Vodafone 2004 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

89

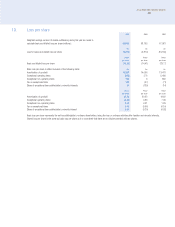

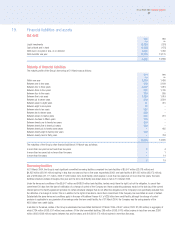

16. Investments

Group Company

2004 2003 2004 2003

£m £m £m £m

Liquid investments 4,381 291 –287

Liquid investments principally comprise collateralised deposits and investments in commercial paper.

Included within liquid investments of the Group and Company, at 31 March 2003, was a restricted deposit account of £287 million for the deferred purchase of

48,935,625 shares in Vodafone Portugal. This was released for payment on 4 April 2003.

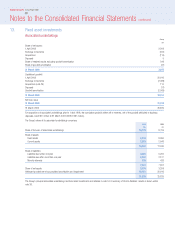

17. Creditors: amounts falling due within one year

Group Company

2004 2003 2004 2003

£m £m £m £m

Bank overdrafts 42 –––

Bank loans and other loans 2,000 1,078 956 351

Commercial paper –245 –245

Finance leases 12 107 ––

Trade creditors 2,842 2,497 ––

Amounts owed to subsidiary undertakings ––93,553 74,242

Amounts owed to associated undertakings 813 ––

Taxation 4,275 4,137 ––

Other taxes and social security costs 367 855 ––

Other creditors 741 1,342 71 460

Accruals and deferred income 4,011 3,407 371 177

Proposed dividend 728 612 728 612

15,026 14,293 95,679 76,087

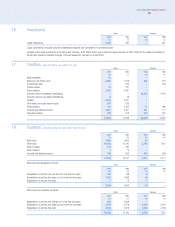

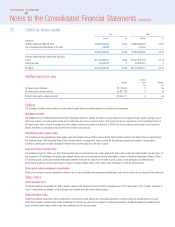

18. Creditors: amounts falling due after more than one year

Group Company

2004 2003 2004 2003

£m £m £m £m

Bank loans 1,504 1,803 23 –

Other loans 10,596 11,191 8,795 7,807

Finance leases 124 181 ––

Other creditors 719 ––

Accruals and deferred income 744 563 453 364

12,975 13,757 9,271 8,171

Bank loans are repayable as follows: Group Company

2004 2003 2004 2003

£m £m £m £m

Repayable in more than one year but not more than two years 105 128 6–

Repayable in more than two years but not more than five years 1,398 1,602 16 –

Repayable in more than five years 173 1–

1,504 1,803 23 –

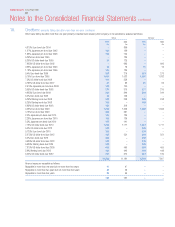

Other loans are repayable as follows: Group Company

2004 2003 2004 2003

£m £m £m £m

Repayable in more than one year but not more than two years 303 1,994 ––

Repayable in more than two years but not more than five years 3,108 2,878 2,549 3,072

Repayable in more than five years 7,185 6,319 6,246 4,735

10,596 11,191 8,795 7,807