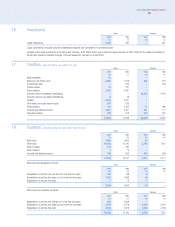

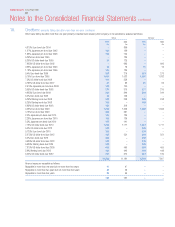

Vodafone 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

91

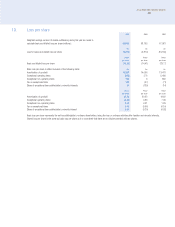

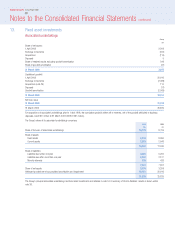

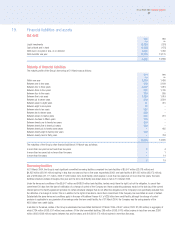

19. Financial liabilities and assets

Net debt

2004 2003

£m £m

Liquid investments (4,381) (291)

Cash at bank and in hand (1,409) (475)

Debt due in one year or less, or on demand 2,054 1,430

Debt due after one year 12,224 13,175

8,488 13,839

Maturity of financial liabilities

The maturity profile of the Group’s borrowings at 31 March was as follows:

2004 2003

£m £m

Within one year 2,054 1,430

Between one to two years 419 2,169

Between two to three years 2,837 1,919

Between three to four years 922 1,795

Between four to five years 776 805

Between five to six years 3,298 1,019

Between six to seven years 416 3,584

Between seven to eight years 11 415

Between eight to nine years 12 –

Between nine to ten years 553 –

Between ten to eleven years 509 –

Between eleven to twelve years 345 251

Between fourteen to fifteen years 770 –

Between twenty one to twenty two years 246 –

Between twenty five to twenty six years 400 –

Between twenty six to twenty seven years –465

Between twenty eight to twenty nine years 710 –

Between twenty nine to thirty years –753

14,278 14,605

The maturities of the Group’s other financial liabilities at 31 March was as follows:

In more than one year but not more than two years 74

In more than two years but not more than five years –1

In more than five years –14

719

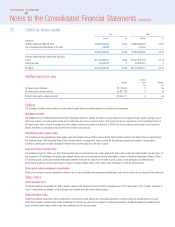

Borrowing facilities

At 31 March 2004, the Group’s most significant committed borrowing facilities comprised two bank facilities of $5,547 million (£3,018 million) and

$4,853 million (£2,641 million) expiring in less than one year and two to five years respectively (2003: one bank facility of $11,025 million (£6,975 million)),

and a ¥225 billion (£1,177 million, 2003: £1,200 million) term credit facility, which expires in more than two years but not more than five years. The bank

facilities remained undrawn throughout the year and the term credit facility was drawn down in full on 15 October 2002.

Under the terms and conditions of the $5,547 million and $4,853 million bank facilities, lenders would have the right, but not the obligation, to cancel their

commitment 30 days from the date of notification of a change of control of the Company and have outstanding advances repaid on the last day of the current

interest period. The facility agreement provides for certain structural changes that do not affect the obligations of the Company to be specifically excluded from

the definition of a change of control. This is in addition to the rights of lenders to cancel their commitment if the Company has committed an event of default.

Substantially the same terms and conditions apply in the case of Vodafone Finance K.K.’s ¥225 billion term credit facility, although the change of control

provision is applicable to any guarantor of borrowings under the term credit facility. As of 31 March 2004, the Company was the sole guarantor of the

¥225 billion term credit facility.

In addition to the above, certain of the Group’s subsidiaries had committed facilities at 31 March 2004 of £467 million (2003: £1,086 million) in aggregate, of

which £134 million (2003: £91 million) was undrawn. Of the total committed facilities, £69 million (2003: £415 million) expires in less than one year, £398

million (2003: £598 million) expires between two and five years, and £nil (2003: £73 million) expires in more than five years.