Vodafone 2004 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

117

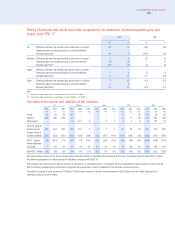

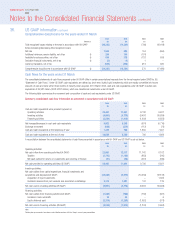

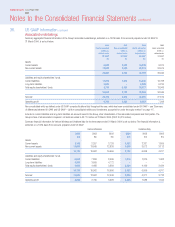

Summary of differences between UK GAAP and US GAAP

The Consolidated Financial Statements are prepared in accordance with UK GAAP, which differ in certain material respects from US GAAP. The differences that

are material to the Group relate to the following items.

(a) Non-consolidated entities and investments accounted for under the equity method

Under UK GAAP, the results and assets of Vodafone Italy have been consolidated in the Group’s financial statements from 12 April 2000. Under US GAAP, as a

result of significant participating rights held by minority shareholders, the Group’s interest in Vodafone Italy has been accounted for as an associated undertaking

under the equity method of accounting. Under UK GAAP, Vodafone Spain has been consolidated in the Group’s financial statements from 29 December 2000.

Under US GAAP, the Group’s interests in Vodafone Spain, have been accounted for as an associated undertaking under the equity method of accounting up to

29 June 2001 and consolidated thereafter, following the completion of the acquisition of a further 17.8% shareholding.

Under UK GAAP, charges for interest and taxation for associated undertakings are aggregated within the Group interest and taxation amounts shown on the face

of the consolidated profit and loss account. The Group’s share of the turnover of associated undertakings is also permitted to be disclosed on the face of the

consolidated profit and loss account. US GAAP does not permit the Group’s share of turnover of associated undertakings to be disclosed on the face of the

consolidated income statement.

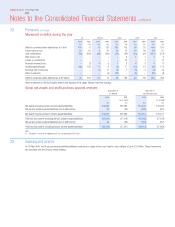

Equity accounting for Vodafone Italy and Vodafone Spain under US GAAP results in the Group operating loss, Group net interest payable, Group taxation payable

and equity minority interests being less than/(more than) the equivalent UK GAAP amount by £1,325 million, £(55) million, £583 million and £459 million (2003:

£1,955 million, £(45) million, £478 million and £264 million; 2002: £2,060 million, £(9) million, £402 million and £249 million), respectively. Equity accounting

for Vodafone Italy and Vodafone Spain results in the Group’s share of the operating loss, interest payable and taxation payable of associated undertakings being

greater/(lower) under US GAAP than UK GAAP by £1,907 million, £(42) million and £448 million (2003: £2,305 million, £(34) million and £367 million; 2002:

£2,402 million, £(7) million and £307 million), respectively. The Group’s investment in the entity consolidated under UK GAAP but equity accounted under

US GAAP at 31 March 2004 was £24,028 million (2003: £21,512 million).

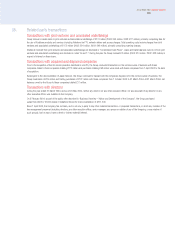

(b) Connection revenues and costs

The Group’s UK GAAP accounting policy on revenue recognition was amended during the year in relation to the deferral of certain equipment, connection,

upgrade and tariff migration fees following the issuance of Application Note G to FRS 5 “Reporting the Substance of Transactions”. Following the prospective

adoption of EITF 00-21, “Accounting for Revenue Arrangements with Multiple Deliverables” on 1 October 2003 under US GAAP the Group’s UK and US GAAP

accounting policies have been substantially aligned.

For transactions prior to 1 October 2003, connection revenues under US GAAP are recognised over the period that a customer is expected to remain connected

to a network. Connection costs directly attributable to the income deferred are recognised over the same period. Where connection costs exceed connection

revenues, the excess costs were charged in the profit and loss account immediately upon connection. The balances of deferred revenue and deferred charges as

of 30 September 2003 will continue to be recognised over the period that a customer is expected to remain connected to a network.

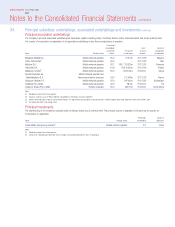

(c) Goodwill and other intangible assets

Under UK GAAP, the policy followed prior to the introduction of FRS 10, “Goodwill and Intangible Assets”, which is effective for accounting periods ended on or

after 23 December 1998 and was adopted on a prospective basis, was to write off goodwill against shareholders’ equity in the year of acquisition. FRS 10

requires goodwill to be capitalised and amortised over its estimated useful economic life. Under US GAAP, following the introduction of SFAS No. 142, “Goodwill

and Other Intangible Assets”, which was effective for accounting periods starting after 15 December 2001 and, transitionally, for acquisitions completed after

30 June 2001, goodwill and intangible assets with indefinite lives are capitalised and not amortised, but tested for impairment, at least annually, in accordance

with SFAS No. 142. Intangible assets with finite lives continue to be capitalised and amortised over their useful economic lives.

The Group believes that the nature of the licences and the related goodwill acquired in business combinations is substantially indistinguishable. In acquisitions

where the primary asset is a licence, the Group, therefore, allocates the surplus of the purchase price over the fair value attributed to the share of net assets

acquired to licences. In a number of the Group’s previous acquisitions, the primary assets acquired were licences to provide mobile telecommunications

services. As a result of the adoption of SFAS 142 and these considerations, on 1 April 2002, £33,664 million of goodwill was reclassified as licences. In

accordance with the provision of SFAS No. 109, “Accounting for Income Taxes”, a related deferred tax liability and a corresponding increase to licence value of

£19,077 million has also been recognised related to the resulting difference in the tax basis versus the book basis of the licences.

Under UK GAAP and US GAAP the purchase price of a transaction accounted for as an acquisition is based on the fair value of the consideration. In the case of

share consideration, under UK GAAP the fair value of such consideration is based on the share price at completion of the acquisition or the date when the

transaction becomes unconditional. Under US GAAP the fair value of the share consideration is based on the average share price over a reasonable period of

time before and after the proposed acquisition is agreed to and announced. This has resulted in a difference in the fair value of the consideration for certain

acquisitions and consequently in the amount of goodwill capitalised under UK GAAP and US GAAP.

Under UK GAAP, costs incurred in reorganising acquired businesses are charged to the profit and loss account as post-acquisition expenses. Under US GAAP,

certain of such costs are considered in the allocation of purchase consideration.

(d) Licence fee amortisation

Under UK GAAP, the Group has adopted a policy of amortising licence fees in proportion to the capacity of the network during the start up period and then on a

straight line basis. Under US GAAP, licence fees are amortised on a straight line basis from the date that operations commence to the date the licence expires.