Vodafone 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report

For the year ended 31 March 2009

Table of contents

-

Page 1

Vodafone Group Plc Annual Report For the year ended 31 March 2009 -

Page 2

... these statements. Vodafone, the Vodafone logo, Vodafone live!, Vodafone Mobile Broadband, Vodafone Office, Vodafone Wireless Office, Vodafone Passport, Vodafone Speak, Vodafone Email Plus, Vodafone M-PESA, Vodafone Money Transfer, Vodafone Station and Vodacom are trade marks of the Vodafone Group... -

Page 3

... 138 140 142 143 144 Shareholder information* History and development * Regulation* Non-GAAP information* Form 20-F cross reference guide Forward-looking statements Definition of terms Selected financial data * These sections make up the directors' report. Vodafone Group Plc Annual Report 2009 1 -

Page 4

... in the day to day lives of our customers. We see this particularly in the way in which our services, particularly data services such as email and internet access, offer new flexibility in the way people lead their business and personal lives. When more stable economic conditions return, this new... -

Page 5

Executive summary Total shareholder return April 2008 to May 2009 Vodafone -13% Vodafone share price +7 % vs FTSE 100 ― Vodafone Group FTSE 100 -20% ― FTSE 100 index 6600 5800 5000 4200 3400 May 2009 170 150 130 110 90 April 2008 We have engaged with governments and policy-makers to urge ... -

Page 6

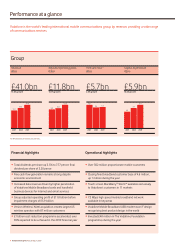

... dividend per share of 5.20 pence • Free cash flow generation remains strong despite economic environment • Increased data revenue driven by higher penetration of Vodafone Mobile Broadband cards and handheld business devices for internet and email services • Group adjusted operating profit... -

Page 7

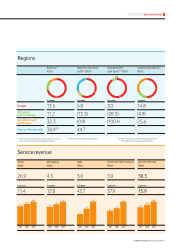

Executive summary Regions Revenue(1) (£bn) 5.8 3.5 5.5 2.9 0.5 0.7 29.6 6.6 7.6 0.9 Adjusted operating profit(1) (£bn) Operating free cash flow(1)(2) (£bn) (0.1) 0.6 Capital expenditure(1) (£bn) 1.9 % growth % growth % growth % growth Europe Africa and Central Europe Asia Pacific and ... -

Page 8

... fixed broadband. Mobile Dividends per share (pence) 7.51 6.76 7.77 Strategy We have made good progress in implementing the strategy announced in November 2008. Drive operational performance To enhance commercial value, we are developing and launching services which deliver more value in return... -

Page 9

... financial year, despite significant increases in mobile voice minutes and data usage, Europe's operating expenses remained broadly flat and mobile contribution margins were stable. Since November 2008: we have established the Vodafone Roaming Services business unit, which will manage international... -

Page 10

... impacts around 17% of Group revenue Competition Total communications Manage portfolio for maximum returns Capital structure and shareholder returns Regulation - Higher dividends: 7.51p in 2008 (6.07p in 2006) - £20 billion cash returned to shareholders 8 Vodafone Group Plc Annual Report 2009 -

Page 11

.... Vodafone supports in-market consolidation, such as the recent agreement to merge the Australian assets of Vodafone and Hutchison 3G Australia to form a 50:50 joint venture. November 2008 revised strategy Focus on free cash flow generation and execution Drive operational performance - Value... -

Page 12

...(2) 50.0% 14.3 (0.6) Germany Spain Italy UK Other (0.3) Vodacom Turkey Romania Other (1) In thousands. Proportionate mobile customer numbers at 31 March 2009. See "Definition of terms" on page 143. (2) Vodacom refers to the Group's interest in Vodacom Group (Pty) Limited in South Africa and its... -

Page 13

... on the maps reflect share of ownership at 31 March 2009 Asia Pacific and Middle East The Group's subsidiaries and joint venture operate under the 'Vodafone' brand, with the Group's investment in China operating as 'China Mobile'. Verizon Wireless (US) The Group's associated undertaking in the... -

Page 14

... all suppliers, excluding handsets, providing cost benefits to the Group through utilisation of scale and scope. Customers page 20 Research and development ('R&D') The emphasis of the Group R&D work programme is to contribute leading edge technical capabilities to Vodafone's thought and leadership... -

Page 15

... to the internet and to business customers' systems such as email, corporate applications and company intranets. Fixed line Provides customers with fixed broadband and fixed voice and data solutions to meet their total communication needs. Routers Vodafone offers broadband services through digital... -

Page 16

...it holds and the related network infrastructure, which enable the Group to operate telecommunications networks in 28 controlled and jointly controlled markets around the world. Customer devices Access and transmission network As a total communications company, Vodafone's customers can use a broad... -

Page 17

...of different services. Mobile operators Internet service providers Service platforms Vodafone's service platforms deliver advanced customer services and applications such as Vodafone live!, multimedia messaging, email, mobile TV and other data related services. Corporate networks Vodafone Group... -

