Vodafone 2004 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

126

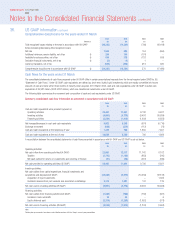

Notes to the Consolidated Financial Statements continued

Group to recognise a charge for certain share-based transactions granted after 7 November 2002, equal to the fair value of the share or share option at the

date of the grant over the vesting period.

FRS 21 (IAS 10) “Events after the Balance Sheet Date”

In May 2004, the ASB issued FRS 21 (IAS 10) “Events after the Balance Sheet Date”, which is applicable for accounting periods beginning on or after 1 January

2005. The adoption of this standard will result in equity dividends, which are currently declared after the balance sheet date but recognised in the Consolidated

Financial Statements at the balance sheet date, being derecognised at the balance sheet date. This would reduce the Group’s retained loss under UK GAAP for

the 2002, 2003 and 2004 financial years by £47 million, £101 million and £116 million, respectively, and increase the Group’s net assets and equity

shareholders’ funds under UK GAAP at 31 March 2004 by £728 million (2003: £612 million).

US Standards

SFAS No. 143, “Accounting for Asset Retirement Obligations”

In June 2001, the FASB issued SFAS No. 143. SFAS No. 143 is effective for financial years beginning after 15 June 2002 and requires that the fair value of a

liability for an asset retirement obligation be recognised in the period in which it is incurred if a reasonable estimate of fair value can be made. The associated

asset retirement costs are capitalised as part of the carrying amount of the long-lived asset. The Group adopted this statement effective 1 April 2003.

The Group is subject to asset retirement obligations in relation to certain operating lease agreements relating to sites on which the Group’s network

infrastructure is positioned. These leases can include legal obligations to restore the leased site at the end of the lease term. Based on the Group’s historical

experience it is expected that a high majority of current sites will continue to be of importance to the network and that, where possible, the Group will continue

to renew leases on these sites. The adoption of SFAS No. 143 did not have a material impact on the Group’s reported financial position and results under

US GAAP.

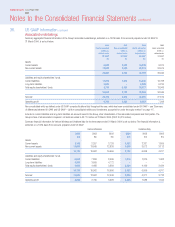

SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of both Liabilities and Equity”

In May 2003, the FASB issued SFAS No. 150. The adoption of SFAS No. 150 on 1 April 2004 resulted in the Group’s class D & E preferred shares issued by

Vodafone Americas, Inc. with a carrying value of £875 million, currently classified as non-equity minority interests, being classified as long term liabilities. The

measurement provisions of SFAS No. 150 related to these preferred shares have, however, been indefinitely deferred. Applying the measurement provisions of

SFAS No. 150 would increase the carrying value as of 1 April 2004 by £23 million.

SFAS No. 132R, “Employers’ Disclosures about Pensions and Other Postretirement Benefits”

In December 2003, the FASB issued SFAS No. 132R (revised 2003), to improve financial statement disclosures for defined benefit plans. This standard requires

that companies provide more details about their plan assets, benefit obligations, cash flows, benefit costs and other relevant information. The provisions of

SFAS 132R are effective for periods ending after 15 December 2003 and have been adopted for domestic plans. However, certain provisions related to non-UK

defined benefit plans are not effective until periods ended after 15 June 2004.

FASB Interpretation No. 46 (revised December 2003) (“FIN 46”), “Consolidation of Variable Interest Entities”

In January 2003, the FASB issued FIN 46. FIN 46 expands upon existing US accounting guidance that prescribes when an entity should consolidate the assets,

liabilities and results of a variable interest entity (“VIE”). A VIE is an entity whose equity is not sufficient to supports its activities without additional subordinated

financial support or its equity investors lack certain characteristics of a controlling financial interest. Under FIN 46 an enterprise shall consolidate a VIE if the

enterprise has a variable interest that will absorb a majority of the VIE’s expected losses or receive the majority of the VIE’s expected residual returns, or both. In

December 2003, the FASB issued a revised FIN 46 to modify some provisions and exempt certain entities. Adoption of FIN 46 and its revision has not impacted

the Group’s reported financial position and results under US GAAP.

EITF 00-21, “Accounting for Revenue Arrangements with Multiple element deliverables”

In November 2002, the Emerging Issues Task Force (“EITF”) of the FASB reached a consensus on EITF 00-21. EITF 00-21 provides guidance on how to account

for arrangements that may involve multiple revenue-generating activities, for example, the delivery of products or performance of services, and/or rights to use

other assets. The requirements of EITF 00-21 will be applicable to agreements entered into for periods beginning after 15 June 2003. The prospective adoption

of EITF 00-21 on 1 October 2003 has not impacted the Group’s reported financial position and results under US GAAP. However, as contracts entered into

before 1 October 2003 are accounted for in accordance with SAB 101, the related deferred connection revenues, and related costs, will continue to be

recognised over the remaining life of the customer relationship. At 31 March 2004, deferred revenue accounted for in accordance with SAB 101 amounted to

£3,737 million.

International Financial Reporting Standards

Introduction

The Group is preparing for the adoption of International Financial Reporting Standards (“IFRS”) as its primary accounting basis, following the adoption of

Regulation No. 1606/2002 by the European Parliament on 19 July 2002. IFRS will apply for the first time in the Group’s Annual Report for the year ending

31 March 2006.

37. Changes in accounting standards continued