Vodafone 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

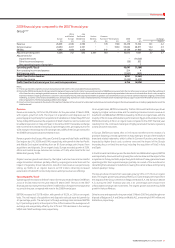

40 Vodafone Group Plc Annual Report 2009

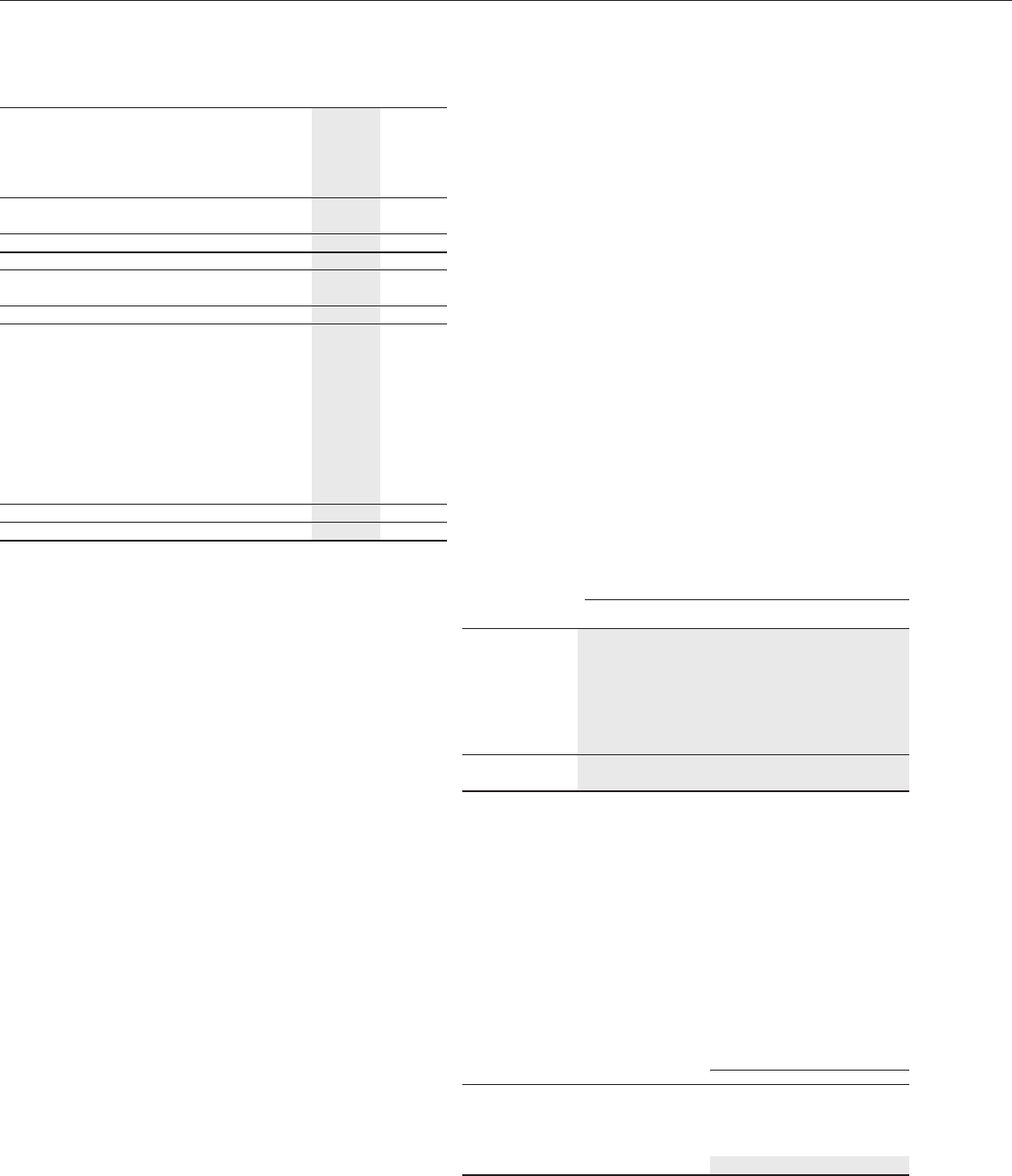

Consolidated balance sheet

2009 2008

£m £m

Non-current assets

Intangible assets 74,938 70,331

Property, plant and equipment 19,250 16,735

Investments in associated undertakings 34,715 22,545

Other non-current assets 10,767 8,935

139,670 118,546

Current assets 13,029 8,724

Total assets 152,699 127,270

Total equity shareholders’ funds 86,162 78,043

Total minority interests (1,385) (1,572)

Total equity 84,777 76,471

Liabilities

Borrowings

Long term 31,749 22,662

Short term 9,624 4,532

Taxation liabilities

Deferred tax liabilities 6,642 5,109

Current taxation liabilities 4,552 5,123

Other non-current liabilities 1,584 1,055

Other current liabilities 13,771 12,318

Total liabilities 67,922 50,799

Total equity and liabilities 152,699 127,270

Non-current assets

Intangible assets

At 31 March 2009, the Group’s intangible assets were £74.9 billion, with goodwill

comprising the largest element at £54.0 billion (2008: £51.3 billion). The increase in

intangible assets was primarily as a result of £10.0 billion of favourable exchange rate

movements and £2.3 billion of additions, partially offset by amortisation of £2.8 billion

and an impairment charge of £5.9 billion. Refer to note 10 to the consolidated

financial statements for further information on the impairment charge.