Page 18

... multiple access ('W-CDMA') standard, provide customers with an optimised data access experience. Vodafone has continued to expand its service offering on 3G networks, now offering high speed internet and email access, video telephony, full track music downloads, mobile TV and other data services in... -

Page 19

...rich Android market. This follows Vodafone's membership of the Open Handset Alliance, established by Google in 2007 to develop the Android operating system for mobile phones; • commercial development of near field communications enabled mobile phones and SIM cards to reach international standards... -

Page 20

... of employees agreed development goals and business objectives with their manager. Succession planning is supported through development boards, which occur annually, covering all functions and levels within the organisation. Leadership roles and key appointments are reviewed monthly by the Executive... -

Page 21

...,909) are included in the scope of these figures. (2) Represents the average number of employees during the financial year, incorporating employees of newly acquired entities from the date of acquisition and the Group's share of employees in joint ventures. Vodafone Group Plc Annual Report 2009 19 -

Page 22

... place to sell directly to business customers. The internet is increasingly a key channel to promote and sell Vodafone's products and services and to provide customers with an easy, user friendly and accessible way to manage their services and access support, whilst reducing costs for the Group. The... -

Page 23

... Business Vodafone offers voice, messaging, data and fixed broadband services through multiple solutions and supporting technologies to deliver on its total communications strategy. The advancements in 3G networks and download speeds, handset capabilities and the mobilisation of internet services... -

Page 24

...user on another network. • Fees paid by operators based on termination rates primarily determined by local regulators. Voice roaming Principal features • Allows Vodafone's customers to make calls on other operators' mobile networks while travelling abroad. • International coverage expanded... -

Page 25

... data services. • Wholesale MVNO: Mobile virtual network operators offer services using Vodafone's network. New agreements signed during the 2009 financial year included ERG Petroli in Italy, Telecable and Hits in Spain and Lebara in the UK. • Business managed services: Vodafone is developing... -

Page 26

... price reductions in the competitive markets in which the Group operates. 548.4bn 427.9bn 245.0bn Notes: (1) Definition of the key terms is provided on page 143. (2) See 'Non-GAAP information' on page 138 for further details on the use of non-GAAP measures. 24 Vodafone Group Plc Annual Report... -

Page 27

... forma basis including India, a result of the rise in the average customer base, although revenue growth has slowed, primarily as a result of stronger competition coupled with maturing market conditions. Operating profit EBITDA increased by 10.0% to £14,490 million, with favourable exchange rates... -

Page 28

... 2008 £m Investment income Financing costs Net financing costs Analysed as: Net financing costs before dividends from investments Potential interest charges arising on settlement of outstanding tax issues(1) Dividends from investments Foreign exchange(2) Changes in fair value of equity put rights... -

Page 29

... fixed line revenue growth was 3.7%, supported by 278,000 fixed broadband customer net additions during the year as well as the benefit from the launch of Vodafone Station during the summer of 2008 and the continued good performance of Tele2. Revenue - Europe Service revenue Germany Italy Spain UK... -

Page 30

... exchange benefits on translation of the results into sterling. Africa and Central Europe(1) Vodacom £m Other £m (2) Africa and Central Europe £m £ % change Organic(3) Year ended 31 March 2009 Revenue Service revenue EBITDA Adjusted operating profit EBITDA margin Year ended 31 March 2008... -

Page 31

... plan. In Romania, EBITDA decreased by 4.0% at constant exchange rates, as aggressive market competition and higher gross customer additions led to the rise in the cost of acquiring and retaining customers. In May 2008, the Group changed the consolidation status of Safaricom from a joint venture... -

Page 32

... launch of services in seven new circles, bringing the closing customer base to 68.8 million. Customer penetration in the Indian mobile market reached 34% at 31 March 2009. EBITDA grew by 5% on a pro forma basis. Customer costs as a percentage of revenue decreased, benefiting from economies of scale... -

Page 33

...'s fixed line communication and broadband operations in Italy and Spain in December 2007. Favourable exchange rate movements increased revenue by 3.4 percentage points, principally due to the 4.2% change in the average euro/£ exchange rate, as 60% of the Group's revenue for the 2008 financial year... -

Page 34

... costs before dividends from investments Potential interest charges arising on settlement of outstanding tax issues Dividends from investments Foreign exchange(1) Changes in fair value of equity put rights and similar arrangements(2) 714 (2,014) (1,300) 789 (1,612) (823) Earnings/(loss) per share... -

Page 35

...exchange rates, due to a higher volume of gross additions and a higher cost per upgrade from an increased focus on higher value customers. Revenue - Europe Service revenue Germany Italy Spain UK Other Europe EBITDA Germany Italy Spain UK Other Europe Adjusted operating profit Germany Italy Spain UK... -

