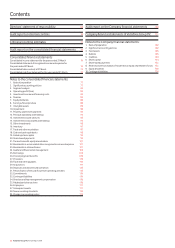

Vodafone 2009 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 Vodafone Group Plc Annual Report 2009

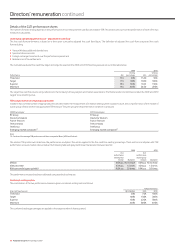

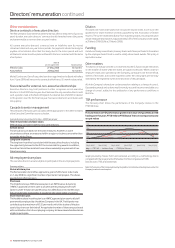

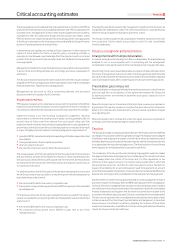

Directors’ interests in the shares of the Company

Historic medium term incentives

This table shows conditional awards of ordinary shares made in prior periods to executive directors under the deferred share bonus (‘DSB’). Shares which vested during the

year ended 31 March 2009 are also shown below.

Shares forfeited Shares vested

Total interest during the year in respect during the year in respect

in DSB at of the 2007 and of the 2007 and 2008 Total interest in DSB

1 April 2008 2008 financial years financial years(1)(2) at 31 March 2009

Number Number Number Number Total value(4)

of shares of shares of shares of shares(3) £’000

Vittorio Colao 153,671 – – 153,671 189

Andy Halford 516,660 – (240,840) 275,820 339

Arun Sarin(5) 1,212,278 (24,708) (1,187,570) – –

Total 1,882,609 (24,708) (1,428,410) 429,491 528

Notes:

(1) The shares vesting gave rise to cash payments equal to the equivalent value of dividends over the vesting period. These cash payments equated to £146,000 for Arun Sarin and £34,000 for

Andy Halford.

(2) Shares granted on 15 June 2006 vested on 15 June 2008. The closing mid-market share prices at these dates were 116.0 pence and 153.1 pence, respectively. The performance condition on these

awards was a two year cumulative EPS growth of 11% to 15%, which was met in full.

(3) There is one outstanding award in respect of the 2008 financial year, which has a performance period ended on 31 March 2009. The performance condition for this award was a requirement to achieve

85% of the cumulative planned free cash flow target for the 2008 and 2009 financial years.

(4) The total value is calculated using the closing mid-market share price as at 31 March 2009 of 122.75p.

(5) In addition to the award that vested on 15 June 2008 noted in 3, a proportion of Arun Sarin’s 15 June 2007 grant vested at the point that he retired on 28 February 2009 (a total of 568,266 shares).

The performance condition for this award was a requirement to achieve 85% of the cumulative planned free cash flow target for the 2008 and 2009 financial years. The award vested after pro-rating

for time and performance. The closing mid-market share price on the award date was 163.2 pence and the equivalent price at the point of vesting was 125.2 pence.

No shares were awarded during the year under the deferred share bonus to any of the Company’s directors or senior management.

