Vodafone 2004 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

118

Notes to the Consolidated Financial Statements continued

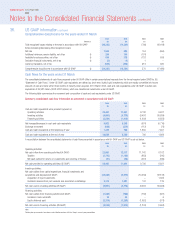

(e) Exceptional items

In the year ended 31 March 2003, the Group recorded an impairment charge under UK GAAP of £405 million in relation to the fixed assets of Japan Telecom.

Under US GAAP, the Group evaluated the recoverability of these fixed assets in accordance with the requirements of SFAS No. 144, “Accounting for the

Impairment or Disposal of Long-Lived Assets”, and determined that the carrying amount of these assets was recoverable. As a result, the UK GAAP impairment

charge of £405 million (£270 million net of minority interests) was not recognised under US GAAP during the year ended 31 March 2003. On disposal of Japan

Telecom in the year ended 31 March 2004, an incremental loss on sale of £476 million (£351 million net of minority interests) was recognised under US GAAP

resulting in a total loss on sale of £555 million (£399 million net of minority interests).

The reconciling item arising in the year ended 31 March 2002 represented the loss on sale of a business, which was sold fifteen months after the date of

acquisition. Under UK GAAP, the fair value of an acquired business can be amended up until the end of the financial year after acquisition. Under US GAAP, the

fair value can only be adjusted for one year following acquisition.

In addition, the exceptional non-operating items recorded under UK GAAP, disclosed in note 6, are reclassified as operating items under US GAAP and reduce

operating profit accordingly.

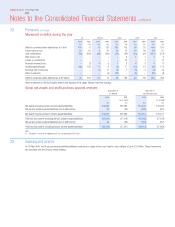

(f) Capitalised interest

Under UK GAAP, the Group’s policy is not to capitalise interest costs on borrowings in respect of the acquisition of tangible and intangible fixed assets. Under

US GAAP, the interest cost on borrowings used to finance the construction of network assets is capitalised during the period of construction until the date that

the asset is placed in service. Interest costs on borrowings to finance the acquisition of licences are also capitalised until the date that the related network

service is launched. Capitalised interest costs are amortised over the estimated useful lives of the related assets.

(g) Income taxes

Under UK GAAP, deferred tax is provided in full on timing differences that result in an obligation at the balance sheet date to pay more tax, or a right to pay less

tax, at a future date, at rates expected to apply when they crystallise based on current tax rates and law. Under US GAAP, deferred tax assets and liabilities are

provided in full on all temporary differences and a valuation adjustment is established in respect of those deferred tax assets where it is more likely than not that

some portion will not be realised. The most significant component of the income tax adjustment is due to the temporary difference between the assigned values

and tax values of intangible assets acquired in a business combination, which results in the recognition of a deferred tax liability under US GAAP. Under

UK GAAP, no deferred tax liability is recognised.

Under UK GAAP, the tax benefit received on the exercise of share options by employees, being the tax on the difference between the market value on the date of

exercise and the exercise price, is shown as a component of the tax charge for the period. Under US GAAP, the tax benefit for deductions not exceeding the

US GAAP accounting charge is recognised in earnings. Any incremental tax benefit from tax deductions in excess of the US GAAP accounting charge is shown

as a component of paid-in capital on issue of shares.

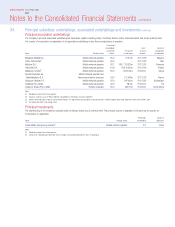

In addition, deferred tax assets are recognised for future deductions and utilisation of tax carry-forwards, subject to a valuation allowance. The valuation

allowance established against deferred tax assets as at 31 March 2004 was £11,150 million (2003: £11,446 million), the movement in the year being

£296 million. The valuation allowance is mainly in respect of tax losses amounting to £11,018 million (2003: £11,226 million) not recognised.

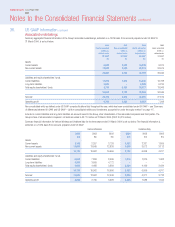

(h) Proposed dividends

Under UK GAAP, final dividends are included in the financial statements when recommended by the Board to the shareholders in respect of the results for a

financial year. Under US GAAP, dividends are included in the financial statements when declared by the Board.

(i) Other

Pension costs – Under both UK GAAP and US GAAP pension costs provide for future pension liabilities. There are differences, however, in the prescribed

methods of valuation, which give rise to GAAP adjustments to the pension cost and the pension prepayment/liability. In addition, in certain circumstances an

additional minimum liability must also be recognised with changes therein reported net of tax in other comprehensive income.

Capitalisation of computer software costs – Under UK GAAP, costs that are directly attributable to the development of computer software for continuing use in

the business, whether purchased from external sources or developed internally, are capitalised. Under US GAAP, data conversion costs and costs incurred during

the research stage of software projects are not capitalised.

Marketable securities – Under US GAAP, SFAS No. 115, “Accounting for Certain Investments in Debt and Equity Securities”, the Group classifies its marketable

equity securities with readily determinable fair values as available for sale and are stated at fair value with the unrealised loss or gain, net of deferred taxes,

reported in comprehensive income. Under UK GAAP such investments are generally carried at cost and reviewed for other than temporary impairment.

Minority interests – Where losses in a subsidiary undertaking attributable to the minority interest result in its interest being one in net liabilities, UK GAAP

requires a parent company make provision only to the extent it has a commercial or legal obligation to provide funding that may not be recoverable in respect of

the accumulated losses attributable to the minority interest. US GAAP requires all losses allocable to minority interests in excess of their interest in the equity of

the respective subsidiary to be charged to the majority shareholder.

36. US GAAP information continued