Page 36

... in commercial operating costs in support of sales channels and customer care activities and a £35 million charge for the restructuring programmes announced in March 2008. Other Europe Other Europe had service revenue growth of 6.9%, or 2.4% on an organic basis, with strong organic growth in data... -

Page 37

...the 2007 financial year, in line with lower average customer growth, which was in turn driven by increased competition in the market, with five mobile operators competing for market share. £ Year ended 31 March 2008 Revenue Service revenue EBITDA Adjusted operating profit EBITDA margin Year ended... -

Page 38

... contract customer base and strong growth in data and fixed line revenue. EBITDA grew by 6.2%, or by 14.3% on an organic basis, with the main drivers of growth being Egypt and Australia. Note: (1) The Group's share of the tax attributable to Verizon Wireless relates only to the corporate entities... -

Page 39

... impact of acquisitions and disposals, foreign exchange and business mix, are expected to decline by a similar amount to the 2009 financial year, reflecting the benefit of the acceleration of the Group's cost savings programme in a weaker revenue environment. Overall Group EBITDA margin is expected... -

Page 40

...certain of the Group's assets are based. This includes an assessment of discount rates and long term growth rates, future technological developments and timing and quantum of future capital expenditure, as well as several factors which may affect revenue and 38 Vodafone Group Plc Annual Report 2009 -

Page 41

Performance profitability identified within other risk factors in this section such as intensifying competition, pricing pressures, regulatory changes and the timing for introducing new products or services. Due to the Group's substantial carrying value of goodwill under International Financial ... -

Page 42

...-current assets mainly relate to other investments held by the Group, which totalled £7.1 billion at 31 March 2009 compared to £7.4 billion at 31 March 2008, primarily as a result of a decrease in the listed share price of China Mobile, which was largely offset by foreign exchange rate movements... -

Page 43

...paid at the discretion of the Board of directors or shareholders of the individual operating and holding companies and Vodafone has no rights to receive dividends, except where specified within certain of the companies' shareholders' agreements, such as with Vodafone Group Plc Annual Report 2009 41 -

Page 44

...purchase price must be transferred to the share premium account. The Board considered the market reaction to the Group's interim management statement, issued on 22 July 2008, and introduced a £1 billion share repurchase programme. This programme was completed on 18 September 2008. Details of shares... -

Page 45

... support agreements mainly reflects the value of the Group's interest rate swap portfolio, which is substantially net present value positive. See note 24 to the consolidated financial statements for further details on these agreements. Date of bond issue Maturity of bond April 2008 May 2008... -

Page 46

.... The facility supports the Group's commercial paper programmes and may be used for general corporate purposes, including acquisitions. Financial assets and liabilities Analyses of financial assets and liabilities, including the maturity profile of debt, currency and interest rate structure, are... -

Page 47

... body of research showing that mobile communications has the potential to change people's lives for the better, by promoting economic and social development. Emerging markets In January 2009, Vodafone published research on the socio-economic impact of mobile phones in India. The report found that... -

Page 48

..., the Group's focus moved towards ensuring a safe and responsible internet experience when using new media applications. These areas have particular relevance to the mobile communications sector and have formed a key part of Vodafone's activities during the 2009 financial year: • Vodafone has... -

Page 49

...Amounts related to the 2007 and 2008 financial years have been amended. Refer to the online CR report for further information. (5) The data includes the network sites managed by Vodafone and the network sites managed by Vodafone's joint venture, Indus Towers. Vodafone Group Plc Annual Report 2009 47 -

Page 50

... Chief Financial Officer of Verizon Wireless in the US and is currently a member of the Board of Representatives of the Verizon Wireless partnership. He is also a director of Vodafone Essar Limited. Prior to joining Vodafone, he was Group Finance Director at 48 Vodafone Group Plc Annual Report 2009 -

Page 51

...as Group Managing Director, he oversaw the development and launch of mobile telecommunications networks in many parts of the world. He remains on the Boards of Cheung Kong Holdings Limited, Compagnie Financière Richemont SA and Orient Overseas (International) Limited and is an Advisory Board Member... -

Page 52

... on the Group's strategy, financial structure and planning, succession planning, organisational development and Group-wide policies. The Executive Committee membership comprises the executive directors, details of whom are shown on pages 48 and above, and the senior managers who are listed below... -

Page 53

... delegated to the Board committees are given on pages 53 and 54. Board meetings The Board meets at least eight times a year and the meetings are structured to allow open discussion. All directors participate in discussing the strategy, trading and financial Vodafone Group Plc Annual Report 2009 51 -

Page 54

... room and can access monthly information including actual financial results, reports from the executive directors in respect of their areas of responsibility and the Chief Executive's report which deals, amongst other things, with investor relations, giving Board members an opportunity to develop an... -

Page 55

... and are reviewed internally on an ongoing basis by the Board. The terms of reference for all Board committees can be found on the Company's website at www.vodafone. com/governance or a copy can be obtained by application to the Company Secretary at the Company's registered office. The committees... -

