Vodafone 2004 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

81

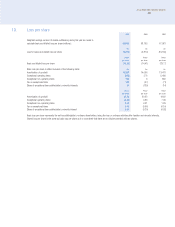

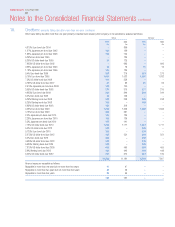

8. Tax on loss on ordinary activities

2004 2003 2002

£m £m £m

United Kingdom corporation tax charge at 30% 209 195 187

Overseas corporation tax

Current tax:

Current year 2,264 1,971 857

Prior year (159) 9 (322)

2,105 1,980 535

Total current tax 2,314 2,175 722

Deferred tax – origination of and reversal of timing differences 736 818 1,489

Tax on profit on ordinary activities, before exceptional items 3,050 2,993 2,211

Tax on exceptional items 104 (37) (71)

Total tax charge on ordinary activities 3,154 2,956 2,140

Parent and subsidiary undertakings 2,866 2,624 1,925

Share of joint ventures –17 (23)

Share of associated undertakings 288 315 238

3,154 2,956 2,140

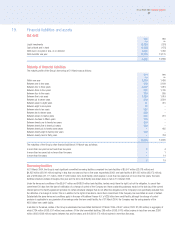

Factors affecting the tax charge for the year

The effective rate of taxation for the year ended 31 March 2004 is (62.5)% (2003: (47.6)%; 2002: (15.8%)). The effective rate includes the impact of goodwill

amortisation and exceptional items, which may not be deductible for tax purposes. Aside from the negative impact of non-tax deductible goodwill amortisation on

the effective tax rate, the Group’s tax charge has benefited further from the restructuring of Italian operations in the prior year, from restructuring of the French

operations in the current year, from a fall in the Group’s weighted average tax rate, calculated by reference to local statutory tax rates and accounting profits,

and from other tax incentives. These benefits have outweighed the absence of the one-off benefit arising from the restructuring of the German group in the

previous year.

The tax charge on exceptional items of £104 million (2003: £(37) million; 2002: £(71) million) is mainly in respect of expected recoveries and provision releases

in relation to a contribution tax levy on Vodafone Italy that is no longer expected to be payable.

Reconciliation of expected tax charge using the standard tax rate to the actual current tax charge

The differences between the Group’s expected tax charge, using the Group’s standard corporation tax rate of 36.4% in 2004 (37.0% in 2003 and 37.2% in

2002), comprising the average rates of tax payable across the Group and weighted in proportion to accounting profits, and the Group’s current tax charge for

each of those years were as follows:

2004 2003 2002

£m £m £m

Expected tax credit at standard tax rate on loss on ordinary activities (1,837) (2,295) (5,037)

Goodwill amortisation 5,535 5,196 5,011

Exceptional non-operating items 38 2 320

Exceptional operating items (83) 213 2,012

Expected tax charge at standard tax rate on profit on ordinary activities, before goodwill

amortisation and exceptional items 3,653 3,116 2,306

Permanent differences 47 140 111

Excess tax depreciation over book depreciation (509) (404) (423)

Short term timing differences (18) (64) (559)

Deferred tax on overseas earnings (418) (424) (491)

Losses carried forward utilised/current year losses for which no credit taken 26 278 415

Prior year adjustments (61) 4 (92)

Non taxable profits/non deductible losses (281) (239) (392)

International corporate tax rate differentials and other (125) (232) (153)

Actual current tax charge (excluding tax on exceptional items) 2,314 2,175 722