Vodafone 2004 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

24

Operating and Financial Review and Prospects continued

movements by restating the current period’s results as if they had been generated at

the prior period’s exchange rates. Management believes that these measures provide

useful information to assist investors in assessing the Group’s operating performance

from period to period.

Foreign Currency Translation

The Company publishes its Consolidated Financial Statements in pounds sterling.

However, many of the Company’s subsidiary and associated undertakings report their

turnover, costs, assets and liabilities in currencies other than pounds sterling and the

Company translates the turnover, costs, assets and liabilities of those subsidiary and

associated undertakings into pounds sterling when preparing its Consolidated

Financial Statements. Consequently, fluctuations in the value of pounds sterling versus

other currencies could materially affect the amount of these items in the Consolidated

Financial Statements, even if their value has not changed in their original currency.

In this Annual Report, references to “US dollars”, “$”, “cents”or “¢” are to United

States currency and references to “pounds sterling”, “£”, “pence”or “p” are to UK

currency. References to “euros”or “a”are to the currency of the EU Member States

which have adopted the euro as their currency. Prior to 1 January 2002, the euro was

used only in “paperless”transactions. Euro banknotes and coins were issued on

1 January 2002. References to “yen”or “¥” are to the currency of Japan. Merely for

convenience, this Annual Report contains translations of certain pounds sterling, euro

and yen amounts into US dollars at specified rates. These translations should not be

construed as representations that the pounds sterling, euro or yen amounts actually

represent such US dollar amounts or could be converted into US dollars at the rate

indicated or at any other rate. Unless otherwise indicated, the translations of pounds

sterling and euro amounts into US dollars have been made at $1.8400 per £1.00,

$1.2292 per a1.00 and ¥104.18 per $1.00, the Noon Buying Rate in the City of New

York for cable transfers in pounds sterling, euro and yen amounts as certified for

customs purposes by the Federal Reserve Bank of New York (the “Noon Buying Rate”)

on 31 March 2004. The Noon Buying Rates on 24 May 2004 were $1.7908 per

£1.00, $1.1978 per a1.00 and ¥112.66 per $1.00.

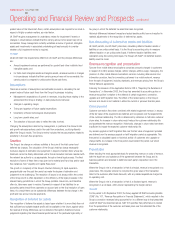

The following table sets out, for the periods and dates indicated, the period end,

average, high and low Noon Buying Rates for pounds sterling expressed in US dollars

per £1.00, to two decimal places.

Years ended 31 March Period end Average High Low

2000 1.59 1.61 1.68 1.55

2001 1.42 1.47 1.60 1.40

2002 1.42 1.43 1.48 1.37

2003 1.58 1.54 1.65 1.43

2004 1.84 1.69 1.90 1.55

Month High Low

November 2003 1.72 1.67

December 2003 1.78 1.72

January 2004 1.85 1.79

February 2004 1.90 1.82

March 2004 1.87 1.79

April 2004 1.86 1.77

May 2004(1) 1.79 1.75

Note:

(1) In respect of May 2004, for the period from 1 May to 24 May 2004, inclusive.

The following table sets out the average exchange rates compared to pounds sterling

of other principal currencies of the Group.

Years to 31 March Change

Currency 2004 2003 %

Euro 1.44 1.56 (8)

Yen 191.5 188.2 2

Inflation

Inflation has not had a significant effect on the Group’s results of operations and

financial condition during the three years ended 31 March 2004.

Critical Accounting Estimates

The Group prepares its Consolidated Financial Statements in accordance with UK

GAAP, the application of which often requires judgements to be made by management

when formulating the Group’s financial position and results. Under UK GAAP, the

directors are required to adopt those accounting policies most appropriate to the

Group’s circumstances for the purposes of giving a true and fair view and to review

them regularly. The Group also prepares a reconciliation of the Group’s revenues, net

loss, shareholders’ equity and total assets between UK GAAP and US GAAP.

In determining and applying accounting policies, judgement is often required in respect

of items where the choice of specific policy, accounting estimate or assumption to be

followed could materially affect the reported results or net asset position of the Group

should it later be determined that a different choice would be more appropriate.

Management considers the accounting estimates and assumptions discussed below to

be its critical accounting estimates and, accordingly, provides an explanation of each

below. Where it is considered that the Group’s US GAAP accounting policies differ

materially from the UK GAAP accounting policy, a separate explanation is provided.

The discussion below should also be read in conjunction with the Group’s disclosure

of material UK GAAP accounting policies, which is provided in note 2 to the

Consolidated Financial Statements, “Accounting policies”on pages 73 to 75 and with

the description of the Group’s US GAAP accounting policies and other US GAAP

related disclosures provided on pages 117 to 119.

Management has discussed its critical accounting estimates and associated

disclosures with the Company’s Audit Committee.

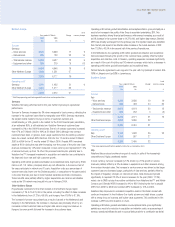

Goodwill and intangible assets

The relative size of the Group’s goodwill and other intangible assets makes a number

of judgements surrounding the determination of their carrying value, and related

amortisation, critical to the Group’s financial position and performance.

At 31 March 2004, intangible assets, including goodwill attributable to the acquisition

of interests in associated undertakings, amounted to £93,622 million (2003:

£108,085 million), and represented 70% (2003: 70%) of the Group’s total fixed

assets. In addition, a further £1,190 million of goodwill is charged against reserves

(2003: £1,190 million).

The charge for goodwill amortisation is included within operating profit as a separate

category of administrative expenses. The charge for amortisation of capitalised licence

and spectrum fees is included within cost of sales.

Goodwill, including associated charges for amortisation, affects all of the Group’s

reported segments. However, given that the majority of the current goodwill asset

arose in connection with the Mannesmann acquisition, the Group’s results for

Northern Europe and Southern Europe are most affected, individually representing

£8,147 million and £4,826 million, respectively, of the £15,207 million total charge

for goodwill amortisation.