Vodafone 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

29

2004, compared with an expense of £576 million in the prior year, and a £1,568

million increase in operating profit before goodwill amortisation and exceptional items

partially offset by a £1,151 million increase in the goodwill amortisation charge. The

charges for goodwill amortisation, which do not affect the cash flows of the Group or

the ability of the Company to pay dividends, increased by 8% to £15,207 million,

principally as a result of the impact of foreign exchange movements.

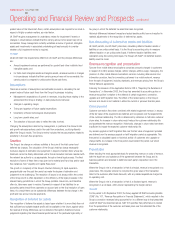

Expenses

Years ended 31 March

2004 2003

% of turnover % of turnover

Direct costs 39.9 38.9

Operating expenses 22.5 24.1

Depreciation and amortisation 13.6 13.6

The increase in direct costs as a percentage of turnover is principally due to an

increase in the proportion of acquisition and retention costs, primarily following the

acquisition of a number of service providers in the UK. Acquisition and retention costs

net of equipment revenues as a percentage of service revenues, for the Group’s

controlled mobile businesses, increased to 12.6%, compared with 12.3% for the

comparable period. This was partially offset by the disposal of Japan Telecom.

The principal reason for the improvement in operating expenses as a percentage of

turnover was the maintenance of network operating costs at a similar level to the

previous financial year, despite the growth in customer numbers and usage. Operating

expenses as a proportion of turnover also benefited from the disposal of Japan

Telecom.

Depreciation and amortisation charges, excluding goodwill amortisation, increased by

10% to £4,549 million from £4,141 million in the comparable period. The launch of

3G services in a number of countries resulted in approximately £0.3 billion of

additional depreciation and amortisation in the current year as 3G infrastructure and

licences have been brought into use.

Goodwill amortisation

Retranslating the goodwill amortisation charge for the year ended 31 March 2004 at

the average exchange rates applicable for the year ended 31 March 2003 would have

reduced the charge by £965 million to £14,242 million, with a corresponding

reduction in total Group operating loss.

Exceptional operating items

Net exceptional operating income for the year ended 31 March 2004 of £228 million

comprises £351 million of recoveries and provision releases in relation to a

contribution tax levy on Vodafone Italy that is no longer expected to be levied, net of

£123 million of restructuring costs principally in Vodafone UK. Net exceptional

operating charges of £576 million were charged in the year ended 31 March 2003,

comprising £485 million of impairment charges in relation to the Group’s interests in

Japan Telecom and Grupo Iusacell, and £91 million of reorganisation costs relating to

the integration of Vizzavi into the Group and related restructuring.

In accordance with accounting standards the Group regularly monitors the carrying

value of its fixed assets. A review was undertaken at 31 March 2004 to assess

whether the carrying value of assets was supported by the net present value of future

cash flows derived from assets using cash flow projections for each asset in respect

of the period to 31 March 2014. The results of the review undertaken at 31 March

2004 indicated that no impairment charge was necessary.

Exceptional non-operating items

Net exceptional non-operating charges for the year of £103 million principally relate to

a loss on disposal of the Japan Telecom fixed line operations. In the prior year, net

exceptional non-operating charges of £5 million mainly represented a profit on

disposal of fixed asset investments of £255 million, principally relating to the disposal

of the Group’s interest in Bergemann GmbH, through which the Group’s 8.2% stake in

Ruhrgas AG was held, offset by an impairment charge in respect of the Group’s

investment in China Mobile of £300 million.

Loss on ordinary activities before interest

The Group’s loss on ordinary activities before interest fell by 21% to £4,333 million

due a reduction in the total operating loss of £1,221 million offset by an increase in

charge for exceptional non-operating items of £98 million.

Net interest payable

Net interest payable, including the Group’s share of the net interest expense of joint

ventures and associated undertakings, decreased from £752 million for the year

ended 31 March 2003 to £714 million for the year ended 31 March 2004.

The Group net interest cost for the current year increased to £499 million, including

£215 million (2003: £55 million) relating to potential interest charges arising on

settlement of a number of outstanding tax issues, from £457 million for the prior year

and was covered 28 times by operating cash flow plus dividends received from

associated undertakings. The Group’s share of the net interest expense of associated

undertakings and joint ventures decreased from £295 million to £215 million,

principally as a result of the sale of the Group’s stake in Grupo Iusacell.

Taxation

The effective rate of taxation for the year ended was (62.5)% compared with (47.6)%

for the year ended 31 March 2003. The effective rate includes the impact of goodwill

amortisation and exceptional items, which may not be deductible for tax purposes.

Aside from the negative impact of non-tax deductible goodwill amortisation on the

effective tax rate, the Group’s tax charge has benefited further from the Group’s Italian

operations in the prior year, from the current year restructuring of the French

operations, from a fall in the Group’s weighted average tax rate and from other tax

incentives. These benefits have outweighed the absence of the one-off benefit arising

from the restructuring of the German group in the previous year.

Basic loss per share

Basic loss per share, after goodwill amortisation and exceptional items, improved from

a loss per share of 14.41 pence to a loss per share of 13.24 pence for the year

ended 31 March 2004. The loss per share includes a charge of 22.33 pence per

share (2003: 20.62 pence per share) in relation to the amortisation of goodwill and a

charge of 0.01 pence per share (2003: 0.60 pence per share) in relation to

exceptional items.