Vodafone 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

41

Wireless’ distributions are determined by the terms of the partnership agreement

distribution policy and comprise income distributions and tax distributions. After the

current distribution policy expires, tax distributions will continue and a new distribution

policy is expected to be set by the Board of Representatives of Verizon Wireless. In

making such policy determinations, the Board shall take into account relevant facts and

circumstances including, without limitation, the financial performance and capital

requirements of Verizon Wireless. Current projections forecast that tax distributions will

not be sufficient to cover the US tax liabilities arising from the Group’s partnership

interest until 2015, and in the absence of additional distributions above the level of tax

distributions during this period, this will result in a net cash outflow for the Group.

Under the terms of the partnership agreement, the Board has no obligation to provide

for additional distributions above the level of the tax distributions.

Pursuant to changes in shareholder agreements that were effected in December

2003, from 1 January 2004 SFR commenced making scheduled quarterly dividend

payments. During the year ended 31 March 2004, cash dividends totalling

£802 million were received in respect of SFR’s earnings during the 2002 and 2003

financial years.

Verizon Communications has an indirect 23.1% shareholding in Vodafone Italy and,

under the terms of the shareholders’ agreement, can request dividends to be paid,

provided that such dividend would not impair the financial condition or prospects of

Vodafone Italy including, without limitation, credit ratings. For the year ended

31 March 2004, Verizon Communications represented that it had no intention of

requesting a dividend. Should circumstances change and dividends be paid in later

periods, this may result in material cash outflows. At 31 March 2004, Vodafone Italy

had cash on deposit with Group companies of £3,201 million.

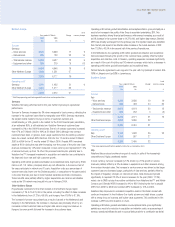

Acquisitions and disposals

Net cash outflow from acquisitions and disposals of £1,312 million in the 2004

financial year arose primarily in respect of the business acquisitions of additional

stakes in certain existing European subsidiary undertakings and the acquisition of

three UK independent service providers, partially offset by the disposal of Japan

Telecom. The acquisitions are described in more detail under “Business Overview –

History and Development of the Company” and “Business Overview – Mobile

Telecommunications” above.

An analysis of the main transactions in the year ended 31 March 2004 is shown

below.

£m

Acquisitions:

Vodafone Portugal (410)

Vodafone Netherlands (144)

Vodafone Greece (815)

Singlepoint (417)

Other acquisitions (278)

Net cash acquired with subsidiary undertakings 10

Disposals:

Japan Telecom 966

Other disposals 34

Net cash disposed of with subsidiary undertakings (258)

(1,312)

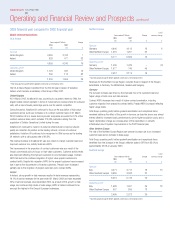

Share purchase programme

When considering how increased returns to shareholders can be provided in the form

of dividends and share purchases, the Board reviews the free cash flow, anticipated

cash requirements and gearing of the Group.

On 18 November 2003, the directors decided to introduce a share purchase

programme and allocated £2.5 billion to this programme. Shares have been

purchased on market on the London Stock Exchange in accordance with shareholder

approval obtained at the Annual General Meeting (“AGM”) in July 2003 and which

expires at the conclusion of the Company’s AGM on 27 July 2004. The maximum

share price payable for any share purchase is no greater than 105% of the average of

the middle market closing price of the Company’s share price on the London Stock

Exchange for the five business days immediately preceding the day on which any

shares were contracted to be purchased. Purchases are made only if accretive to EPS,

before goodwill amortisation and exceptional items. In accordance with the Companies

(Acquisition of Own Shares) (Treasury Shares) Regulations 2003 issued on

1 December 2003, shares purchased are held in treasury.

For the period from 1 December 2003 to 31 March 2004, 800 million shares for a

total consideration of £1.1 billion, including stamp duty and broker commissions, were

purchased. The average share price paid, excluding transaction costs, was

135.3 pence, compared with the average volume weighted price over the same period

of 137.5 pence.

The Board intends to decide the amount to allocate to the share purchase programme

on an annual basis at the end of each financial year. In addition to the £1.1 billion

already expended, £3 billion of shares are planned to be purchased during the next

year, starting in early June 2004, subject to maintenance of credit ratings,

superseding the £2.5 billion announced in November 2003. Because shareholder

approval to purchase shares expires on 27 July 2004, this amount is subject to

receiving renewed shareholder approval on 27 July 2004 at the AGM. In addition to

ordinary market purchases, the Company currently plans to purchase shares over its

close periods by selling short dated put options, subject to receiving shareholder

approval at the AGM, and by placing irrevocable purchase instructions, both prior to

the start of a close period.

Further details of shares purchased under the programme are shown in note 23.

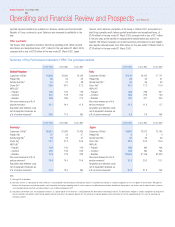

Funding

As a result of the cash flow items discussed above and £144 million of foreign

exchange movements, the Group’s consolidated net debt position at 31 March 2004

decreased to £8,488 million, from £13,839 million at 31 March 2003. This

represented approximately 10% of the Group’s market capitalisation at 31 March

2004 compared with 18% at 31 March 2003. Average net debt at month end

accounting dates over the twelve month period ended 31 March 2004 was £11,164

million, and ranged between £8,488 million and £13,839 million during the year.

A further analysis of net debt, including a full maturity analysis, can be found in notes

18 and 19 to the Consolidated Financial Statements.

The Group remains committed to maintaining a solid credit profile, as currently

demonstrated by its stable credit ratings of P-1/F1/A-1 short term and A2/A/A long

term from Moody’s, Fitch Ratings and Standard & Poor’s, respectively. Credit ratings

are not a recommendation to purchase, hold or sell securities, in as much as ratings

do not comment on market price or suitability for a particular investor, and are subject

to revision or withdrawal at any time by the assigning rating organisation. Each rating

should be evaluated independently.

The Group’s credit ratings enable it to have access to a wide range of debt finance

including commercial paper, bonds and committed bank facilities.

Commercial paper programmes

The Group currently has US and euro commercial paper programmes of $15 billion

and £5 billion, respectively, which are available to be used to meet short term liquidity

requirements and which were undrawn at 31 March 2004 and 31 March 2003. The

commercial paper facilities are supported by $10.4 billion (£5.7 billion) of committed

bank facilities, comprised of a $5.5 billion Revolving Credit Facility that matures in

June 2004, but which can be extended for one year, and a $4.9 billion Revolving

Credit Facility that matures in June 2006. As at 31 March 2004, no amounts had

been drawn under either facility.