Vodafone 2004 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

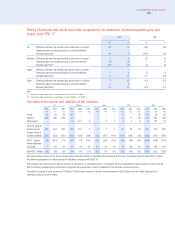

Stock based compensation – Under UK GAAP, options granted over the Company’s ordinary shares are accounted for using the intrinsic value method, with the

difference between the fair value of shares at grant date and the exercise price charged to the profit and loss over the period until the shares first vest. Grants

under the Company’s SAYE schemes are exempt from this accounting methodology.

Under US GAAP, the Group accounts for option plans in accordance with the requirements of Accounting Principles Board (“APB”) 25, “Accounting for Stock

Issued to Employees”and applies the disclosure provisions of SFAS No. 148, “Accounting for Stock-Based Compensation – Transition and Disclosure”. Under

APB 25, such plans are accounted for as variable and the cost is calculated by reference to the market price of the shares at the measurement date and

amortised over the period until the shares first vest. Where the measurement period has not yet been completed, the cost is calculated by reference to the

market price of the relevant shares at the end of each accounting period.

Derivative instruments – All the Group’s transactions in derivative financial instruments are undertaken for risk management purposes only and are used to

hedge its exposure to interest rate and foreign currency risk. In accordance with UK GAAP, to the extent that such instruments are matched against an

underlying asset or liability, they are accounted for as hedging transactions and recorded at appropriate historical amounts, with fair value information disclosed

in the notes to the consolidated financial statements. Under US GAAP, in accordance with SFAS No. 133, the Group’s derivative financial instruments, together

with any separately identified embedded derivatives, are reported as assets or liabilities on the Group’s balance sheet at fair value. In a hedge of fair values,

changes in the fair value of the derivative are recorded in earnings with a corresponding change in the fair value of the hedged item also being recorded in

earnings. For hedges of future cash flows, the changes in fair value of the derivative are recorded in other comprehensive income and reclassified to earnings

when the hedged item affects earnings. Under US GAAP, all changes in fair value of derivatives not designated in hedging relationships are accounted for in the

consolidated profit and loss account. The Group does not pursue hedge accounting treatment for:

–interest rate futures, which are typically used to switch floating interest rates to fixed interest rates; or

– derivatives entered into for funding and liquidity purposes, including forwards; or

–individual contracts where the underlying value of the transactions amounts to less than £10 million.

Upon first adopting SFAS No. 133, on 1 April 2002, a cumulative transition adjustment was made which increased US GAAP net income and other

comprehensive income by £17 million and £nil, respectively.

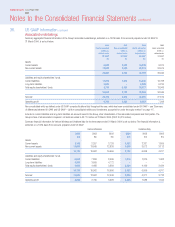

(j) Comprehensive (loss)/income

Total recognised losses under UK GAAP include net loss and currency translation adjustment. Under US GAAP, comprehensive loss/(income) is the change in

equity during a period resulting from transactions other than with shareholders. Comprehensive (loss)/income is comprised of net loss, the minimum pension

liability adjustment, changes in the fair value of available for sale securities and derivatives used in cash flow hedging relationships, and currency translation

adjustment.

(k) Loss per share

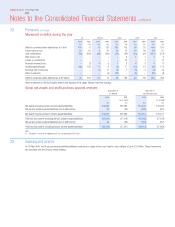

Loss per share information is calculated based on:

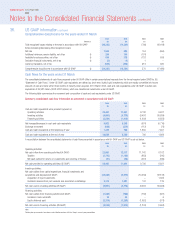

2004 2004 2003 2002

$£££

(in millions, except per share amounts)

Loss from continuing operations (14,231) (7,734) (9,135) (16,444)

(Loss)/income on operations and disposal of discontinued operations (723) (393) 80 (261)

Cumulative effect of change in accounting principle ––– 17

Net loss (14,954) (8,127) (9,055) (16,688)

Weighted average number of ordinary shares outstanding 68,096 68,096 68,155 67,961

Basic and diluted loss per share:

Loss from continuing operations (20.90)¢ (11.36)p (13.40)p (24.20)p

(Loss)/income on operations and disposal of discontinued operations (1.05)¢ (0.57)p 0.11p (0.38)p

Cumulative effect of change in accounting principle –––0.02p

Net loss (21.95)¢ (11.93)p (13.29)p (24.56)p

There were no securities with a dilutive effect for the year ended 31 March 2004. The Group has not included 382 million shares (2002: 246 million) in the

computation of diluted loss per share for the year ended 31 March 2003 as their inclusion would be antidilutive.

Annual Report 2004 Vodafone Group Plc

119