Page 56

... management of the Group's businesses, the overall financial performance of the Group in fulfilment of strategy, plans and budgets and Group capital structure and funding. It also reviews major acquisitions and disposals. The members of the Executive Committee and their biographical details are set... -

Page 57

...and Exchange Commission rules and forms, and that such information is accumulated and communicated to management, including the Company's Group Chief Executive and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosure. Vodafone Group Plc Annual Report 2009... -

Page 58

... corporate Code of Ethics for senior executives, financial and accounting officers, separate from and additional to its Business Principles. A copy of this code is available on the Group's website at www.vodafone. com/governance. Report from the Audit Committee The Audit Committee assists the Board... -

Page 59

... details, the terms of reference can be found on page 54. Remuneration Committee Chairman Committee members Luc Vandevelde Simon Murray Professor Jürgen Schrempp (until 29 July 2008) Anthony Watson Philip Yea Management attendees Chief Executive Group HR Director Group Reward Director Vittorio... -

Page 60

.... Changes to the individual elements of the package are set out below. Summary of key reward philosophies 0 2,000 4,000 6,000 Estimated values assuming an investment of two times base salary £'000 Link to business strategy • The annual bonus continues to support the short term operational... -

Page 61

... plan in the 2009 financial year • 2009 performance measures: - Three key financial measures: operating profit (25%), service revenue (25%) and free cash flow (25%); - Total communications revenue (10%) - this measure has been used to promote the new business area set out in the May 2006 strategy... -

Page 62

...% 100% 150% 200% The target free cash flow level is set by reference to the Company's three year plan and market expectations. The Remuneration Committee consider the 2009 and 2010 targets to be stretching ones. TSR out-performance of a peer group median Vodafone has a limited number of appropriate... -

Page 63

... GLTI plan (565,703 shares) and therefore received a matching award with a face value of 100% base salary at target. Annual bonus Long term incentive plan Investment opportunity Arun Sarin Arun stepped down from the Board on 29 July 2008, and later retired from the business on 28 February 2009. He... -

Page 64

... The Vodafone Group 2008 sharesave plan is an HM Revenue & Customs ('HMRC') approved scheme open to all permanently employed UK staff. Options under the plan are granted at up to a 20% discount to market value. Executive directors' participation is included in the option table on page 65. Share... -

Page 65

... from the 2009 financial year Vodafone Group short term incentive plan applicable to the year ended 31 March 2009. These awards are in relation to the performance against targets in adjusted operating profit, service revenue, free cash flow, total communications revenue and customer delight for... -

Page 66

...2008. The award was made using the closing mid-market share price of 145.25 pence on 25 July 2005. The equivalent share price on the vesting date was 132.9 pence. The performance condition on these awards was a relative total shareholder return measure against the companies making up the FTSE global... -

Page 67

... awards vested when he retired on 28 February 2009. The number of share options vesting was pro-rated for time and performance. (5) Arun exercised his SAYE options on 1 September 2008. The mid-market closing share price on 29 August 2008 was 141.05 pence. Vodafone Group Plc Annual Report 2009 65 -

Page 68

... non-executive director's remuneration for the 2009 financial year are included in the table below. Non-executive directors do not participate in any incentive or benefit plans. The Company does not provide any contribution to their pension arrangements. The Chairman is entitled to use of a car and... -

Page 69

... had been no change to the directors' interests in share options from 31 March 2009 (see page 65). Other than those individuals included in the table above, at 18 May 2009, members of the Group's Executive Committee at that date held options for 19,282,900 ordinary shares at prices ranging from 91... -

Page 70

...Company financial statements of Vodafone Group Plc Notes to the Company financial statements: 1. Basis of preparation 2. Significant accounting policies 3. Fixed assets 4. Debtors 5. Creditors 6. Share capital 7. Share-based payments 8. Reserves and reconciliation of movements in equity shareholders... -

Page 71

...IFRS as issued by the International Accounting Standards Board ('IASB') and IFRS as adopted by the EU, give a true and fair view of the assets, liabilities, financial position and profit or loss of the Group; and • the directors' report includes a fair review of the development and performance of... -

Page 72

Audit report on internal controls Report of independent registered public accounting firm to the members of Vodafone Group Plc We have audited the internal control over financial reporting of Vodafone Group Plc and subsidiaries and applicable joint ventures (the 'Group') as of 31 March 2009 based on... -

Page 73

...to the customer, after trade discounts, with any related expenditure charged as an operating cost. Where the Group's role in a transaction is that of an agent, revenue is recognised on a net basis, with revenue representing the margin earned. Impairment reviews IFRS requires management to undertake... -

Page 74

...value and related depreciation are critical to the Group's financial position and performance. Finite lived intangible assets Other intangible assets include the Group's aggregate amounts spent on the acquisition of 2G and 3G licences, computer software, customer bases, brands and development costs... -

Page 75

... consolidated financial statements, and of whether the accounting policies are appropriate to the Group's circumstances, consistently applied and adequately disclosed. Deloitte LLP Chartered Accountants and Registered Auditors London United Kingdom 19 May 2009 Vodafone Group Plc Annual Report 2009... -

