Vodafone 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

84

Notes to the Consolidated Financial Statements continued

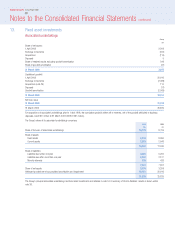

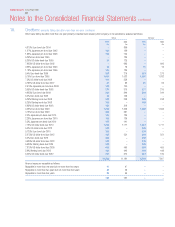

11. Intangible fixed assets

Licence and

Goodwill spectrum fees Total

£m £m £m

Cost:

1 April 2003 133,451 15,379 148,830

Exchange movements (4,101) (326) (4,427)

Acquisitions (note 25) 1,434 – 1,434

Additions – 10 10

Disposals (407) –(407)

31 March 2004 130,377 15,063 145,440

Accumulated amortisation and impairment:

1 April 2003 40,618 127 40,745

Exchange movements (1,709) (4) (1,713)

Charge for the year 13,095 98 13,193

Disposals (407) –(407)

31 March 2004 51,597 221 51,818

Net book value

31 March 2004 78,780 14,842 93,622

31 March 2003 92,833 15,252 108,085

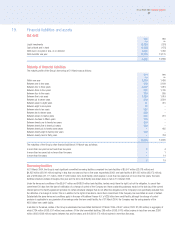

For acquisitions prior to 1 April 1998, the cumulative goodwill written off to reserves, net of the goodwill attributed to business disposals, was £723 million at

31 March 2004 (2003: £723 million).

In accordance with accounting standards the Group regularly monitors the carrying value of its fixed assets. A review was undertaken at 31 March 2004 to

assess whether the carrying value of assets was supported by the net present value of future cash flows derived from assets using cash flow projections for

each asset in respect of the period to 31 March 2014.

Cash flow projections for the mobile businesses reflect investment in network infrastructure to provide enhanced voice services and a platform for new data

products and services, enabled by GPRS and 3G technologies, which are forecast to be significant drivers of future revenue growth. Capital expenditure is

heaviest in the early years of the projections, but in most countries is expected to fall to below 10% of revenues by the year ended 31 March 2008. Revenue

growth is forecast from a combination of new customers and enhanced customer propositions. Data revenue is expected to increase significantly to 2009 but

grow at more modest rates to 2014. Voice ARPU is forecast to benefit in the longer term from new services and traffic moving from fixed networks to mobile

networks following a period of stabilisation reflecting the impact of price declines.

Accordingly, the directors believe that it is appropriate to use projections in excess of five years as growth in cash flows for the period to 31 March 2014 is

expected to exceed relevant country growth in nominal gross domestic product (“GDP”). For the years beyond 1 April 2014, forecast growth rates at nominal

GDP, using rates from independent sources, have been assumed for mobile businesses and below nominal GDP for non-mobile businesses. The discount rates

for the major markets reviewed were based on company specific pre-tax weighted average cost of capital percentages and ranged from 8.1% to 10.3%.

The results of the review undertaken at 31 March 2004 indicated that no impairment charge was necessary.