Vodafone 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

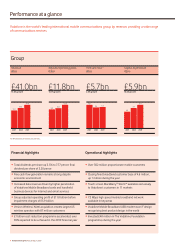

8 Vodafone Group Plc Annual Report 2009

Operating environment and strategy

Vodafone’s strategy is focused on improving operational execution and pursuing growth

opportunities in total telecommunications services, while delivering strong free cash ow.

The telecommunications industry

remains attractive

Notwithstanding a challenging economic background and rising

unemployment, the fundamentals of the telecommunications

industry continue to be attractive. The sector remains relatively

resilient, but not immune, as it provides essential services that serve a

fundamental human need to communicate for work and social

purposes. In this environment, the sector leaders, such as Vodafone,

continue to be able to innovate and deliver new products and services

as well as generate strong cash flow.

Although revenue from traditional services of voice and messaging

in mature markets is growing more slowly due to competitive and

regulatory pressures, there remains a significant growth opportunity

in mobile data. There are also growth opportunities in enterprise and

broadband markets due to increasing demand for integrated solutions,

international services and converged offerings.

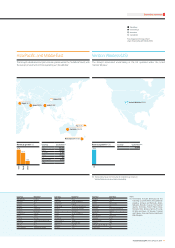

Within the Vodafone footprint, emerging markets, such as India,

continue to exhibit the potential for strong growth due to low mobile

penetration rates of around 38% on average, compared to over 120%

in Europe, which together with higher GDP growth prospects, provide

a significant customer growth opportunity.

Vodafone is well positioned in the

telecommunications industry

The Group believes its leading market position is demonstrated by a

strong level of free cash flow, with some £18 billion generated over the

last three years, a resilient structure based on a diverse portfolio of

assets in both mature and emerging markets and a number one or two

ranking in most countries in which it operates. The Group has also

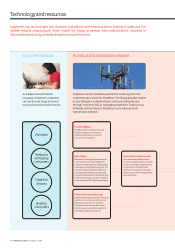

been a pioneer in data products and services, developing high speed

mobile broadband networks and providing simple to use and attractive

devices with features such as touch screen technology. The Group has

a recognised brand in consumer markets and a strong position in the

enterprise segment. In addition, Vodafone is already well placed to

benefit from growth in emerging markets, with a presence in a number

of the countries where significant growth is expected. In a difficult

market environment, the ability to control and reduce costs is ever

more important. Against this background, the Group continues to

drive network and IT savings through both consolidation and

centralisation of core activities, as well as local operating company

initiatives. Vodafone also benefits from a variable cost base as only

around one third of cash operating costs are fixed.

May 2006 strategy

In May 2006, Vodafone formulated a five point strategy and strong

progress has been made against the key objectives. Mobile phone

usage has grown significantly, partly offsetting price declines, key

operating costs and capital expenditure targets have been met and

exposure to emerging markets has increased. The share of revenue

from non-core mobile or total communication services has grown

through both significant data revenue growth and an increased fixed

broadband presence. In addition, the Group has refined its portfolio of

businesses and disposed of several non-core assets. Lastly, Vodafone

has maintained a disciplined approach to its capital structure, which has

proved right for the business, particularly in the current environment,

and also returned a significant level of cash to shareholders.

Evolving telecommunications environment

A number of challenges have evolved since 2006. In particular, the

macro economic environment has become more challenging.

Competitive pressures continue to be strong, contributing to price

declines of around 15% per annum. Consumers have an ever growing

choice of converged communication offers from established mobile

and fixed line operators and newer entrants including handset

manufacturers, internet based companies and software providers. In

addition, mobile virtual network operators, that lease network capacity

from mobile companies, are becoming increasingly prevalent. Finally,

regulators continue to press for substantially lower mobile termination

rates and roaming prices, and these areas together account for around

17% of Group revenue.

November 2008 revised strategy

In light of the changing environment the Group revised its May 2006

strategy. The new key target is to focus on driving free cash flow

generation. This target is supported by four main objectives: drive

operational performance, pursue growth opportunities in total

communications, execute in emerging markets and strengthen

capital discipline.

May 2006 strategy Environment: economic, competitive

and regulatory pressures

May 2006 Progress to November 2008

Revenue stimulation and

cost reduction in Europe

– Driving usage growth to offset price declines

– Delivered on cost and capital expenditure targets

Emerging market growth – Increased presence: Ghana, India, Poland,

Qatar and Vodacom

Total communications – Annualised data revenue £2.8 billion

– Broadband capabilities in 12 markets

Manage portfolio for

maximum returns

– Disposal of non-core assets: Switzerland and Belgium

Capital structure and

shareholder returns

– Higher dividends: 7.51p in 2008 (6.07p in 2006)

– £20 billion cash returned to shareholders

Economy – Weaker global economic growth and

rising unemployment

– Lower roaming revenue as enterprise

and consumer customers travel less

Competition – Ongoing price reductions due to

competitive pressures

– New entrants: Growing range of providers

of converged fixed and mobile services

– Expanding presence of mobile virtual

network operators

Regulation – Industry regulators continue to press

for lower mobile termination rates and

roaming prices, which impacts around

17% of Group revenue