Page 76

..., net of tax Exchange differences on translation of foreign operations, net of tax Net actuarial (losses)/gains on defined benefit pension schemes, net of tax Revaluation gain Foreign exchange (gains)/losses transferred to the consolidated income statement Fair value gains transferred to the... -

Page 77

...: 25, 35 27 28 9,624 4,552 373 13,398 27,947 152,699 4,532 5,123 356 11,962 21,973 127,270 Vittorio Colao Chief Executive Andy Halford Chief Financial Officer The accompanying notes are an integral part of these consolidated financial statements. Vodafone Group Plc Annual Report 2009 75 -

Page 78

Consolidated cash flow statement for the years ended 31 March Note 2009 £m 2008 £m 2007 £m Net cash flow from operating activities Cash flows from investing activities Purchase of interests in subsidiary undertakings and joint ventures, net of cash acquired Purchase of intangible assets Purchase... -

Page 79

...and equity instruments issued by the Group in exchange for control of the acquiree, plus any costs directly attributable to the business combination. The acquiree's identifiable assets and liabilities are recognised at their fair values at the acquisition date. Vodafone Group Plc Annual Report 2009... -

Page 80

... and customer bases, are recorded at fair value at the date of acquisition. Amortisation is charged to the income statement on a straight-line basis over the estimated useful lives of intangible assets from the date they are available for use. Estimated useful lives The estimated useful lives of... -

Page 81

..., data services and information provision, connection fees and equipment sales. Products and services may be sold separately or in bundled packages. Revenue for access charges, airtime usage and messaging by contract customers is recognised as revenue as services are performed, with unbilled revenue... -

Page 82

... benefits For defined benefit retirement plans, the difference between the fair value of the plan assets and the present value of the plan liabilities is recognised as an asset or liability on the balance sheet. Scheme liabilities are assessed using the projected unit funding method and applying... -

Page 83

... date of the equity-settled share-based payments is expensed on a straight-line basis over the vesting period, based on the Group's estimate of the shares that will eventually vest and adjusted for the effect of non market-based vesting conditions. Fair value is measured using a binomial pricing... -

Page 84

... consolidated financial statements continued 3. Segment analysis The Group has a single group of related services and products, being the supply of communications services and products. Segment information is provided on the basis of geographic areas, being the basis on which the Group manages its... -

Page 85

... of EBITDA to operating profit/(loss) is shown below. For a reconciliation of operating profit/(loss) to profit/(loss) before taxation, see the consolidated income statement on page 74. 2009 £m 2008 £m 2007 £m EBITDA Depreciation and amortisation including loss on disposal of fixed assets Share... -

Page 86

...to pension schemes and charitable foundations associated to the Group. A description of the work performed by the Audit Committee in order to safeguard auditor independence when non-audit services are provided is set out in "Corporate governance" on page 55. 84 Vodafone Group Plc Annual Report 2009 -

Page 87

... financing costs 2009 £m 2008 £m 2007 £m Investment income: Available-for-sale investments: Dividends received Other(1) Loans and receivables at amortised cost(2) Fair value through the income statement (held for trading): Derivatives - foreign exchange contracts Other(3) Equity put rights and... -

Page 88

..." on page 26. 2009 £m 2008 £m 2007 £m Profit/(loss) before tax on continuing operations as shown in the consolidated income statement Expected income tax expense/(income) on profit from continuing operations at UK statutory tax rate Effect of taxation of associated undertakings, reported within... -

Page 89

... may affect the Group's future tax charge include the impact of corporate restructuring, the resolution of open tax issues, future planning opportunities, corporate acquisitions and disposals, the use of brought forward tax losses and changes in tax legislation and tax rates. Vodafone is routinely... -

Page 90

... the position at 31 March 2008 is due to foreign exchange. The Group holds provisions in respect of deferred taxation that would arise if temporary differences on investments in subsidiaries, associates and interests in joint ventures were to be realised after the balance sheet date. No deferred tax... -

Page 91

.... The net book value at 31 March 2009 and expiry dates of the most significant licences are as follows: Expiry date 2009 £m 2008 £m Germany UK Qatar Italy December 2020 December 2021 June 2028 December 2021 5,452 4,246 1,482 1,240 5,089 4,579 - 1,150 Vodafone Group Plc Annual Report 2009 89 -

Page 92

... the consolidated income statement, as a separate line item within operating profit, in respect of goodwill and licences and spectrum fees are as follows: Cash generating unit Reportable segment 2009 £m 2008 £m 2007 £m Spain Turkey Ghana Germany Italy Spain Other Africa and Central Europe Other... -

Page 93

...compound annual growth rate in EBITDA in years eight to ten of the management plan. Long term growth rate Pre-tax risk adjusted discount rate The discount rate applied to the cash flows of each of the Group's operations is based on the risk free rate for ten year bonds issued by the government in... -

