Vodafone 2004 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

108

Notes to the Consolidated Financial Statements continued

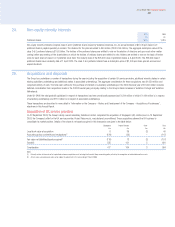

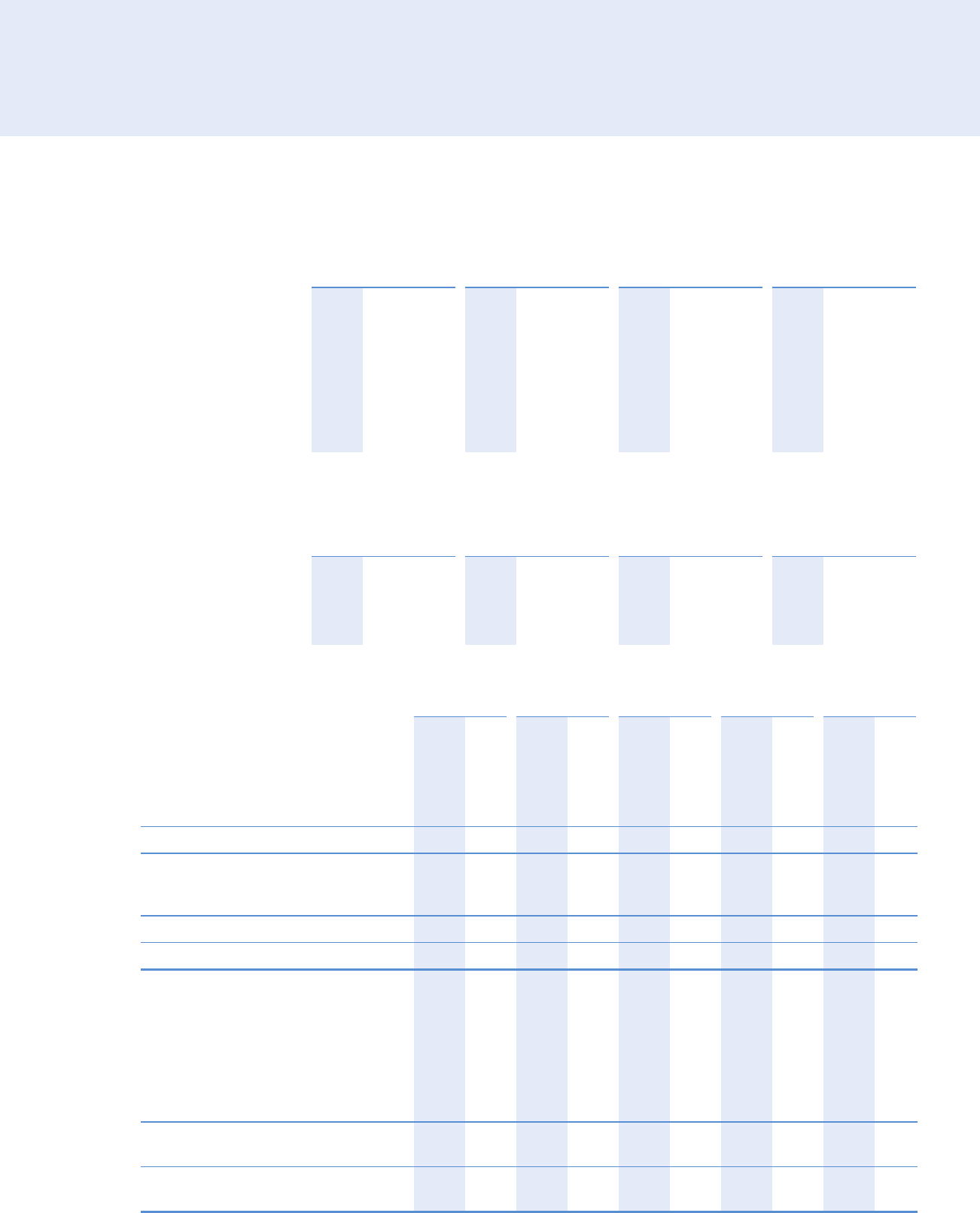

Additional disclosures in respect of FRS 17

The most recent full formal actuarial valuations for defined benefit schemes have been updated by qualified independent actuaries for the financial year ended