Property, plant and equipment

Property, plant and equipment increased from £16.7 billion at 31 March 2008 to

£19.3 billion at 31 March 2009, predominantly as a result of £4.8 billion of additions

and £2.1 billion of favourable foreign exchange movements, which more than offset

the £4.1 billion of depreciation charges and a £0.3 billion reduction due to disposals.

Investments in associated undertakings

The Group’s investments in associated undertakings increased from £22.5 billion at

31 March 2008 to £34.7 billion at 31 March 2009, mainly as a result of favourable

foreign exchange movements of £8.7 billion. The Group’s share of the results of its

associated undertakings, after deductions of interest, tax and minority interest,

contributed a further £4.1 billion to the increase, mainly arising from the

Group’s investment in Verizon Wireless, and was partially offset by £0.8 billion of

dividends received.

Other non-current assets

Other non-current assets mainly relate to other investments held by the Group,

which totalled £7.1 billion at 31 March 2009 compared to £7.4 billion at 31 March

2008, primarily as a result of a decrease in the listed share price of China Mobile,

which was largely offset by foreign exchange rate movements. The movement in

other non-current assets primarily represents a £1.6 billion increase in the revaluation

of financial instruments.

Current assets

Current assets increased to £13.0 billion at 31 March 2009 from £8.7 billion at

31 March 2008, mainly as a result of the increased holdings due to funding requirements

in relation to the completion of the Vodacom transaction and in anticipation of bond

redemptions occurring in May 2009.

Total equity shareholders’ funds

Total equity shareholders’ funds increased from £78.0 billion at 31 March 2008 to

£86.2 billion at 31 March 2009. The increase comprises primarily the profit for the

year of £3.1 billion and a £12.6 billion benefit from the impact of favourable exchange

rate movements less equity dividends of £4.0 billion.

Borrowings

Long term borrowings and short term borrowings increased to £41.4 billion at

31 March 2009 from £27.2 billion at 31 March 2008, mainly as a result of foreign

exchange movements and new bond issues.

Taxation liabilities

The deferred tax liability increased from £5.1 billion at 31 March 2008 to £6.6 billion

at 31 March 2009, which arose mainly from the impact of foreign exchange movements.

Other current liabilities

The increase in other current liabilities from £12.3 billion at 31 March 2008 to

£13.8 billion at 31 March 2009 was primarily to due foreign exchange differences

arising on translation of liabilities in foreign subsidiaries and joint ventures. Group

trade payables at 31 March 2009 were equivalent to 38 days (2008: 37 days)

outstanding, calculated by reference to the amount owed to suppliers as a proportion

of the amounts invoiced by suppliers during the year.

Contractual obligations and contingencies

A summary of the Group’s principal contractual financial obligations is shown below.

Further details on the items included can be found in the notes to the consolidated

financial statements. Details of the Group’s contingent liabilities are included in note

33 to the consolidated financial statements.

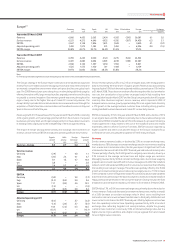

Payments due by period £m

1-3 3-5

Contractual obligations(1) Total <1 year years years >5 years

Borrowings(2) 49,130 10,809 12,509 7,594 18,218

Operating lease

commitments(3) 5,616 1,041 1,451 989 2,135

Capital

commitments(3)(4) 2,107 1,874 153 69 11

Purchase

commitments 2,518 1,616 524 283 95

Total contractual

cash obligations(1) 59,371 15,340 14,637 8,935 20,459

Notes:

(1) The above table of contractual obligations excludes commitments in respect of options over

interests in Group businesses held by minority shareholders (see “Option agreements and

similar arrangements”) and obligations to pay dividends to minority shareholders (see “Dividends

from associated undertakings and to minority shareholders”). The table excludes current and

deferred tax liabilities and obligations under post employment benefit schemes, details of which

are provided in notes 6 and 26 to the consolidated financial statements, respectively.

(2) See note 25 to the consolidated financial statements.

(3) See note 32 to the consolidated financial statements.

(4) Primarily related to network infrastructure.

Equity dividends

The table below sets out the amounts of interim, final and total cash dividends paid

or, in the case of the final dividend for the 2009 financial year, proposed, in respect of

each financial year.

Pence per ordinary share

Year ended 31 March Interim Final Total

2005 1.91 2.16 4.07

2006 2.20 3.87 6.07

2007 2.35 4.41 6.76

2008 2.49 5.02 7.51

2009 2.57 5.20(1) 7.77

Note:

(1) The final dividend for the year ended 31 March 2009 was proposed on 19 May 2009 and is

payable on 7 August 2009 to holders of record as of 5 June 2009. For American Depositary

Share (‘ADS’) holders, the dividend will be payable in US dollars under the terms of the ADS

depositary agreement.

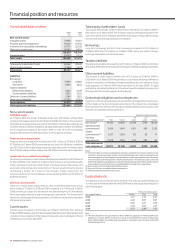

Liquidity and capital resources

Cash ows

Financial position and resources