Vodafone 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Introduction

The Board has delegated to the Remuneration Committee the assessment and

recommendation of policy on remuneration for executive directors.

At the 2002 AGM, shareholders approved a new remuneration policy (“the Policy”) the

key principles of which are as follows:

•the expected value of total remuneration must be benchmarked against the

relevant market;

• a high proportion of total remuneration is to be delivered through performance-

related payments;

•performance measures must be balanced between absolute financial measures

and sector comparative measures to achieve maximum alignment between

executive and shareholder objectives;

•the majority of performance-related remuneration is to be provided in the form of

equity; and

•share ownership requirements are to be applied to executive directors.

The current Policy was produced following extensive consultation with shareholders

and institutional bodies in 2001 and 2002. In the two years since the Policy was

introduced, the Chairman and the Chairman of the Remuneration Committee have

maintained proactive annual dialogue on remuneration matters with the Company’s

major shareholders and relevant institutions. Extensive consultations with shareholders

were held again in 2003 and 2004. The objective of this dialogue is to provide

information about the Company and its views on remuneration issues and to listen to

shareholders’ opinions on any proposed adjustments to policy implementation.

The Remuneration Committee strives to ensure that the Policy provides a strong and

demonstrable link between incentives and the Company’s strategy and sets a

framework for remuneration that is consistent with the Company’s scale and scope. As

a result of this year’s review, the Remuneration Committee has concluded that the

existing policy continues to serve the Company and shareholders well and will remain

in place for the 2005 financial year. The Committee has also reviewed the

effectiveness of the current policy and is satisfied that the incentive plans have

delivered, or are forecast to deliver, rewards that are consistent with the Company’s

performance achievement.

At the 2004 AGM, shareholders will be invited to vote on the Board’s report to

shareholders on directors’ remuneration. The chart that follows shows the

performance of the Company relative to the FTSE100 index and the FTSE Global

Telecommunications index, which are the most relevant indices for the Company.

It should be noted that the performance of the Company shown by the graph is not

indicative of vesting levels under the Company’s various incentive plans.

Remuneration Committee

The Remuneration Committee consists of independent non-executive directors and the

Company Chairman. Penny Hughes (Chairman), Dr Michael Boskin, Lord MacLaurin,

and Professor Jürgen Schrempp all continue as members. Sir David Scholey stepped

down from the Committee in September 2003. He was replaced by Luc Vandevelde

who joined the Company as a non-executive director on 1 September 2003.

The Board has considered whether or not it remains appropriate for the Company

Chairman to continue to be a member of the Remuneration Committee. The

conclusion is that the Chairman provides important contributions to the work of the

Committee, for example in his contact with shareholders and management, and

therefore his membership remains appropriate.

The Chief Executive attends meetings of the Remuneration Committee, other than

when his own remuneration is being discussed. The Remuneration Committee met on

five occasions during the year.

The Remuneration Committee appointed and received advice from Towers Perrin

(market data and advice on market practice and governance) and Kepler Associates

(performance analysis and advice on performance measures and market practice) and

received advice from the Group Human Resources Director and the Group

Compensation and Benefits Director. The advisers also provided advice to the

Company on general human resource and compensation related matters.

Remuneration Policy

The Policy was approved by shareholders in July 2002. The Policy is set out below:

Vodafone Group Plc Annual Report 2004

54

Board’s Report to Shareholders on Directors’ Remuneration

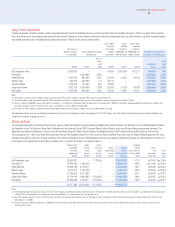

Historical Total Shareholder Return (“TSR”) Performance Growth

in the value of a hypothetical £100 holding up to March 2004

FTSE Global Telecoms and FTSE 100 Comparison Based on

30 trading day average values

£20

£40

£60

£80

£100

£120

£140

Vodafone Group Plc

FTSE 100

FTSE Global Telecoms

£160

£180

March 1999 March 2000 March 2001 March 2002 March 2003 March 2004

Value of Hypothetical £100 Holding

Graph supplied by Towers Perrin and calculated according to a methodology that is compliant with the requirements

of the regulations. Data sources: FTSE and Datastream.

The overriding objective of the Policy on incentives is to ensure that Vodafone is

able to attract, retain and motivate executives of the highest calibre essential to

the successful leadership and effective management of a global company at the

leading edge of the telecommunications industry.

To achieve this objective, Vodafone, from the context of its UK domicile, takes into

account both the UK regulatory framework, including best practice in corporate

governance, shareholder views, political opinion and the appropriate geographic

and nationality basis for determining competitive remuneration, recognising that

this may be subject to change over time as the business evolves.

The total remuneration will be benchmarked against the relevant market.

Vodafone is one of the largest companies in Europe and is a global business;

Vodafone’s policy will be to provide executive directors with remuneration

generally at levels that are competitive with the largest companies in Europe. A

high proportion of the total remuneration will be awarded through performance-

related remuneration, with phased delivery over the short, medium and long term.

For executive directors, approximately 80% of the total expected remuneration will

be performance-related. Performance measures will be balanced between

absolute financial measures and sector comparative measures to achieve

maximum alignment between executive and shareholder objectives.

All medium and long term incentives are delivered in the form of Vodafone shares

and options. Executive directors are required to comply with share ownership

guidelines.