31 March 2004 to derive the FRS 17 disclosures below.

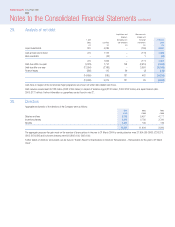

Major assumptions used

UK Germany Japan Other(2)

2004 2003 2002 2004 2003 2002 2004 2003 2002 2004 2003 2002

%%%%%%%%%%%%

Rate of inflation 2.5 2.5 2.5 2.0 1.5 2.0 –––2.0 1.8 2.0

Rate of increase in salaries 4.5 4.5 4.5 3.0 3.5 4.0 –(1) –(1) –(1) 3.0 3.5 4.2

Rate of increase in pensions

in payment 2.5 2.5 2.5 2.0 1.5 2.0 N/a N/a N/a 2.0 1.9 2.2

Rate of increase in deferred

pensions 2.5 2.5 2.5 –––N/a N/a N/a 2.0 1.9 2.2

Discount rate 5.5 5.4 6.0 5.3 5.3 6.3 2.3 1.5 2.5 4.8 5.3 6.2

Notes:

(1) Rate of increase in salaries in Japan is calculated in line with company specific experience.

(2) Figures shown for other schemes represent weighted average assumptions of individual schemes.

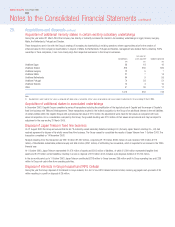

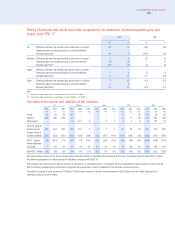

The expected rates of return at 31 March were:

UK Germany Japan Other

2004 2003 2002 2004 2003 2002 2004 2003 2002 2004 2003 2002

%%%%%%%%%%%%

Bonds 4.8 5.5 6.0 4.5 4.8 N/a 1.0 N/a N/a 4.6 4.9 5.5

Equities 7.5 8.0 8.0 6.8 7.3 N/a 4.0 N/a N/a 6.8 7.8 8.5

Other assets 4.0 4.5 6.0 2.0 2.8 6.0 –3.0 4.4 2.0 3.5 5.3

Charges that would have been made to the profit and loss account and consolidated statement of total

recognised gains and losses on compliance with FRS 17 and on the basis of the assumptions stated above

UK Germany Japan Other Total

2004 2003 2004 2003 2004 2003 2004 2003 2004 2003

£m £m £m £m £m £m £m £m £m £m

Operating profit:

Current service cost 32 24 821 10 12 44 40 94 97

Past service cost –––––51116

Gains and losses on curtailments –––––10 –1–11

Total charge to operating profit 32 24 821 10 27 45 42 95 114

Finance costs/(income):

Interest cost 22 19 910 126638 37

Expected return on pension scheme assets (22) (22) (5) (1) ––(2) (3) (29) (26)

Total (credit)/charge to finance (income)/costs –(3) 491243911

Total charge to loss before taxation 32 21 12 30 11 29 49 45 104 125

Consolidated statement of total recognised gains and

losses:

Actual return less expected return on pension

scheme assets (56) 95 (3) 1––(7) 14 (66) 110

Experience (gains) and losses arising on the

scheme liabilities ––3(7) (1) 1(3) (1) (1) (7)

Changes in assumptions underlying the present

value of the plan liabilities 16 37 11 11 (5) 16 (2) 520 69

Actuarial (gains)/losses on assets and liabilities (40) 132 11 5(6) 17 (12) 18 (47) 172

Exchange rate movements ––(1) 11 (3) 1(5) 4(9) 16

Total (gains)/losses recognised in statement of

total recognised gains and losses (40) 132 10 16 (9) 18 (17) 22 (56) 188

32. Pensions continued