Vodafone 2004 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

115

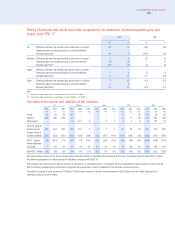

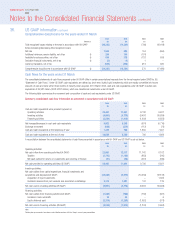

Shareholders’ equity at 31 March

2004 2004 2003

Reference $m £m £m

Equity shareholders’ funds in accordance with UK GAAP(2) 205,940 111,924 128,630

Items increasing/(decreasing) equity shareholders’ funds:

Investments accounted for under the equity method (a) 10,241 5,566 4,630

Connection revenues and costs (b) (101) (55) (84)

Goodwill and other intangible assets (c) 83,389 45,320 51,144

Licence fee amortisation (d) (201) (109) (43)

Exceptional items (e) ––270

Capitalised interest (f) 2,972 1,615 1,073

Income taxes (g) (73,736) (40,074) (45,446)

Proposed dividends (h) 1,340 728 612

Other (i) 209 114 (350)

Shareholders’ equity in accordance with US GAAP 230,053 125,029 140,436

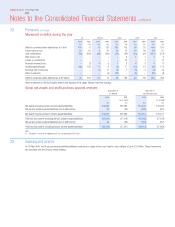

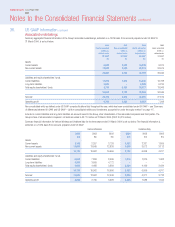

Total assets at 31 March

2004 2004 2003

Reference $m £m £m

Total assets in accordance with UK GAAP(2) 270,718 147,129 163,239

Items (decreasing)/increasing total assets:

Investments accounted for under the equity method (a) 3,733 2,029 1,849

Connection costs (b) 6,775 3,682 4,179

Goodwill and other intangible assets (c) 83,389 45,320 51,144

Licence fee amortisation (d) (201) (109) (43)

Exceptional items (e) ––270

Capitalised interest (f) 2,972 1,615 1,073

Income taxes (g) ––45

Other (i) 1,076 585 (344)

Total assets in accordance with US GAAP 368,462 200,251 221,412

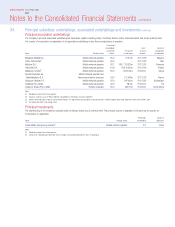

Notes:

The reconciliations of net loss for the years ended 31 March 2003 and 2002 and shareholders’ equity and total assets as at 31 March 2003 include reclassifications to provide comparability with the presentation

as at 31 March 2004 and for the year then ended. The Group now shows amounts previously reported as “other”related to licence fee amortisation as a separate line item in the reconciliation. In addition, the

Group now reflects only the Group’s interest in each adjustment. These reclassifications had no impact on the Group’s previously reported net loss or shareholders’ equity under US GAAP.

(1) The results of operations of Japan Telecom are reported as discontinued operations under US GAAP and are included in the segment “Other operations – Asia Pacific”. The pre-tax loss, including the loss on

sale, was £515 million for the year ended 31 March 2004 (2003: income of £133 million; 2002: loss of £428 million).

(2) Change in accounting principle for 2002 relates to the Group’s transitional adjustment in respect of the adoption of Statement of Financial Accounting Standards (“SFAS”) No. 133, “Accounting for Derivative

Instruments and Hedging Activities”, on 1 April 2001.

The Group’s retrospective adoption of UITF 38 “Accounting for ESOP Trusts”resulted in the UK GAAP equity shareholders’ funds and total assets for prior years being restated (see note 37). The

reconciliations of shareholders’ equity and total assets have been restated to reflect this change in UK GAAP reporting which had no effect on previously reported US GAAP net income, shareholders’ equity

or total assets.