Vodafone 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

40

Operating and Financial Review and Prospects continued

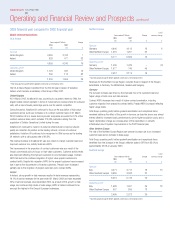

Liquidity and Capital Resources

Cash flows

The major sources of Group liquidity over the three years ended 31 March 2004 have

been cash generated from operations, borrowings through long term and short term

issuance in the capital markets, borrowings drawn from committed bank facilities,

asset disposals and, for the year ended 31 March 2002 only, the proceeds from a

share issuance. The Group does not use off-balance sheet special purpose entities as

a source of liquidity or for other financing purposes.

The Group’s key sources of liquidity for the foreseeable future are likely to be cash

generated from operations and borrowings through long term and short term

issuances in the capital markets, as well as committed bank facilities. Additionally, the

Group has a put option in relation to its interest in Verizon Wireless which, if exercised,

could provide material cash inflow. Please see “Option agreements”.

The Group’s liquidity and working capital may be affected by a material decrease in

cash flow due to factors such as increased competition, litigation, timing of tax

payments and the resolution of outstanding tax issues, regulatory rulings, delays in

development of new services and networks, inability to receive expected revenues

from the introduction of new services, reduced dividends from associates and

investments or dividend payments to minority shareholders. See “Risk Factors”, above.

The Group is also party to a number of option agreements that may result in a cash

outflow if exercised. Option agreements are discussed further in “Option agreements”

at the end of this section.

Wherever possible, surplus funds in the Group (except in Albania, Egypt and Hungary)

are transferred to the centralised treasury department through repayment of

borrowings, deposits and dividends. These are then on-lent or contributed as equity to

fund Group operations, used to retire external debt or invested externally.

Increase in cash in the year

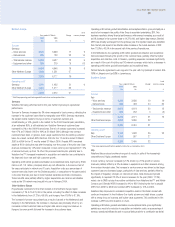

During the year ended 31 March 2004, the Group increased its net cash inflow from

operating activities by 11% to £12,317 million and generated £1,069 million of net

cash flow, as analysed in the following table.

The Group holds its cash and liquid investments in accordance with the counterparty

and settlement risk limits of the Board approved treasury policy. The main forms of

liquid investments at 31 March 2004 were collateralised deposits, money market

funds and euro commercial paper.

Year ended Year ended

31 March 31 March

2004 2003

£m £m

Net cash inflow from operating

activities (Note 28) 12,317 11,142

Purchase of intangible fixed assets (21) (99)

Purchase of tangible fixed assets (4,508) (5,289)

Disposal of tangible fixed assets 158 109

Net capital expenditure on intangible

and tangible fixed assets (4,371) (5,279)

7,946 5,863

Dividends from joint ventures

and associated undertakings 1,801 742

Taxation (1,182) (883)

Interest on group debt 31 (475)

Dividends from investments 25 15

Dividends paid to minority interests (100) (91)

Net cash outflow for returns on

investments and servicing of finance (44) (551)

Free cash flow 8,521 5,171

Other net capital expenditure and

financial investment 104 (80)

Net cash outflow from acquisitions

and disposals (1,312) (4,880)

Equity dividends paid (1,258) (1,052)

Management of liquid resources (4,286) 1,384

Net cash outflow from financing (700) (150)

Increase in cash in the year 1,069 393

Capital expenditure and financial investment

The decrease in net cash outflow for capital expenditure and financial investment from

£5,359 million for the year ended 31 March 2003 to £4,267 million for the year

ended 31 March 2004 was due primarily to the timing of cash payments for tangible

fixed assets.

During the year ended 31 March 2004, £21 million was spent on intangible assets,

principally in respect of additional GSM spectrum in Italy. The Group’s expenditure on

tangible fixed assets reduced by £781 million to £4,508 million during the 2004

financial year, including approximately £1.5 billion spent on 3G network infrastructure.

The Group expects capitalised tangible fixed asset additions to be approximately

£5 billion in the next financial year. Incremental expenditure on 3G infrastructure in the

2005 financial year is expected to represent approximately 35% of total capital

expenditure, and is expected to be financed through operating cash flows and existing

borrowing facilities.

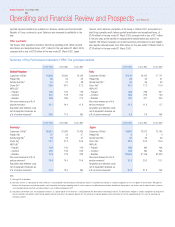

Dividends from associated undertakings and dividends to minority

shareholders

Dividends from the Group’s associated undertakings are generally paid at the

discretion of the Board of directors or shareholders of the individual operating

companies and Vodafone has no rights to receive dividends, except where specified

within certain of the companies’ shareholders’ agreements. Similarly, the Group does

not have existing obligations under shareholders’ agreements to pay dividends to

minority interest partners of Group subsidiaries, except as specified below.

Included in the dividends received from joint ventures and associated undertakings was

an amount of £671 million received from Verizon Wireless. Until April 2005, Verizon