Page 94

... growth rates in the initial five years of the plans used for impairment testing. (2) Budgeted capital expenditure is expressed as the range of capital expenditure as a percentage of revenue in the initial five years of the plans used for impairment testing. 92 Vodafone Group Plc Annual Report 2009 -

Page 95

...depreciated, with a cost of £44 million and £1,186 million, respectively (2008: £28 million and £1,013 million). Property, plant and equipment with a net book value of £148 million (2008: £1,503 million) has been pledged as security against borrowings. Vodafone Group Plc Annual Report 2009 93 -

Page 96

...Q.S.C.'s issued and outstanding share capital. The Group has rights, both pre and post the public offering, through its shareholding in Vodafone and Qatar Foundation LLC that enable it to control the strategic and operating decisions of Vodafone Qatar Q.S.C. 94 Vodafone Group Plc Annual Report 2009 -

Page 97

... financial and operating policies of Vodafone Omnitel N.V., despite the Group's 76.9% ownership interest. Effect of proportionate consolidation of joint ventures The following table presents, on a condensed basis, the effect on the consolidated financial statements of including joint ventures using... -

Page 98

...%. (6) At 31 March 2009, the fair value of Safaricom Limited was KES 48 billion (£421 million) based on the closing quoted share price on the Nairobi stock exchange. The Group's share of the aggregated financial information of equity accounted associated undertakings is set out below. The amounts... -

Page 99

... rate swaps 16 104 120 2,587 2,707 70 42 112 780 892 The fair values of these financial instruments are calculated by discounting the future cash flows to net present values using appropriate market interest and foreign currency rates prevailing at 31 March. Vodafone Group Plc Annual Report 2009... -

Page 100

... balances and money market funds comprise cash held by the Group on a short term basis with original maturity of three months or less. The carrying amount of these assets approximates their fair value. 19. Called up share capital Number 2009 £m Number 2008 £m Authorised: Ordinary shares of 113... -

Page 101

...to performance conditions but are subject to continued employment. Vodafone Group executive plans Under the Vodafone global incentive plan and its predecessor, the Vodafone Group Plc 1999 Long Term Stock Incentive Plan, awards of performance shares are granted to directors and certain employees. The... -

Page 102

... 33 42 Fair value of options granted ADS options Other 2007 (1) Ordinary share options Board of directors and Executive Committee(1) 2008 2007 Other 2007 2008 2009 2008 Expected life of option (years) Expected share price volatility Dividend yield Risk free rates Exercise price(2) 4-5 25.5-33... -

Page 103

...with equity shareholders Share premium account £m Own shares held £m Additional paid-in capital £m Capital redemption reserve £m 1 April 2006 Issue of new shares Own shares released on vesting of share awards Share consolidation B share capital redemption B share preference dividend Share-based... -

Page 104

... Officer, Group General Counsel and Company Secretary, Corporate Finance Director and Director of Financial Reporting, meets at least annually to review treasury activities and its members receive management information relating to treasury activities on a quarterly basis. The Group accounting... -

Page 105

... interest on outstanding tax issues. There would be no material impact on equity. Foreign exchange management As Vodafone's primary listing is on the London Stock Exchange, its share price is quoted in sterling. Since the sterling share price represents the value of its future multi-currency cash... -

Page 106

...£m Financial liabilities measured at amortised cost: Bank loans Bank overdrafts Redeemable preference shares Commercial paper Bonds Other liabilities(1) Bonds in fair value hedge relationships Note: (1) At 31 March 2009, amount includes £691 million (2008: £nil) in relation to collateral support... -

Page 107

... shares at an independently appraised fair market value. Fair values are calculated using discounted cash flows with a discount rate based upon forward interest rates available to the Group at the balance sheet date. Banks loans include a ZAR6.1 billion loan held by Vodafone Holdings SA Pty Limited... -

Page 108

... VEL. The terms and conditions of the security arrangements mean that should members of the VEL Group not meet all of their loan payment and performance obligations, the lenders may sell the pledged shares and/or assets to recover their losses, with any remaining sales proceeds being returned to the... -

Page 109

...interest rate swaps used to manage the interest rate profile of financial liabilities. Interest on floating rate borrowings is generally based on national LIBOR equivalents or government bond rates in the relevant currencies. At 31 March 2009, the Group had entered into foreign exchange contracts to... -

Page 110

... charged to the income statement (note 36) 73 40 113 63 28 91 32 62 94 Defined benefit schemes The principal actuarial assumptions used for estimating the Group's benefit obligations are set out below: 2009(1) 2008(1) 2007(1) Current service cost Interest cost Expected return on pension assets... -

Page 111

...April Exchange rate movements Expected return on pension assets Actuarial (losses)/gains Employer cash contributions Member cash contributions Benefits paid 31 March Movement in pension liabilities: 1 April Exchange rate movements Arising on acquisition Current service cost Interest cost Member cash... -

