Vodafone 2004 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

121

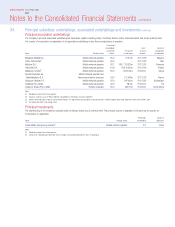

Finite-lived intangible assets

2004 2003

Gross carrying Accumulated Gross carrying Accumulated

amount amortisation amount amortisation

£m £m £m £m

Licences 159,482 48,012 164,873 34,717

Customer bases 7,417 4,939 6,942 3,634

166,899 52,951 171,815 38,351

Further analysis as to how amounts presented within the US GAAP reconciliation for goodwill and other intangibles, net of amortisation have been determined is

provided below.

2004 2003

£m £m

Use of a different measurement date for the purposes of determining purchase consideration 2,630 3,542

Deferred tax 42,188 46,960

Other 502 642

45,320 51,144

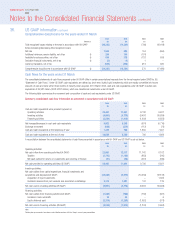

The total amortisation charge for the year ended 31 March 2004, under US GAAP, was £15,893 million (2003: £13,873 million). The estimated future

amortisation charge on finite-lived intangible assets for each of the next five years is set out in the following table. The estimate is based on finite-lived

intangible assets recognised at 31 March 2004 using foreign exchange rates on that date. It is likely that future amortisation charges will vary from the figures

below, as the estimate does not include the impact of any future investments, disposals, capital expenditures or fluctuations in foreign exchange rates.

Year ending 31 March £m

2005 16,054

2006 15,194

2007 14,918

2008 14,794

2009 14,708

The following pro forma information presents the impact of results under US GAAP, had the Group accounted for its goodwill and identifiable intangible assets

under SFAS No. 142 for all years presented after giving effect to such reclassifications for all years presented.

2004 2003 2002

£m £m £m

Reported net loss (8,127) (9,055) (16,688)

Amortisation of licences with indefinite lives, net of income taxes –– 704

Pro forma net loss (8,127) (9,055) (15,984)

Reported basic and diluted loss per share (11.93)p (13.29)p (24.56)p

Amortisation of licences with indefinite lives, net of income taxes ––1.04p

Pro forma basic and diluted net loss per share (11.93)p (13.29)p (23.52)p