Vodafone 2004 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

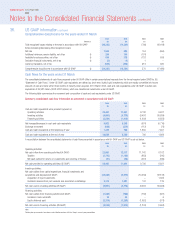

Had compensation cost been determined based upon the fair value of the share options and ADS options at grant date, the Group’s net loss and loss per share

would have been restated to the pro forma amounts indicated below (in millions, except per share amounts):

2004 2003 2002

£m £m £m

Net loss as reported under US GAAP (8,127) (9,055) (16,688)

Share-based employee compensation expense net of related tax effects, included in the

determination of net income as reported 129 48 –

Share-based employee compensation expense, under fair value based method

for all awards, net of related tax effects (107) (65) (81)

Pro forma net loss (8,105) (9,072) (16,769)

Loss per share

Basic and diluted – as reported under US GAAP (11.93)p (13.29)p (24.56)p

Basic and diluted – pro forma (11.90)p (13.31)p (24.67)p

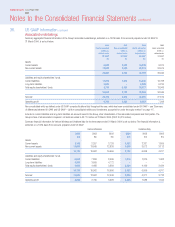

Pensions and other post retirement benefits

As at 31 March 2004, the Group operated a number of pension plans for the benefit of its employees throughout the world, which vary with conditions and

practices in the countries concerned. A description of the major pension plans provided is given in note 32.

Analyses of the net pension cost, plan assets, obligations and funded status for the major defined benefit plans in the UK, Germany and Japan, prepared under

US GAAP, are provided below.

The investment policy and strategy of the main scheme in the UK is set by the Trustees and reflects the liabilities of the plan. As at 31 March 2004, 79% (2003:

79%; 2002: 90%) of the assets are invested in equities and the remainder in bonds. The investment policy and strategy of the German plans are set by the

Investment Sub-Committee of the Contractual Trust Agreement and similarly reflects the liabilities of the plans, which are more heavily weighted towards

pensioners than the UK plan. 70% of the assets are invested in bonds and the remainder in equities.

The basis used to determine the overall long term return on plan assets is to apply the expected rate of return on bonds based on market interest rates at the

relevant date to that proportion of the assets invested in bonds. The bond rate of return is then increased by an allowance for the expected equity risk premium

in each market, based on past experience and future expectations of return and this rate is applied to the relevant proportion invested in equities. The

measurement date for the Group’s pension assets and obligations is 31 March. The measurement date for the Group’s net periodic pension cost is 1 April. The

cash contributions for the UK plan for the year ending 31 March 2005 are currently estimated to be £36 million.

UK Germany Japan

2004 2003 2002 2004 2003 2002 2004 2003 2002

£m £m £m £m £m £m £m £m £m

Service cost 25 23 27 33210 12 5

Interest costs 19 16 11 777121

Expected return on assets (21) (23) (16) (4) (1) ––––

Amortisation of prior service cost –– 1 ––––––

Amortisation of gains and losses 16 9323111 –

Net periodic pension cost 39 25 26 812 10 12 15 6

Termination benefits and curtailment costs ––––––(16) 24 1

Accumulated benefit obligation 390 279 218 153 141 113 25 106 101

Change in projected benefit obligation

Benefit obligation at 1 April 327 258 184 145 119 114 127 115 97

Service cost 25 23 27 33210 12 4

Interest cost 19 16 11 777121

Members’ contributions 10 99––––––

Amendments ––––(3) 5 –523

Actuarial loss/(gain) 82 28 33 19 13 – (3) 4 –

Curtailment –––(2) –––2 –

Settlement ––––––(76) 13 –

Special termination benefit –––––––9 –

Benefits paid (estimated) (6) (7) (6) (9) (9) (8) (22) (36) (10)

Exchange movement –––(5) 15 (1) (2) 1 –

Benefit obligation at 31 March 457 327 258 158 145 119 35 127 115

Vodafone Group Plc Annual Report 2004

124

Notes to the Consolidated Financial Statements continued

36. US GAAP information continued