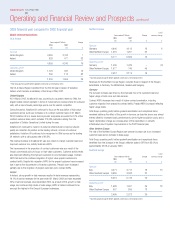

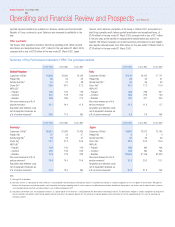

Vodafone 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

33

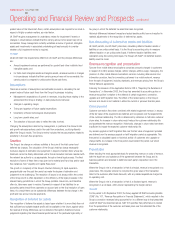

Northern Europe

Local

Years ended 31 March Change currency change

2004 2003

£m £m % %

Turnover

Germany

– Voice services 4,123 3,699 11 3

– Data services 895 728 23 14

– Total service revenue 5,018 4,427 13 5

– Equipment and other 386 219 76 63

5,404 4,646 16 8

Other Northern Europe 1,949 1,531 27

7,353 6,177 19

Operating profit*

Germany 1,741 1,435 21 9

Other Northern Europe 1,451 1,077 35

3,192 2,512 27

* Total Group operating profit before goodwill amortisation and exceptional items

Germany

Vodafone Germany performed well in the year, further improving its operational

performance.

Turnover in Germany increased by 8% when measured in local currency, reflecting the

increase in the customer base offset by marginally lower ARPU. Germany represents

the largest mobile market in Europe in terms of customer numbers and,

notwithstanding a 10% growth in the market for the 2004 financial year, penetration,

at an estimated 80%, is still relatively low. Vodafone Germany’s customer base

increased by 9% in the 2004 financial year. The mix of contract customers increased

from 47% at 31 March 2003 to 49% at 31 March 2004, although new contract

customers have been, in general, lower usage customers than the existing customer

base. As a result, contract ARPU fell from a519 for the 12 months ended 31 March

2003 to 1494 for the 12 months ended 31 March 2004. Prepaid ARPU remained

stable at 1130 during the year after increasing over the course of the prior year. Data

revenues increased by 14% when measured in local currency and represented 17.4%

of service revenues, up from 16.4% in the previous financial year, primarily due to

Vodafone live!™ Increased investment in acquisition and retention has contributed to

the improved churn rate and high customer growth.

Operating profit before goodwill amortisation and exceptional items improved by £306

million to £1,741 million, principally driven by cost efficiencies in the second half of

the year, particularly in network and IT costs. Acquisition costs as a percentage of

turnover were also lower over the Christmas period, in comparison to the same period

in the prior financial year, due to lower handset subsidies and trade commissions.

These benefits were partially offset by higher depreciation and licence amortisation

costs as the 3G network was brought into use in February 2004.

Other Northern Europe

Proportionate customers for the other markets in the Northern Europe region

increased by 11% to 15,575,000 in the period, including the effect of stake increases

in the Netherlands, from 97.2% to 99.9%, and Hungary, from 83.8% to 87.9%.

The increase in turnover was primarily as a result of growth in the Netherlands and

Hungary. In the Netherlands, the increase in revenues was principally driven by an

increased contract customer base and higher data service usage and revenue. In

Hungary, turnover growth followed the increase in the customer base.

Operating profit, before goodwill amortisation and exceptional items, grew principally as a

result of an increase in the profits of the Group’s associated undertaking, SFR. This

business reported a strong financial performance, with revenue increasing as a result of

an 8% increase in the customer base to 14,370,000, and higher data revenue. Blended

ARPU was broadly unchanged from the previous year. The reported results also benefited

from the full year impact of an effective stake increase in the mobile business of SFR

from 31.9% to 43.9% in the second half of the previous financial year.

In the Netherlands, the operating profit before goodwill amortisation and exceptional

items increased following the growth in the customer base, partially offset by higher

acquisition and retention costs. In Sweden, operating expenses increased significantly

as a result of the cost of building out 3G network coverage, which led to a decrease in

operating profit before goodwill amortisation and exceptional items.

Partner Network Agreements were signed in the year with Og Fjarskipti in Iceland, Bite˙

GSM in Lithuania and LuxGSM in Luxembourg.

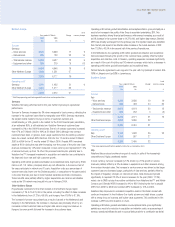

Southern Europe

Local

Years ended 31 March Change currency change

2004 2003

£m £m % %

Turnover

Italy

– Voice services 4,346 3,656 19 10

– Data services 668 463 44 34

– Total service revenue 5,014 4,119 22 13

– Equipment and other 262 252 4 (3)

5,276 4,371 21 12

Other Southern Europe 4,500 3,680 22

9,776 8,051 21

Operating profit*

Italy 2,143 1,588 35 23

Other Southern Europe 1,156 907 27

3,299 2,495 32

* Total Group operating profit before goodwill amortisation and exceptional items

Italy

Vodafone Italy produced another strong set of results, in spite of the increasingly

competitive and highly penetrated market.

In local currency, turnover increased by 12% driven by a 13% growth in service

revenues, partially offset by a 3% decrease in equipment and other revenues arising

from reduced handset sales. The increase in service revenue was driven by the larger

customer base and increased usage, particularly of data services, partially offset by

the impact of regulatory changes on interconnect rates. Data revenues improved

significantly, to represent 13.3% of service revenues for the year (2003: 11.3%),

mainly due to SMS but also the positive contribution from Vodafone live!™ and Mobile

Connect card. Blended ARPU increased by 4% to 1361 following the rise in prepaid

ARPU from 1298 to 1309 and contract ARPU increased by 10% to 1900.

Vodafone Italy responded to increased competition levels in the Italian market with

continued investment in the Vodafone One loyalty scheme and retail stores, coupled

with a strong focus on business and higher value customers. This contributed to the

increase in ARPU and the reduction in churn.

Operating profit before goodwill amortisation and exceptional items grew significantly,

partially as a result of a reduction in acquisition and retention costs, as a percentage of

revenue, operational efficiencies and no accrual being made for a contribution tax levied