Vodafone 2004 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

99

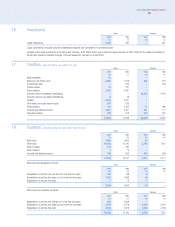

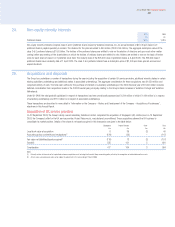

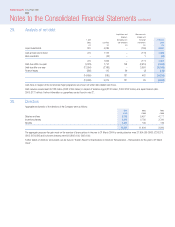

24. Non-equity minority interests

2004 2003

£m £m

Preferred shares 875 1,015

Non-equity minority interests comprise class D and E preferred shares issued by Vodafone Americas, Inc. An annual dividend of $51.43 per class D & E

preferred share is payable quarterly in arrears. The dividend for the year amounted to £50 million (2003: £55 million). The aggregate redemption value of the

class D & E preferred shares is $1.65 billion. The holders of the preferred shares are entitled to vote on the election of directors and upon each other matter

coming before any meeting of the shareholders on which the holders of ordinary shares are entitled to vote. Holders are entitled to vote on the basis of twelve

votes for each share of class D or E preferred stock held. The maturity date of the 825,000 class D preferred shares is 6 April 2020. The 825,000 class E

preferred shares have a maturity date of 1 April 2020. The class D & E preferred shares have a redemption price of $1,000 per share plus all accrued and

unpaid dividends.

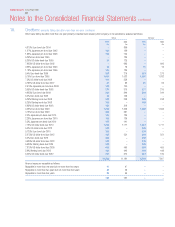

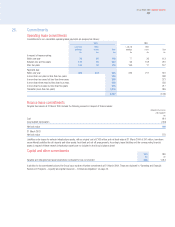

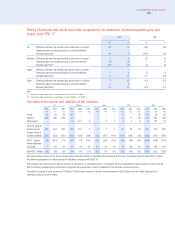

25. Acquisitions and disposals

The Group has undertaken a number of transactions during the year including the acquisition of certain UK service providers, additional minority stakes in certain

existing subsidiary undertakings and additional stakes in associated undertakings. The aggregate consideration for these acquisitions was £1,659 million and

comprised entirely of cash. The total cash outflow for the purchase of interests in subsidiary undertakings in the 2004 financial year of £2,064 million includes

deferred consideration from acquisitions made in the 2003 financial year, principally relating to the Group’s stake increases in Vodafone Portugal and Vodafone

Netherlands.

Under UK GAAP, the total goodwill capitalised in respect of transactions has been provisionally assessed as £1,544 million of which £1,434 million is in respect

of subsidiary undertakings and £110 million is in respect of associated undertakings.

These transactions are described in more detail in “Information on the Company – History and Development of the Company – Acquisitions of businesses”,

elsewhere in this Annual Report.

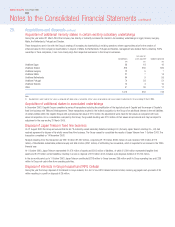

Acquisition of UK service providers

On 22 September 2003, the Group’s wholly owned subsidiary, Vodafone Limited, completed the acquisition of Singlepoint (4U) Limited, and on 19 September

2003, the Company’s offer for the UK service provider, Project Telecom plc, was declared unconditional. These acquisitions allowed the UK business to

consolidate its market position. Details of the share of net assets acquired in this transaction are given in the table below:

Singlepoint Project Telecom Other Total

£m £m £m £m

Local book value at acquisition 6 36 (2) 40

Accounting policy conformity and revaluations(1) (124) (23) –(147)

Fair value net (liabilities)/assets acquired(2) (118) 13 (2) (107)

Goodwill 535 151 5 691

Consideration 417 164 3 584

Notes:

(1) Primarily relates to the write off of capitalised customer acquisition costs to bring into line with Group accounting policy, offset by the recognition of related deferred tax assets.

(2) All fair values are provisional and may be subject to adjustment in the year ending 31 March 2005.