on prepaid cards in Italy resulting from

new regulation issued in March 2007 and the Group’s ongoing reduction of European

roaming rates. Business segment service revenue, which represents 28% of

European service revenue, grew by approximately 5% on an organic basis, driven by

a 21% growth in the average business customer base, including strong growth in

closing handheld business devices and mobile PC connectivity devices.

EBITDA increased by 3.1% for the year ended 31 March 2008, with a decline of 0.1%

on an organic basis, and the difference primarily due to favourable exchange rate

movements. EBITDA included the benefit from the release of a provision following a

revised agreement in Italy related to the use of the Vodafone brand and related

trademarks, which is offset in Common Functions. EBITDA was also impacted by

higher customer and direct costs and the impact of the Group’s increased focus

on fixed line services, including the acquisition of Tele2 in Italy and Spain.

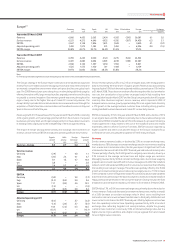

Germany

Service revenue remained stable, or declined by 2.9% at constant exchange rates,

mainly due to a 7.8% decrease at constant exchange rates in voice revenue resulting

from a reduction in termination rates, the full year impact of significant tariff cuts

introduced in the second half of the 2007 financial year and reduced roaming rates.

This was partially offset by the 34.4% growth in outgoing voice minutes, driven by a

9.1% increase in the average customer base and higher usage per customer.

Messaging revenue fell by 9.0% at constant exchange rates, due to lower usage by

prepaid customers and new tariffs with inclusive messages sent within the Vodafone

network, which stimulated an 8.8% growth in volumes, but was more than offset by

the resulting lower rate per message. These falls were partially offset by the 35.8%

growth at constant exchange rates in data revenue, largely due to a 71.9% increase

in the combined number of registered mobile PC connectivity devices and handheld

business devices, particularly in the business segment, as well as increased Vodafone

HappyLive! bundle penetration in the consumer segment. During the year, the fixed

broadband customer base increased by 0.5 million to 2.6 million at 31 March 2008.

EBITDA fell by 1.1%, or 5.0% at constant exchange rates, primarily due to the reduction

in voice revenue. Total costs decreased at constant exchange rates, mainly as a result

of a 3.6% decrease at constant exchange rates in direct costs resulting from

termination rate cuts as well as fewer handset sales to third party distributors and

lower content costs than in the 2007 financial year, offset by higher access line fees

from the expanding customer base. Operating expenses fell by 9.2% at constant

exchange rates, reflecting targeted cost saving initiatives, despite the growing

customer base. Customer costs rose by 5.0% at constant exchange rates, due to a

higher volume of gross additions and a higher cost per upgrade from an increased

focus on higher value customers.