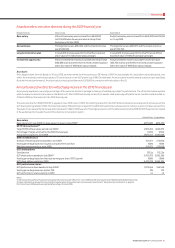

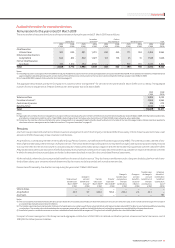

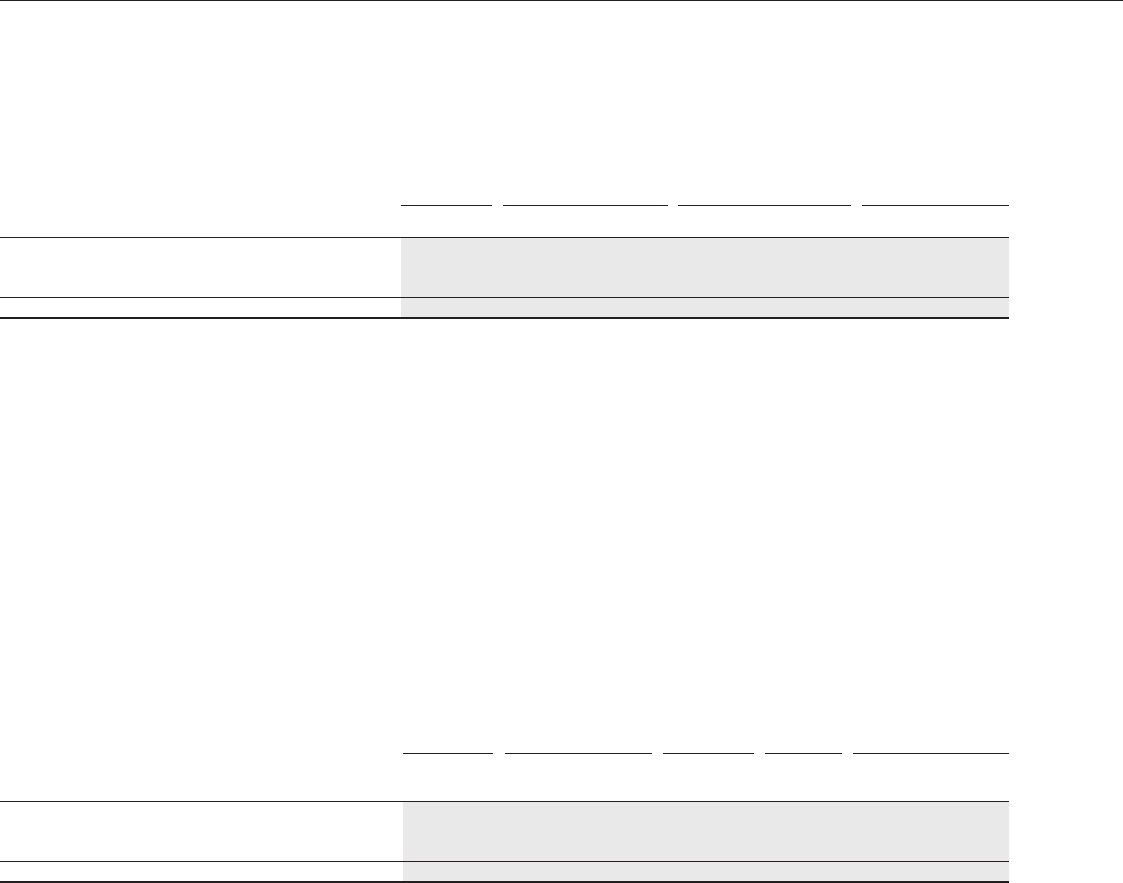

Long term incentives

Performance shares

Conditional awards of ordinary shares made to executive directors under the Vodafone Group Plc 1999 Long Term Stock Incentive Plan (‘LTSIP’) and the Vodafone Global

Incentive Plan (‘GIP’) are shown below. Long term incentive shares that vested during the year ended 31 March 2009 are also shown below.

Total interest Shares Shares vested

in performance forfeited in in respect

shares at respect of awards of awards

1 April 2008 Shares conditionally for the 2006, for the 2006,

or date of awarded during the 2007 and 2008 2007 and 2008 Total interest in performance

appointment 2009 financial year financial years financial years shares at 31 March 2009

Value at date

Number Number of award(1) Number Number Number Total value(4)

of shares of shares £’000 of shares(2) of shares(2) of shares(3) £’000

Vittorio Colao 2,630,874 7,127,741 9,262 – – 9,758,615 11,979

Andy Halford 2,676,838 4,357,399 5,662 (323,985) (215,990) 6,494,262 7,972

Arun Sarin(5)(6) 7,291,372 – – (3,381,994) (3,909,378) – –

Total 12,599,084 11,485,140 14,924 (3,705,979) (4,125,368) 16,252,877 19,951

Notes:

(1) The value of awards granted during the year under the Vodafone global incentive plan is based on the price of the Company’s ordinary shares on 28 July 2008 (the date of grant) of 129.95 pence.

These awards have a performance period running from 1 April 2008 to 31 March 2011. The performance conditions are detailed on page 59. The vesting date will be in July 2011.

(2) Shares granted on 26 July 2005 vested on 26 July 2008. The award was made using the closing mid-market share price of 145.25 pence on 25 July 2005. The equivalent share price on the vesting date

was 132.9 pence . The performance con dition on these awards was a relative total sharehold er return measu re aga ins t the companies mak ing up the F TSE globa l telecommunicat ions in de x at the st ar t

of the performance period. This condition was met in part.

(3) The total interest at 31 March 2009 includes awards over three different performance periods ending on 31 March 2009, 31 March 2010 and 31 March 2011. The performance conditions ending on

31 March 2009 and 31 March 2010 are in line with those for Arun Sarin set out in footnote 5 below. The performance condition for the award vesting in July 2009 is detailed on page 60 of this report.

(4) The total value is calculated using the closing mid-market share price as at 31 March 2009 of 122.75p.

(5) In addition to the award that vested on 26 July 2008 noted above, a proportion of Arun Sarin’s 25 July 2006 and 24 July 2007 grants vested at the point that he retired on 28 February 2009 (a total of

3,222,530 shares). The performance conditions for these awards were relative total shareholder return measures against companies from the FTSE global telecommunications index taken at the

start of each performance period. The award vested after pro-rating for time and performance. The share price used for the July 2006 award was 115.25 pence and for the July 2007 award 167.8 pence.

The closing mid-market price at the point of vesting was 125.2 pence.

(6) The shares that vested for Arun Sarin on 28 February 2009 gave rise to a cash payment equal to the equivalent value of dividends over the vesting period. The cash payment equated to £418,000.

The aggregate number of shares conditionally awarded during the year to the Company’s senior management is 20,509,280 shares. For a description of the performance

and vesting conditions see “GLTI performance shares” on page 60.

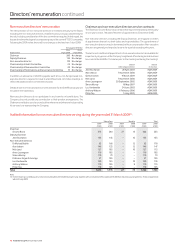

Directors’ remuneration continued