Vodafone 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

36

Operating and Financial Review and Prospects continued

2003 financial year compared to 2002 financial year

Mobile telecommunications

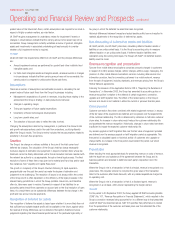

UK & Ireland

Years ended 31 March Change

2003 2002

£m £m %

Turnover

United Kingdom 4,026 3,763 7

Ireland 629 477 32

4,655 4,240 10

Operating profit*

United Kingdom 1,120 941 19

Ireland 206 113 82

1,326 1,054 26

* Total Group operating profit before goodwill amortisation and exceptional items

The UK & Ireland Region benefited from the first full year inclusion of Vodafone

Ireland, which became a subsidiary of the Group in May 2001.

United Kingdom

At 31 March 2003, Vodafone UK was, according to a quarterly review by Oftel, the

largest mobile network operator in terms of mobile service revenue share for outbound

calls, with a lead of seven percentage points over its nearest competitor.

During the period, Vodafone UK continued to focus on the acquisition of high value

customers and as such saw increases in its contract customer base. At 31 March

2003, Vodafone UK’s in-house service provider companies accounted for 57% of the

contract customer base, which includes 370,000 customers arising from the

acquisition of Cellular Operations Limited during the year.

Vodafone UK continued to invest in its network infrastructure to improve network

quality and maintain its position as the leading network, in terms of customer

satisfaction. Vodafone UK continues to be recognised in Oftel surveys as the leading

UK network, with a call success rate of 98.3%.

The revenue increase in Vodafone UK was as a result of a larger customer base and

improved customer mix, activity levels and ARPU.

The improvement in the proportion of contract customers was as a result of the

Group’s commercial policy to focus on high value customers. Customer activity levels

also improved reflecting the improved customer mix and increased usage. Contract

ARPU fell due to the continued migration of higher value prepaid customers to

contract tariffs. Despite this migration, ARPU for the prepaid customer base increased

due in part to the disconnection of inactive customers. Prepaid churn increased

partially due to the migration of prepaid customers onto contract tariffs.

Ireland

In Ireland, strong growth in data revenues resulted in data revenues representing

19.1% of service revenues for the year ended 31 March 2003 and have exceeded

20% of service revenues since December 2002. As a result of this growth in data

usage, and continued high levels of voice usage, ARPU in Ireland continued to be

amongst the highest in the Group’s European businesses.

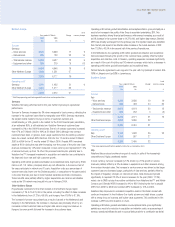

Northern Europe

Local

Years ended 31 March Change currency change

2003 2002

£m £m % %

Turnover

Germany 4,646 4,112 13 8

Other Northern Europe 1,531 1,257 22

6,177 5,369 15

Operating profit*

Germany 1,435 1,429 –(3)

Other Northern Europe 1,077 745 45

2,512 2,174 16

* Total Group operating profit before goodwill amortisation and exceptional items

Revenues for the Northern Europe Region comprise those in respect of the Group’s

subsidiaries in Germany, the Netherlands, Sweden and Hungary.

Germany

The turnover increase was driven by the improved mix in the customer base and

higher usage of both voice and data services.

Contract ARPU decreased as a result of higher contract penetration, including

customer migration from prepaid to contract tariffs. Prepaid ARPU increased reflecting

higher usage levels.

Total Group operating profit, before goodwill amortisation and exceptional items,

remained stable as the effect of the growth in turnover, as describe above, was almost

entirely offset by increased costs, predominantly due to higher acquisition costs, and a

higher depreciation charge as a consequence of the expenditure on network

infrastructure and IT system improvements in the 2002 financial year.

Other Northern Europe

The rest of the Northern Europe Region saw turnover increase due to an increased

customer base and an increase in data usage.

Total Group operating profit, before goodwill amortisation and exceptional items

benefited from the increase in the Group’s effective stake in SFR from 32.0% to

approximately 43.9% in January 2003.

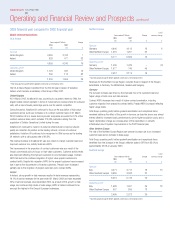

Southern Europe

Local

Years ended 31 March Change currency change

2003 2002

£m £m % %

Turnover

Italy 4,371 3,711 18 13

Other Southern Europe 3,680 3,032 21

8,051 6,743 19

Operating profit*

Italy 1,588 1,267 25 18

Other Southern Europe 907 805 13

2,495 2,072 20

* Total Group operating profit before goodwill amortisation and exceptional items