Vodafone 2004 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

104

Notes to the Consolidated Financial Statements continued

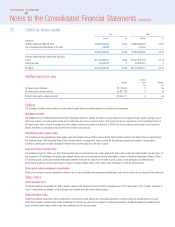

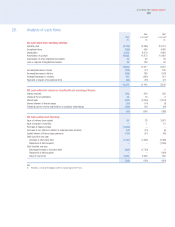

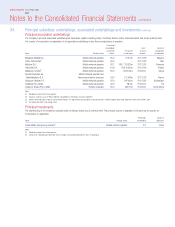

29. Analysis of net debt

Acquisitions and Other non-cash

disposals changes and

1 April (excluding cash exchange 31 March

2003 Cash flow and overdrafts) movements 2004

£m £m £m £m £m

Liquid investments 291 4,286 –(196) 4,381

Cash at bank and in hand 475 1,112 – (178) 1,409

Bank overdrafts –(43) – 1 (42)

475 1,069 – (177) 1,367

Debt due within one year (1,323) 1,791 148 (2,616) (2,000)

Debt due after one year (12,994) (2,186) – 3,080 (12,100)

Finance leases (288) 115 39 (2) (136)

(14,605) (280) 187 462 (14,236)

(13,839) 5,075 187 89 (8,488)

Cash flows in respect of the Commercial Paper programme are shown net within debt-related cash flows.

Debt includes secured debt of £132 million (2003: £364 million) in respect of Vodafone Egypt (£132 million, 2003: £192 million) and Japan Telecom (£nil,

2003: £172 million). Further information on guarantees can be found in note 27.

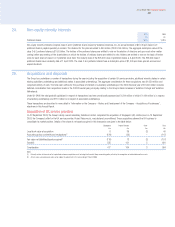

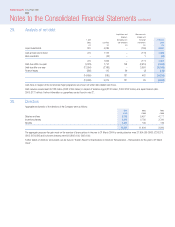

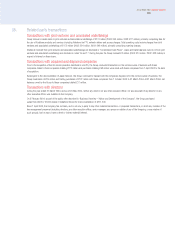

30. Directors

Aggregate emoluments of the directors of the Company were as follows:

2004 2003 2002

£’000 £’000 £’000

Salaries and fees 6,752 5,457 4,777

Incentive schemes 5,418 5,738 3,760

Benefits 1,371 709 749

13,541 11,904 9,286

The aggregate gross pre-tax gain made on the exercise of share options in the year to 31 March 2004 by serving directors were £1,904,000 (2003: £226,873,

2002: £129,328) and by former directors were £nil (2003: £nil, 2002: £nil).

Further details of directors’ emoluments can be found in “Board’s Report to Shareholders on Directors’ Remuneration – Remuneration for the year to 31 March

2004”.