Vodafone 2004 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

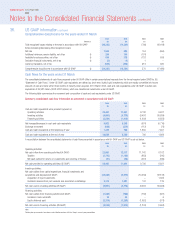

UK Germany Japan

2004 2003 2002 2004 2003 2002 2004 2003 2002

£m £m £m £m £m £m £m £m £m

Change in plans’ assets

Fair value of assets at 1 April 264 229 178 86 12111

Actual return/(loss) on plans’ assets 77 (73) (7) 7–(1) 1––

Employer’s contributions 88 106 55 57 88 8 22 36 10

Members’ contributions 10 99––––––

Benefits paid (estimated) (6) (7) (6) (9) (9) (8) (22) (36) (10)

Exchange movement –––(5) 6 – –––

Fair value of assets at 31 March 433 264 229 136 86 1 211

Funded status (24) (63) (29) (22) (59) (118) (33) (126) (114)

Unrecognised net loss 203 195 80 57 46 31 324 21

Prior period service cost 111–––55 –

Net amount recognised 180 133 52 35 (13) (87) (25) (97) (93)

Amounts recognised in the statement of

financial position

Prepaid/(accrued) benefit cost 180 (15) 11 (11) (55) (112) (25) (105) (99)

Intangible asset –11––––5 –

Other comprehensive income –147 40 46 42 25 –36

Net amount recognised 180 133 52 35 (13) (87) (25) (97) (93)

Weighted average actuarial assumptions

used to determine benefit obligations

Discount rate 5.5% 5.9% 6.5% 5.3% 5.3% 6.0% 2.3% 1.5% 2.5%

Rate of compensation increase 4.5% 4.0% 4.0% 3.0% 2.0% 2.5% –––

Weighted average actuarial assumptions used

to determine net periodic benefit cost

Discount rate 5.9% 6.5% 5.9% 5.3% 6.0% 6.5% 1.5% 2.5% 3.0%

Rate of compensation increase 4.0% 4.0% 4.0% 2.0% 2.5% 2.5% –––

Expected long-term return on plan assets 7.5% 8.0% 6.5% 5.3% 6.0% 6.0% 3.0% 4.4% 4.4%

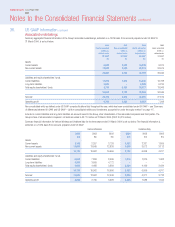

37. Changes in accounting standards

UK standards

UITF 38, “Accounting for ESOP Trusts”

During the financial year, the UK Accounting Standards Board (“ASB”) issued UITF 38 “Accounting for ESOP Trusts”which supersedes UITF 13 and requires

presentation of an entity’s own shares held in an ESOP trust to be deducted in arriving at shareholders’ funds as opposed to being recognised as assets. The Group

has early adopted this Abstract in the preparation of its Consolidated Financial Statements for the year ended 31 March 2004, and has restated its balance sheets at

31 March 2003 and 31 March 2002 accordingly.

The impact of adopting UITF 38 was to reduce investments and shareholders’ funds by £41 million as at 31 March 2003. In addition, the cash outflow on

purchasing own shares in relation to employee share schemes has been reclassified from “Purchase of investments”within “Net cash outflow for capital

expenditure and financial investment”to its own line within financing activities in the Statement of Consolidated Cash Flows.

Loss on ordinary activities before taxation in the 2002, 2003 and 2004 financial years has not been impacted by the adoption of UITF 38, however, the reported

value of fixed asset investments, net assets and equity shareholders’ funds would be £48 million higher at 31 March 2004 had the Group not adopted UITF 38.

Application Note G to FRS 5, “Reporting the Substance of Transactions”

In November 2003, the ASB issued this application note setting out principles of revenue recognition. It specifically addresses five types of arrangement, which

give rise to turnover and have been subject to differing interpretations in practice. Following the issuance of the Application Note, the Group has amended its

accounting policy on revenue recognition in relation to the deferral of certain equipment, connection, upgrade and tariff migration fees. The effect of the revised

policy on the Group’s turnover is not material in either the current or previous financial years.

FRS 20 (IFRS 2) “Share-based Payment”

In April 2004, the ASB issued FRS 20 (IFRS 2) “Share-based Payment”, which is applicable for accounting periods beginning on or after 1 January 2005.

Current UK GAAP requires that a charge for employee share schemes should be made based on the intrinsic value at grant date and as such no expense is

recognised for a number of share based payment transactions, such as the grant of share options to employees at market value. The new standard requires the

Annual Report 2004 Vodafone Group Plc

125