Vodafone 2004 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

100

Notes to the Consolidated Financial Statements continued

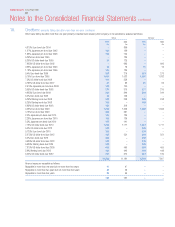

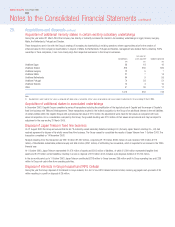

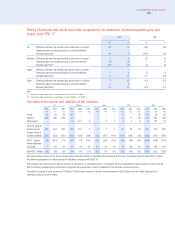

Acquisition of additional minority stakes in certain existing subsidiary undertakings

During the year ended 31 March 2004 the Company has directly or indirectly increased its interest in its subsidiary undertakings in Egypt, Greece, Hungary,

Malta, the Netherlands, Portugal and Sweden.

These transactions are in line with the Group’s strategy of increasing its shareholding in existing operations where opportunities arise for the creation of

enhanced value for the Company’s shareholders. In respect of Malta, the Netherlands, Portugal and Sweden, management also believe that by obtaining 100%

ownership in these companies, it can more closely align their respective businesses to the Group’s businesses.

Fair value net

Consideration assets acquired(1) Goodwill capitalised

£m £m £m

Vodafone Egypt 28 18 10

Vodafone Greece 815 230 585

Vodafone Hungary 1257

Vodafone Malta 21 7 14

Vodafone Netherlands 64 9 55

Vodafone Portugal 74 23 51

Vodafone Sweden 14 4 10

Other 47 36 11

1,075 332 743

Note:

(1) No adjustments were made for fair values as compared with book values at acquisition. All fair values are provisional and may be subject to adjustment in the year ending 31 March 2005.

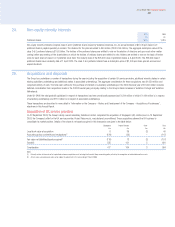

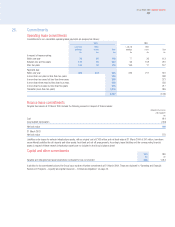

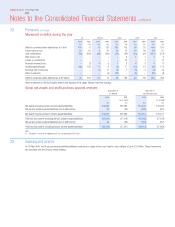

Acquisition of additional stakes in associated undertakings

In December 2003, Cegetel Groupe completed a series of transactions including the simplification of the legal structure of Cegetel and the merger of Cegetel’s

fixed line business with Télécom Développement. These transactions resulted in the indirect acquisition by the Group of an additional interest in the net liabilities

of certain entities within the Cegetel Groupe with a provisional fair value of £110 million. No adjustments were made for fair values as compared with book

values at acquisition. As no consideration was paid by the Group, the goodwill resulting was £110 million. All fair values are provisional and may be subject to

adjustment in the year ending 31 March 2005.

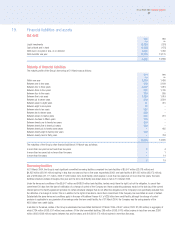

Disposal of Japan Telecom fixed line business

On 21 August 2003 the Group announced that its 66.7% indirectly owned subsidiary Vodafone Holdings K.K. (formerly Japan Telecom Holdings Co., Ltd) had

reached agreement to dispose of its wholly-owned fixed line business. The Group ceased to consolidate the results of Japan Telecom from 1 October 2003. The

transaction completed on 14 November 2003.

Receipts resulting from this transaction are ¥257.9 billion (£1,392 million), comprising ¥178.9 billion (£966 million) of cash received, ¥32.5 billion (£175

million) of transferable redeemable preferred equity and ¥46.5 billion (£251 million) of withholding tax recoverable, which is expected to be received in the 2005

financial year.

At 1 October 2003, Japan Telecom represented £1,976 million of assets and £505 million of liabilities, of which £1,309 million represented tangible fixed

assets and £478 million current liabilities, resulting in a loss on disposal of £79 million which includes a pre-disposal dividend of £1,254 million.

In the six month period up to 1 October 2003, Japan Telecom contributed £818 million to Group turnover, £66 million profit to Group operating loss and £238

million to Group net cash inflow from operating activities.

Disposal of interests in Grupo Iusacell and RPG Cellular

During the year the Group disposed of its interests in Grupo Iusacell, S.A. de C.V. and RPG Cellular Services Limited, receiving aggregate cash proceeds of £5

million resulting in a profit on disposal of £9 million.

25. Acquisitions and disposals continued