Vodafone 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

62

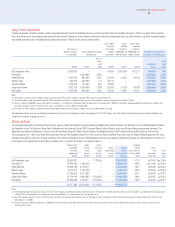

Board’s Report to Shareholders on Directors’ Remuneration continued

The aggregate number of options granted during the year to the Company’s senior management, other than executive directors, is 11,058,407. The weighted average exercise price

of the options granted to senior management during the year is 119.25 pence. The earliest date from which they are exercisable is July 2006 and the latest expiry date is 29 July

2013. The weighted average exercise price of options granted to US-based senior management has been translated at the average exchange rate for the year of $1.6953: £1.

Further details of options outstanding at 31 March 2004 are as follows:

Exercisable Market price Exercisable Option price

greater than option price(1) greater than market price(1) Not yet exercisable

Weighted Weighted Weighted

average Latest average Latest average Earliest date

exercisable expiry Options exercise expiry Options exercise from which

Options held price date held price date held price exercisable

Number Pence Number Pence Number Pence

Sir Christopher Gent 9,294,123 97.0 Dec 04 15,893,264 208.9 Dec 04 –––

Arun Sarin 5,000,000 95.1 Jun 06 6,250,000 242.4 Jul 06 7,396,164 119.2 Jul 06

Peter Bamford 150,500 58.7 Jul 04 3,360,755 272.5 Jul 10 12,433,175 124.5 Jul 04

Vittorio Colao ––––– –5,762,813 108.8 Jul 04

Thomas Geitner –– –2,933,055 290.4 Jul 10 11,637,006 128.0 Jul 04

Julian Horn-Smith –– –3,136,455 280.4 Jul 10 16,057,234 124.4 Jul 04

Ken Hydon –– –3,235,255 279.8 Jul 10 12,155,975 123.9 Jul 04

14,444,623 34,808,784 65,442,367

Notes:

(1) Market price is the closing middle market price of the Company’s ordinary shares at 31 March 2004 of 128.75p.

(2) Some of Arun Sarin’s options are in respect of American Depositary Shares, each representing ten ordinary shares in the Company, which are traded on the New York Stock Exchange. The number and option price have been

converted into the equivalent amounts for the Company’s ordinary shares, with the option price being translated at the average exchange rate for the year of $1.6953: £1.

The Company’s register of directors’ interests (which is open to inspection) contains full details of directors’ shareholdings and options to subscribe. These options by exercise

price were:

Options held at

1 April 2003 Options Options Options lapsed Options

Option or date of granted during exercised during during held at

price appointment the year the year the year 31 March 2004

Pence Number Number Number Number Number

Vodafone Group Plc Executive Share Option Scheme (Approved – 1988)

Vodafone Group Plc Share Option Scheme (Unapproved – 1988)

Vodafone Group 1998 Company Share Option Scheme (Approved)

Vodafone Group 1998 Executive Share Option Scheme (Unapproved)

58.70 2,627,000 – 2,476,500 – 150,500

155.90 1,520,500 –––1,520,500

255.00 764,000 –––764,000

282.30 1,522,500 –––1,522,500

Vodafone Group Plc Savings Related Share Option Scheme (1988)

Vodafone Group 1998 Sharesave Scheme

70.92 50,126 –––

50,126

95.30 – 16,710 ––16,710

AirTouch Communications, Inc. 1993 Long Term Incentive Plan(1)

95.12 5,000,000 –––

5,000,000

Vodafone Group Plc 1999 Long Term Stock Incentive Plan

97.00 30,140,785 –––30,140,785

119.25 – 25,637,680 ––25,637,680

151.56 2,796,100 –––2,796,100

157.50 24,943,043 –––24,943,043

164.49 100,146 –––100,146

242.43 6,250,000 –––6,250,000

291.50 15,803,684 –––15,803,684

91,517,884 25,654,390 2,476,500 – 114,695,774

Note:

(1) These share options are in respect of American Depositary Shares, each representing ten ordinary shares in the Company, which are traded on the New York Stock Exchange. The number and option price have been converted

into the equivalent amounts for the Company’s ordinary shares, with the option price being translated at the average exchange rate for the year of $1.6953: £1.