Page 112

.... 2009 £m 2008 £m Included within "Derivative financial instruments": Fair value through the income statement (held for trading): Interest rate swaps Foreign exchange swaps Fair value hedges: Interest rate swaps 381 37 418 17 435 160 358 518 26 544 110 Vodafone Group Plc Annual Report 2009 -

Page 113

... the combined companies. 2009 £m Revenue Profit for the financial year Profit attributable to equity shareholders Basic earnings per share Diluted earnings per share 41,069 3,052 3,050 Pence 5.78 5.76 Other During the 2009 financial year, the Group completed a number of smaller acquisitions for... -

Page 114

... discontinued operations(3) Basic loss per share Diluted loss per share Notes: (1) Including gains and losses on disposal of fixed assets. (2) Includes £719 million of foreign exchange differences transferred to the income statement on disposal. (3) Amount attributable to equity shareholders for... -

Page 115

... net cash flows from operating activities 2009 £m 2008 £m Restated 2007 £m Profit/(loss) for the financial year from continuing operations Loss for the financial year from discontinued operations Adjustments for(1): Share-based payments Depreciation and amortisation Loss on disposal of property... -

Page 116

... expenditure not provided in the financial statements(1) Note: (1) Commitment includes contracts placed for property, plant and equipment and intangible assets. Company and subsidiaries 2009 2008 £m £m Share of joint ventures 2009 2008 £m £m 2009 £m Group 2008 £m 1,706 1,477 401 143... -

Page 117

... defendants on behalf of the same putative investor class. Thereafter, an additional plaintiff, a US pension fund that purportedly purchased Vodafone ADRs on the New York Stock Exchange, was added as an additional plaintiff by stipulated order. The Company believes that the allegations are without... -

Page 118

... pages 57 to 67. Key management compensation Aggregate compensation for key management, being the directors and members of the Executive Committee, was as follows: 2009 £m 2008 £m 2007 £m Short term employee benefits Post-employment benefits: Defined benefit schemes Defined contribution schemes... -

Page 119

..., the Group changed its organisation structure. The information on employees by segment are presented on the revised basis, with prior years amended to conform to the current year presentation. 2009 Number 2008 Number 2007 Number By activity: Operations Selling and distribution Customer care and... -

Page 120

... on the Group's accounting for business acquisitions post adoption. This standard has not yet been endorsed for use in the EU. An amendment to IAS 27 "Consolidated and Separate Financial Statements" was issued in January 2008 and is effective for annual periods beginning on or after 1 July 2009. The... -

Page 121

...reported 2005 £m 2007 £m 2006 £m Adjustments 2005 £m 2007 £m 2006 £m Restated 2005 £m Consolidated income statement (Loss)/profit for the financial year from discontinued operations (Loss)/profit for the financial year Attributable to equity shareholders Basic (loss)/earnings per share (Loss... -

Page 122

... the related notes 1 to 10. These parent Company financial statements have been prepared under the accounting policies set out therein. We have reported separately on the consolidated financial statements of Vodafone Group Plc for the year ended 31 March 2009 and on the information in the directors... -

Page 123

... and reserves Called up share capital Share premium account Capital redemption reserve Capital reserve Other reserves Own shares held Profit and loss account Equity shareholders' funds The Company financial statements were approved by the Board of directors on 19 May 2009 and were signed on its... -

Page 124

... is governed by the Group's policies approved by the Board of directors, which provide written principles on the use of financial derivatives consistent with the Group's risk management strategy. Derivative financial instruments are initially measured at fair value on the contract date and... -

Page 125

...profit and loss account. Share-based payments The Group operates a number of equity settled share-based compensation plans for the employees of subsidiary undertakings using the Company's equity instruments. The fair value of the compensation given in respect of these share-based compensation plans... -

Page 126

...million) and 50,000 (2008: 50,000) 7% cumulative fixed rate shares of £1 each were authorised, allotted, issued and fully paid by the Company. (2) On 31 July 2006, Vodafone Group Plc undertook a return of capital to shareholders via a B share scheme and associated share consolidation. A total of 66... -

Page 127

... currently uses a number of equity settled share plans to grant options and shares to the directors and employees of its subsidiary undertakings, as listed below. Share option plans Vodafone Group savings related and sharesave plans Vodafone Group executive plans Vodafone Group 1999 long term... -

Page 128

...a guarantee relating to a commitment to the Spanish tax authorities of £229 million (2008: £197 million). Legal proceedings Details regarding certain legal actions which involve the Company are set out in note 33 to the consolidated financial statements. 126 Vodafone Group Plc Annual Report 2009 -

Page 129

...Final B share redemption date In accordance with the terms of the 2006 return of capital and share consolidation, the Company redeemed and cancelled all outstanding B shares in issue on 5 August 2008 at their nominal value of 15 pence per share. Further details will be available at www.vodafone.com... -

Page 130

...London Stock Exchange Pounds per ordinary share High Low NYSE Dollars per ADS High Low Asset Checker Limited The Company participates in Asset Checker, the online service which provides a search facility for solicitors and probate professionals to quickly and easily trace UK shareholdings relating... -

