Vodafone 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

61

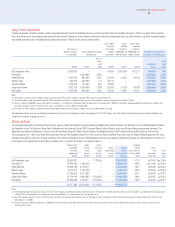

Long Term Incentives

Conditional awards of ordinary shares made to executive directors under the Vodafone Group Long Term Incentive Plan and Vodafone Group Plc 1999 Long Term Stock Incentive

Plan, and dividends on those shares paid under the terms of the Company’s scrip dividend scheme and dividend reinvestment plan, are shown below. Long Term Incentive shares

that vested and were sold or transferred during the year ended 31 March 2004 are also shown below.

Shares added Shares Shares sold or

during the forfeited transferred

Total interest in year through in respect of in respect of

Long Term incentives Shares conditionally awarded dividend 2000/2001 and 2000/20001 and Total interest in Long Term

at 1 April 2003(1) during the year reinvestment 2002/03 awards 2002/03 awards Incentives at 31 March 2004

Value at

date of Total

award(2) Number of value(4)

Number Number £’000 Number Number Number(3) shares £’000

Sir Christopher Gent 2,963,018 ––41,899 2,031,684 422,571 550,662 709

Arun Sarin – 1,844,863 2,200 –––1,844,863 2,375

Peter Bamford 1,441,524 882,000 1,052 20,294 74,582 43,614 2,225,622 2,865

Vittorio Colao 694,022 648,868 774 10,175 ––1,353,065 1,742

Thomas Geitner 1,016,319 781,633 932 14,899 ––1,812,851 2,334

Julian Horn-Smith 1,822,879 1,080,000 1,288 25,886 74,583 43,613 2,810,569 3,619

Ken Hydon 1,441,524 882,000 1,052 20,294 74,582 43,614 2,225,622 2,865

Notes:

(1) Restricted share awards under the Vodafone Group Long Term Incentive Plan and the Vodafone Group Plc 1999 Long Term Stock Incentive Plan.

(2) The value of awards under the Vodafone Group Plc 1999 Long Term Incentive Plan is based on the purchase price of the Company’s ordinary shares on 30 July 2003 of 119.25p.

(3) Shares in respect of 2000/2001 awards were sold or transferred on 1 July 2003 and 13 November 2003. The balance of Sir Christopher Gent’s 2002/03 share awards, following application of performance conditions and

pro-ration in respect of service to retirement, were sold or transferred on 14 January 2004 and 8 April 2004.

(4) The value at 31 March 2004 is calculated using the closing middle market price of the Company’s ordinary shares at 31 March 2004 of 128.75p.

The aggregate number of shares conditionally awarded during the year to the Company‘s senior management is 2,373,014 shares. For a description of the performance and vesting conditions see

“Long term incentives”on pages 56 and 57.

Share options

The following information summarises the directors’ options under the Vodafone Group Plc Savings Related Share Option Scheme, the Vodafone Group 1998 Sharesave Scheme,

the Vodafone Group Plc Executive Share Option Scheme and the Vodafone Group 1998 Company Share Option Scheme, which are all Inland Revenue approved schemes. The

table also summarises the directors’ options under the Vodafone Group Plc Share Option Scheme, the Vodafone Group 1998 Executive Share Option Scheme, the AirTouch

Communications, Inc. 1993 Long Term Stock Incentive Plan and the Vodafone Group Plc 1999 Long Term Stock Incentive Plan, which are not Inland Revenue approved. No other

directors have options under any of these schemes. Only under the Vodafone Group 1998 Sharesave Scheme may shares be offered at a discount in future grants of options. For

a description of the performance and vesting conditions see “Long term incentives”on pages 56 and 57.

Options held at Options Options Weighted

1 April 2003 granted exercised Options Options average Earliest

or date of during during lapsed during held at exercise price at date Latest

appointment(1) the year(1) the year the year 31 March 2004 31 March 2004 from which expiry

Number Number Number Number Number Pence exercisable date

Sir Christopher Gent 25,365,387 – 178,000 – 25,187,387 167.6 Jul 2001 Dec 2004

Arun Sarin(2)(3) 11,250,000 7,396,164 ––

18,646,164 154.0 Jun 1999 Jul 2013

Peter Bamford 12,204,753 3,739,677 ––15,944,430 155.1 Jul 2000 Jul 2013

Vittorio Colao 3,011,611 2,751,202 ––5,762,813 108.8 Jul 2004 Jul 2013

Thomas Geitner 11,196,479 3,373,582 ––

14,570,061 160.7 Jul 2003 Jul 2013

Julian Horn-Smith 15,794,101 4,654,088 1,254,500 –19,193,689 149.9 Jul 2001 Jul 2013

Ken Hydon 12,695,553 3,739,677 1,044,000 – 15,391,230 156.7 Jul 2001 Jul 2013

91,517,884 25,654,390 2,476,500 – 114,695,774

Notes:

(1) The weighted average exercise price of options over shares in the Company granted during the year and listed above is 119.25 pence. The earliest date from which they are exercisable is July 2006 and the latest expiry date

is 29 July 2013. For a description of the performance and vesting conditions see “Long term incentives”on pages 56 and 57.

(2) Some of the options held by Arun Sarin are held in the form of ADSs, each representing ten ordinary shares of the Company, which are traded on the New York Stock Exchange. The number of ADSs over which Arun Sarin

holds options is 1,125,000.

(3) The terms of the share options granted over 11,250,000 shares in 1999 to Arun Sarin allow exercise until the earlier of the date on which he ceases to be a director of the Company and the seventh anniversary of the

respective dates of grant.