Vodafone 2004 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

31

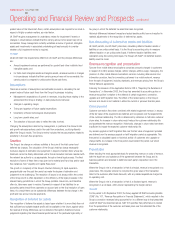

For the 2002 financial year, exceptional operating costs of £5,408 million comprised

impairment charges of £5,100 million in relation to the carrying value of goodwill for

Arcor, Cegetel, Grupo Iusacell and Japan Telecom, and £222 million representing the

Group’s share of exceptional items of its associated undertakings and joint ventures,

comprising £107 million of, principally, asset write downs in Vodafone Japan and

£115 million of reorganisation costs in Verizon Wireless and Vizzavi. A further £86

million of reorganisation costs was also incurred in the 2002 financial year, principally

in respect of the Group’s operations in Australia and the UK.

In accordance with applicable accounting standards, the Group regularly monitors the

carrying value of its fixed assets. A review was undertaken at 31 March 2003 to

assess whether the carrying value of assets was supported by the net present value of

future cash flows derived from assets using cash flow projections for each asset in

respect of the period to 31 March 2013.

The results of the review indicated that, whilst no impairment charge was necessary in

respect of the Group’s controlled mobile businesses, impairment charges totalling

£810 million were necessary in respect of non-controlled mobile and non-mobile

businesses as detailed below.

Year ended

31 March 2003

Company £m

Japan Telecom 430

Grupo Iusacell 80

China Mobile 300

810

The charge in respect of China Mobile and £25 million of the charge for Japan

Telecom are included within exceptional non-operating items.

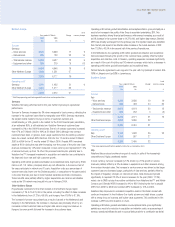

Exceptional non-operating items

Net exceptional non-operating items amounted to £5 million for the year ended

31 March 2003. Exceptional non-operating items during the 2003 financial year

principally included impairment charges of £300 million in respect of the Group’s

interest in China Mobile and £25 million in respect of certain investments held by

Japan Telecom, offset by a profit on disposal of fixed asset investments of £255

million, principally relating to the disposal of the Group’s interest in Bergemann GmbH,

through which the Group’s 8.2% stake in Ruhrgas AG was held, and £55 million

representing the Group’s share of the profit on disposal for cash of AOL Europe shares

by Cegetel.

The 2002 financial year exceptional non-operating costs of £860 million principally

comprised an impairment charge of £900 million in respect of the Group’s investment

in China Mobile, partly offset by an aggregate profit of £60 million on the disposal of

fixed assets, businesses and fixed asset investments, principally relating to the

reduction in the Group’s interest in Vodafone Greece from 55% to 51.9%, the disposal

of the Group’s interest in the Korean mobile operator, Shinsegi, offset by a net loss on

disposal of certain other operations.

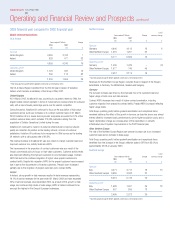

Loss on ordinary activities before interest

During the year ended 31 March 2003, the Group reported a loss on ordinary

activities before interest of £5,456 million, compared with a loss for the year ended

31 March 2002 of £12,694 million. The principal items that resulted in the decreased

loss were improved total Group operating profit, before goodwill amortisation and

exceptional items, which increased from £7,044 million for the year ended 31 March

2002 to £9,181 million for the year ended 31 March 2003 and the decrease in

exceptional operating items and exceptional non-operating items, which decreased

from £5,408 million for the year ended 31 March 2002 to £576 million for the year

ended 31 March 2003 and £860 million for the year ended 31 March 2002 to £5

million for the year ended 31 March 2003, respectively. These were partially offset by

the increased charge in respect of goodwill amortisation from £13,470 million for the

year ended 31 March 2002 to £14,056 million for the year ended 31 March 2003.

Net interest payable

Total Group net interest payable, including the Group’s share of the net interest

expense of joint ventures and associated undertakings, decreased from £845 million

for the year ended 31 March 2002 to £752 million for the year ended 31 March

2003. Net interest costs in respect of the Group’s net borrowings decreased from

£503 million for the year to 31 March 2002 to £457 million for the year ended

31 March 2003, reflecting the reduction in average net debt levels. The Group’s share

of the net interest expense of joint ventures and associated undertakings decreased

from £342 million for the year ended 31 March 2002 to £295 million for the year

ended 31 March 2003 partly as a result of the consolidation of the Group’s former

associate undertakings, Japan Telecom and Vodafone Japan, from October 2001, and

of Vizzavi from 29 August 2002, and reduced levels of indebtedness in SFR.

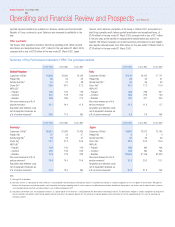

Taxation

The effective rate of taxation for the year ended 31 March 2003 was (47.6)%

compared with (15.8)% for the year ended 31 March 2002. The effective rate

includes the impact of goodwill amortisation and exceptional items, which may not be

deductible for tax purposes. Aside from the negative impact of non-tax deductible

goodwill amortisation on the effective tax rate, the Group’s tax charge for the year

ended 31 March 2003 benefited from the reorganisation of the Group’s Italian

operations and a one-off benefit in Germany arising from the reorganisation of the

German Group of companies. In the year ended 31 March 2002, the Group’s tax

charge included a one-off tax credit received in Germany arising from the distribution

of earnings and also the Visco law incentive scheme in Italy. The Visco law was

subsequently replaced by a less favourable regime.

Basic loss per share

Basic loss per share, after goodwill amortisation and exceptional items, decreased

from a loss of 23.77p for the year ended 31 March 2002 to a loss per share of

14.41p for the year ended 31 March 2003. The loss per share of 14.41p included an

increase in the charge for the amortisation of goodwill from 19.82p per share for the

year ended 31 March 2002, to a charge of 20.62p per share for the year ended

31 March 2003, offset by a decrease in the charge for exceptional items from 9.10p

per share for the year ended 31 March 2002 to 0.60p per share for the year ended

31 March 2003.