Vodafone 2004 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

106

Notes to the Consolidated Financial Statements continued

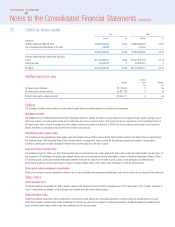

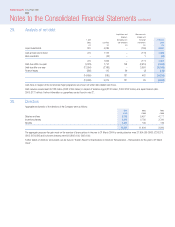

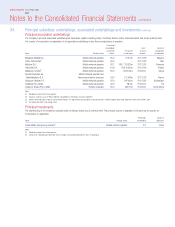

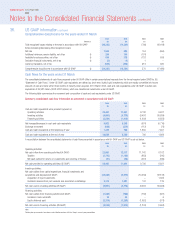

32. Pensions

As at 31 March 2004, the Group operated a number of pension plans for the benefit of its employees throughout the world, which vary with conditions and

practices in the countries concerned. All the Group’s pension plans are provided either through defined benefit or defined contribution arrangements. Defined

benefit schemes provide benefits based on the employees’ length of pensionable service and their final pensionable salary or other criteria. Defined contribution

schemes offer employees individual funds that are converted into benefits at the time of retirement.

Further details on the three principal defined benefit pension schemes, in the United Kingdom, Germany and Japan are shown below. In addition to the principal

schemes, the Group operates defined benefit schemes in Greece, Ireland, Italy, Sweden and the United States. Defined contribution pension schemes are

provided in Australia, Egypt, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, New Zealand, Portugal, Spain, the United Kingdom and the

United States. There is a post retirement medical plan in the United States for a small closed group of participants.

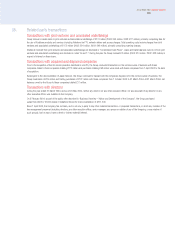

The Group accounts for its pension schemes in accordance with SSAP 24, “Accounting for pension costs”. Scheme liabilities are assessed by independent

actuaries using the projected unit funding method using the principal actuarial assumptions as set out in “Pension disclosures required under SSAP 24”below.

Assets are shown at market value. Additional disclosures required under the transitional provisions of FRS 17, “Retirement benefits”are also set out below.

The bases of calculation under FRS 17 are significantly different to SSAP 24. Whilst both require use of formal actuarial valuations, FRS 17 requires the use of a

different set of underlying assumptions and also specifies more frequent valuation updates. Accordingly, if FRS 17 is implemented in full, the Group’s reported

pension costs and balance sheet position are likely to change.

United Kingdom

The majority of the UK employees are members of the Vodafone Group Pension Scheme (the “main scheme”). This is a tax approved scheme, the assets of

which are held in a separate trustee-administered fund. In addition there is an internally funded unapproved defined benefit plan in place for a small number of

senior executives. The Group also operates a funded unapproved defined contribution scheme for certain senior executives. The pension cost for all three

arrangements is included in the summary information shown below.

The main scheme is subject to quarterly funding updates by independent actuaries and to formal actuarial valuations at least every three years. The most recent

formal valuation of this scheme was carried out as at 31 March 2001.

At 31 March 2001, the market valuation of the main scheme assets of £177 million was sufficient to cover 84% of the benefits accrued to members using the

assumptions set out within “Pension disclosures required under SSAP 24”. The funding level as at 31 March 2003 was reviewed and as a result the UK

companies made special lump sum contributions of £50 million during the 2004 financial year, in addition to ongoing contributions of 13% of pensionable

earnings. The variation in regular cost under SSAP 24 was also changed as a result of the review. The contributions payable over the coming year will be

determined by the results of the formal valuation of the main scheme as at 31 March 2004 which is currently underway. The updated funding level as at

31 March 2004 has been estimated as 116%, using financial assumptions consistent with those of the last formal valuation. An accurate figure for this funding

level, including the impact of any changes in demographic assumptions, will be obtained once the next valuation is completed.

As a result of the acceleration of payments, a net prepayment of £193 million (2003: £136 million) is included in debtors due after more than one year,

representing the excess of the amounts funded over accumulated pension costs.

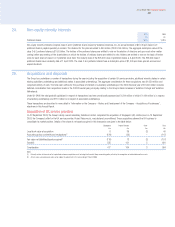

Germany

There are a number of separate pension and associated arrangements in Germany, one of which is fully externally financed and a number of which are funded

through a trust arrangement. The German schemes are subject to annual valuations, with the last formal valuations having been completed as at 31 March

2004.

At 31 March 2004, the total pension liability for benefits funded through the trust arrangement was £171 million, using the assumptions as set out within

“Additional disclosures in respect of FRS 17”, and the market value of the trust arrangement was £155 million representing a funding level of 91%. The total

pension liability for the externally funded benefits was £10 million and the market value of the scheme’s assets for the externally funded benefits also amounted

to £10 million representing a funding level of 100%. A contribution of £54 million was made into the trust arrangement and £2 million was made into the

externally funded arrangement during the 2004 financial year.

An amount of £14 million (2003: £64 million) is included in provisions for liabilities and charges, representing the excess of the accumulated pension costs over

the amounts funded externally and reflects the internally funded nature of part of the principal arrangements.

Japan

There are a number of separate pension schemes in relation to employees in Japan and these are not generally funded, with any shortfall in external funding

being accrued within provisions.

The Japanese schemes are subject to valuations at intervals of between one and two years, with the last formal valuations being prepared at 31 March 2002. At

31 March 2002, the total pension liability for the internally funded benefits was £110 million using the assumptions set out within “Pension disclosures required

under SSAP 24”. The total pension liability for the externally funded benefits was £5 million and the market value of the scheme’s assets for the externally

funded benefits amounted to £1 million representing a percentage cover of accrued benefits for members of 20%.

An amount of £26 million (2003: £88 million) is included in provisions for liabilities and charges, representing the excess of the accumulated pension costs over

the amounts funded externally and reflects the internally funded nature of the principal arrangements.