Vodafone 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

32

Operating and Financial Review and Prospects continued

Regional review

Please refer to the summary of Key Performance Indicators on page 38 and note 3 of

the Consolidated Financial Statements.

In June 2003, the Group announced changes in the regional structure of its

operations. The former Northern Europe and Central Europe regions were combined

into a new Northern Europe region, with the exception of the United Kingdom and

Ireland which now form their own region. The following results are presented in

accordance with the new regional structure.

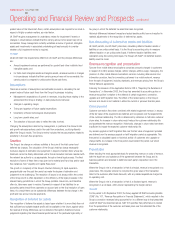

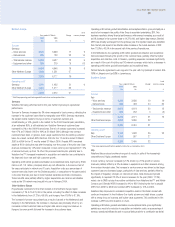

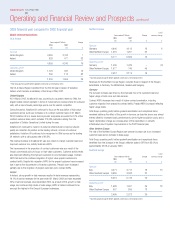

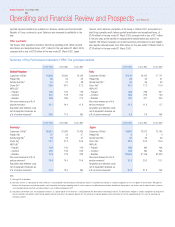

2004 financial year compared to 2003 financial year

Mobile telecommunications

UK & Ireland

Years ended 31 March Change

2004 2003

£m £m %

Turnover

United Kingdom

– Voice services 3,487 3,207 9

– Data services 671 541 24

– Total service revenue 4,158 3,748 11

– Equipment and other 586 278 111

4,744 4,026 18

Ireland 760 629 21

5,504 4,655 18

Operating profit*

United Kingdom 1,098 1,120 (2)

Ireland 262 206 27

1,360 1,326 3

* Total Group operating profit before goodwill amortisation and exceptional items

United Kingdom

Vodafone UK successfully maintained its leading market position, based on revenue

share, according to the regulator’s last published data, in line with its strategic

objectives, despite pricing pressures caused by intensifying competition and regulatory

activity.

Total UK turnover increased by 18% to £4,744 million, driven by organic growth of

12% and the acquisition of a number of service providers, including Singlepoint which

contributed growth of 6%. The organic growth resulted from the larger customer base

and increased usage of both voice and data services, partially offset by a regulatory

reduction in termination rates and the inclusion of calls to other mobile operators

within new bundled price plans. Data revenues, as a percentage of service revenues,

improved over the year to 16.1% for the year ended 31 March 2004 as usage levels

of SMS and other data offerings increased. The increased number of Vodafone live!™

customers contributed towards the improved data usage. Equipment and other

revenue increased by 111%, principally as a result of revenues from non-Vodafone

customers acquired with the service providers and increased customer acquisition and

upgrade activity.

Blended ARPU increased in the year, mainly due to growth in prepaid ARPU and the

Singlepoint acquisition. Prepaid ARPU improved to £130 for the year ended 31 March

2004 from £125 for the year ended 31 March 2003. Contract ARPU, excluding the

impact of the Singlepoint acquisition, increased by £14 to £531 for the year ended

31 March 2004.

Vodafone UK’s share of mobile service revenue in the latest quarterly review by

OFCOM, the new national UK regulator, for the quarter ended 30 September 2003,

was 31.8%, representing a lead of 6.5 percentage points over the second placed

competitor.

Registered customers increased by 6% to 14,095,000 and the proportion of contract

customers and activity levels remained stable throughout the year. The acquisition of

the service providers, including Singlepoint, during the year increased the proportion

of in-house managed contract customers from 57% to 93%, enabling closer

management of the contract customer base.

On 24 July 2003, Vodafone UK reduced its termination charges by RPI minus 15% (on

the weighted average charge for the previous year) to comply with its licence

requirements. This reduction implemented the decision of the UK Competition

Commission in January 2003. OFCOM is required to conduct a market review of call

termination under the new EC regulatory framework brought into force on 25 July

2003 and is expected to conclude its review in summer 2004. The previous regulator,

Oftel, had proposed further cuts in the current and next financial year.

UK operating profit before goodwill amortisation and exceptional items fell by

£22 million to £1,098 million. Contributing factors included: increased investment in

the acquisition and retention of the customer base; increased interconnect costs due

to changes in the call mix; lower incoming revenues due to the reduction in

termination rates; increased depreciation as a result of a general increase in capital

expenditure; and amortisation of the 3G licence, which was charged for the first time

in this year. As the Singlepoint business has a lower margin, this has diluted the

margin in the second half of the year. These factors have been partially offset by

operating efficiencies, including reductions in network operating costs as a percentage

of turnover.

Vodafone UK announced a restructuring programme in the second half of the year

which resulted in an exceptional charge of £130 million relating to staff costs,

property provisions and the write down of other assets. The objective of the

restructuring is to consolidate recent business acquisitions and to reorganise the

customer management organisation to meet the changing needs of Vodafone UK’s

customers. In addition, the business reorganised its network and technology

organisations and implemented a programme to consolidate switching centres in its

network. The benefits of this strategic initiative are expected to be realised through a

reduction in operating expenses during the coming financial years.

Ireland

Vodafone Ireland’s turnover increased by 12% when measured in local currency,

benefiting from increased voice and data usage. Blended ARPU grew from a553 to

a582, in part as a result of strong growth in data revenues, which improved to

represent 20.5% of service revenues for the year ended 31 March 2004, from 19.1%

for the prior year. Ireland continues to have the highest levels of outgoing voice usage

per customer in the Group’s controlled mobile businesses and the highest data usage

in the Group’s European mobile businesses, which combine to generate the strong

ARPU performance. Operating profit before goodwill amortisation and exceptional

items increased by 16% when measured in local currency, principally driven by the

increased turnover combined with improvements in operating efficiency.

Vodafone Ireland successfully maintained its leadership with an approximate market

share of 54% and a closing customer base of 1,864,000. Phase 1 of its 3G licence

obligation was met on 1 May 2003.