Vodafone 2004 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

130

Additional Shareholder Information continued

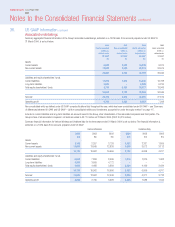

Two year data on a quarterly basis

London Stock Frankfurt Stock

Exchange Exchange NYSE

Pounds per Euros per Dollars

ordinary share ordinary share per ADS

Financial Year High Low High Low High Low

2002/2003

First Quarter 1.31 0.87 2.15 1.34 18.80 13.13

Second Quarter 1.10 0.81 1.73 1.26 16.87 12.76

Third Quarter 1.27 0.84 2.00 1.36 20.19 13.35

Fourth Quarter 1.26 1.01 1.90 1.50 20.30 16.80

2003/2004

First Quarter 1.35 1.13 1.93 1.61 22.16 18.28

Second Quarter 1.28 1.12 1.86 1.59 21.14 18.10

Third Quarter 1.40 1.20 2.03 1.70 25.15 20.26

Fourth Quarter 1.50 1.24 2.22 1.88 27.88 22.81

2004/2005

First Quarter(1) 1.42 1.29 ––25.68 23.38

Note:

(1) covering period up to 24 May 2004.

Six month data on a monthly basis

London Stock Frankfurt Stock

Exchange Exchange NYSE

Pounds per Euros per Dollars

ordinary share ordinary share per ADS

Financial Year High Low High Low High Low

November 2003 1.39 1.21 2.02 1.78 23.79 20.55

December 2003 1.40 1.32 2.03 1.84 25.15 23.41

January 2004 1.50 1.36 2.22 1.96 27.88 25.04

February 2004 1.43 1.28 2.12 1.92 27.02 24.25

March 2004(1) 1.38 1.24 2.11 1.88 25.86 22.81

April 2004 1.42 1.29 ––25.56 23.38

May 2004(2) 1.41 1.32 ––25.68 23.92

Note:

(1) High and low share prices for the Frankfurt Stock Exchange only reported to 23 March 2004, the date of

delisting from this exchange.

(2) High and low share prices for May 2004 only reported until 24 May 2004.

The current authorised share capital comprises 78,000,000,000 ordinary shares of

$0.10 each and 50,000 7% cumulative fixed rate shares of £1.00 each.

Markets

Ordinary shares of Vodafone Group Plc are traded on the London Stock Exchange and,

in the form of ADSs, on the New York Stock Exchange. In addition, the Company’s

ordinary shares were listed on the Frankfurt Stock Exchange until 23 March 2004.

ADSs, each representing ten ordinary shares, are traded on the New York Stock

Exchange under the symbol ‘VOD’. The ADSs are evidenced by ADRs issued by The

Bank of New York, as Depositary, under a Deposit Agreement, dated as of 12 October

1988, as amended and restated as of 26 December 1989, as further amended and

restated as of 16 September 1991 and as further amended and restated as of 30

June 1999, between the Company, the Depositary and the holders from time to time

of ADRs issued thereunder.

ADS holders are not members of the Company but may instruct The Bank of New York

on the exercise of voting rights relative to the number of ordinary shares represented

by their ADRs. See “Memorandum and Articles of Association and Applicable English

Law – Rights attaching to the Company’s shares – Voting rights”below.

Shareholders at 31 March 2004

Number of % of total

ordinary shares Number of issued

held accounts shares

1 – 1,000 461,540 0.21

1,001 – 5,000 117,560 0.37

5,001 – 50,000 34,072 0.67

50,001 – 100,000 1,863 0.19

100,001 – 500,000 1,746 0.58

More than 500,000 2,432 97.98

619,213 100.00

Geographical analysis of shareholders

At 31 March 2004, approximately 53.25% of the Company’s shares were held in the

UK, 28.37% in North America, 14.89% in Europe (excluding the UK) and 3.49% in the

Rest of the World.

Memorandum and Articles of Association and

Applicable English law

The following description summarises certain provisions of the Company’s

Memorandum and Articles of Association and applicable English law. This summary is

qualified in its entirety by reference to the Companies Act 1985 of Great Britain (the

“Companies Act”), as amended, and the Company’s Memorandum and Articles of

Association. Information on where shareholders can obtain copies of the

Memorandum and Articles of Association is provided under “Documents on Display”.

All of the Company’s ordinary shares are fully paid. Accordingly, no further contribution

of capital may be required by the Company from the holders of such shares.

The Company’s Objects

The Company is a public limited company under the laws of England and Wales. The

Company is registered in England & Wales under the name Vodafone Group Public

Limited Company, with the registration number 1833679. The Company’s objects are

set out in the fourth clause of its Memorandum of Association and cover a wide range

of activities, including to carry on the business of a holding company, to carry on

business as dealers in, operators, manufacturers, repairers, designers, developers,

importers and exporters of electronic, electrical, mechanical and aeronautical

equipment of all types as well as to carry on all other businesses necessary to attain

the Company’s objectives. The Memorandum of Association grants the Company a

broad range of powers to effect its objects.

Directors

The Company’s Articles of Association provide for a board of directors, consisting of

not fewer than three directors, who shall manage the business and affairs of the

Company.

Under the Company’s Articles of Association, a director cannot vote in respect of any

proposal in which the director, or any person connected with the director, has a

material interest other than by virtue of the director’s interest in the Company’s shares

or other securities. However, this restriction on voting does not apply to resolutions (a)

giving the director or a third party any guarantee, security or indemnity in respect of

obligations or liabilities incurred at the request of or for the benefit of the Company, (b)

giving any guarantee, security or indemnity to the director or a third party in respect of

obligations of the Company for which the director has assumed responsibility under an

indemnity or guarantee, (c) relating to an offer of securities of the Company in which

the director participates as a holder of shares or other securities or in the underwriting

of such shares or securities, (d) concerning any other company in which the director