Page 131

... table sets out, for the periods and dates indicated, the period end, average, high and low exchanges rates for pounds sterling expressed in US dollars per £1.00. Year ended 31 March 31 March Average High Low AXA S.A. Legal & General Group Plc 4.61% 4.43% 2005 2006 2007 2008 2009 Month 1.89... -

Page 132

... or an officer or is otherwise interested, provided that the director (together with any connected person) is not interested in 1% or more of any class of the company's equity share capital or the voting rights available to its shareholders, (e) relating to the arrangement of any employee benefit in... -

Page 133

.... Class rights are deemed not to have been varied by the creation or issue of new shares ranking equally with or subsequent to that class of shares in sharing in profits or assets of the Company or by a redemption or repurchase of the shares by the Company. Limitations on voting and shareholding As... -

Page 134

...to special rules including officers of the Company, employees and holders that, directly or indirectly, hold 10% or more of the Company's voting stock. The tax consequences of the return of capital and the share consolidation undertaken during the 2007 financial year pursuant to a B share scheme are... -

Page 135

.... An interest charge in respect of the tax attributable to each such year would also apply. Dividends received from Vodafone would not be eligible for the preferential tax rate applicable to qualified dividend income for certain non-corporate holders. Vodafone Group Plc Annual Report 2009 133 -

Page 136

...). On 18 May 2009, Vodacom became a subsidiary undertaking following the listing of its shares on the Johannesburg Stock Exchange and concurrent termination of the shareholder agreement with Telkom SA Limited, the seller and previous joint venture partner. 134 Vodafone Group Plc Annual Report 2009 -

Page 137

... made a policy announcement on the 800 MHz 'digital dividend' spectrum (to be released following the transition from analogue to digital TV). It urged Europe, and the member states in particular, to identify new harmonised bands of spectrum for mobile broadband services and mobile TV. European... -

Page 138

... mobile broadband. The UK Government is expected to publish further details of its proposals over the summer of 2009. Other Europe Greece Vodafone Greece and other mobile operators have encountered difficulties in obtaining authorisations to install and maintain base stations and antennae. Operators... -

Page 139

...2G licence expiry date 3G licence expiry date Europe Germany Italy Spain UK Albania Greece Ireland Malta(5) Netherlands Portugal Africa and Central Europe Vodacom: South Africa Romania Turkey(7) Czech Republic Ghana Hungary Asia Pacific and Middle East India(11) Egypt Australia New Zealand Qatar(14... -

Page 140

... and expense. Adjusted earnings per share also excludes changes in fair value of equity put rights and similar arrangements and certain foreign exchange differences, together with related tax effects. The Group believes that it is both useful and necessary to report these measures for the following... -

Page 141

... revenue India - pro forma EBITDA Australia - service revenue Australia - EBITDA Verizon Wireless Service revenue Revenue EBITDA Group's share of result of Verizon Wireless 31 March 2008 Group Data revenue Service revenue Adjusted operating profit Europe Italy - direct costs Italy - customer costs... -

Page 142

... Not applicable Not applicable Selected financial data Shareholder information - Inflation and foreign currency translation Not applicable Not applicable Principal risk factors and uncertainties History and development Contact details Group at a glance Business overview Customers, marketing and... -

Page 143

... Directors' statement of responsibility - Management's report on internal control over financial reporting Audit report on internal controls Corporate governance - Board committees Corporate governance Note 4 "Operating profit/(loss)" Corporate governance - Auditors Not applicable Financial... -

Page 144

... and greater than anticipated prices of new mobile handsets; • changes in the costs to the Group of, or the rates the Group may charge for, terminations and roaming minutes; • the Group's ability to realise expected benefits from acquisitions, partnerships, joint ventures, franchises, brand... -

Page 145

... network operator when a customer makes a call to another mobile or fixed line network operator. Termination rate Total communications revenue Comprises all fixed location services revenue, data revenue, fixed line revenue and other service revenue. Vodafone Group Plc Annual Report 2009... -

Page 146

... income statement data Revenue Operating profit/(loss) Profit/(loss) before taxation Profit/(loss) for the financial year from continuing operations Profit/(loss) for the financial year Consolidated balance sheet data Total assets Total equity Total equity shareholders' funds Earnings per share... -

Page 147

Contact details Investor Relations Telephone: +44 (0) 1635 664447 Media Relations Telephone: +44 (0) 1635 664444 Corporate Responsibility Fax: +44 (0) 1635 674478 E-mail: [email protected] Website: www.vodafone.com/responsibility This report has been printed on Revive 75 Special Silk ... -

Page 148

Vodafone Group Plc Registered Office Vodafone House The Connection Newbury Berkshire RG14 2FN England Registered in England No. 1833679 Tel: +44 (0) 1635 33251 Fax: +44 (0) 1635 45713 www.vodafone.com