Vodafone 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

granted FT a cash settled call option to cover certain of FT’s obligations under its

4.125% Exchange Notes due 29 November 2004, which are convertible into Vodafone

Greece shares. Exercise of this option will not change the Group’s effective interest in

Vodafone Greece. During the 2003 financial year the Group made additional market

purchases which increased the Group’s effective interest in Vodafone Greece to

64.0% at 31 March 2003.

On 1 December 2003, following the purchase of a 9.433% stake in Vodafone Greece

from Intracom S.A., the Group announced a public offer for all remaining shares not

held by the Group. As a result of the offer and subsequent market purchases, the

Group increased its effective interest in Vodafone Greece to 99.4% at 31 March 2004.

The total aggregate cash consideration paid in the 2004 financial year was £815

million.

Other subsidiaries

On 3 May 2002, the Group completed the purchase of the 4.5% minority interest in

Vodafone Australia Limited (“Vodafone Australia”), formerly Vodafone Pacific Limited,

for a cash consideration of £43 million, as a result of which Vodafone Australia

became a wholly owned subsidiary.

On 23 January 2003, the Group increased its stake in V.R.A.M. Telecommunications

Limited, now called Vodafone Hungary Mobile Telecommunications Limited (“Vodafone

Hungary”), to 83.8% by purchasing RWE Com GmbH & Co OHG’s 15.565% interest in

Vodafone Hungary for an undisclosed cash consideration. Options were granted to

Antenna Hungaria RT (“Antenna”) on 23 January 2003 over certain of the shares

acquired from RWE on this date, representing a maximum interest of 3.89%. All of

these options expired on 9 October 2003, unexercised.

On 10 June 2003, the Group increased its stake in Vodafone Hungary to 87.9% by

subscribing for Antenna’s share of an issue of ‘C’ shares. Antenna’s call options over

5,659,500, 5,072,700 and 7,845,855 Vodafone Hungary ‘C’ shares, relating to equity

injections in October 2001, April 2002 and June 2003, respectively, expired on

9 October 2003 unexercised.

On 16 May 2003, the Group increased its shareholding in Vodafone Egypt from 60.0%

to 67.0% for an undisclosed sum. In December 2003, it was announced that a

preliminary understanding had been reached with Telecom Egypt for the proposed

disposal of a 16.9% stake in Vodafone Egypt, which would reduce the Group’s

effective interest to 50.1%.

On 1 August 2003, the Group announced that it had increased its shareholding in

Vodafone Malta Limited (“Vodafone Malta”) from 80% to 100% by purchasing

Maltacom Plc’s 20% interest in Vodafone Malta for cash consideration of a30 million.

Acquisition of remaining 50% interest in Vizzavi

On 29 August 2002, the Group acquired Vivendi’s 50% stake in the Vizzavi joint

venture, which operated a mobile content business, for a cash consideration of

a143 million (£91 million). As a result of this transaction, the Group owns 100% of

Vizzavi, with the exception of Vizzavi France, which is now wholly owned by Vivendi.

Vizzavi services are now provided under the Vodafone brand.

Acquisition of service providers by Vodafone UK

On 22 September 2003, the Group acquired 100% of Singlepoint (4U) Limited

(“Singlepoint”) for consideration of £417 million. In addition, as a result of a

recommended cash offer announced on 5 August 2003, the Group acquired 98.92%

of Project Telecom plc, after the offer was declared unconditional on 19 September

2003, and subsequently acquired the remaining 1.08% in November 2003, for a total

consideration of £164 million.

Acquisition of additional interests in associated companies

During December 2002, the Group completed the purchase of an additional 3.5%

indirect equity stake in its South African associated undertaking, Vodacom Group (Pty)

Vodafone Group Plc Annual Report 2004

18

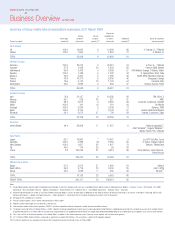

Business Overview continued

A recommended cash offer for all remaining shares in Vodafone Sweden not held by

the Group was announced on 5 February 2003. As a result of shares bought in the

offer and in the market, the Company increased its effective shareholding in Vodafone

Sweden to approximately 99.1%. The total aggregate cash consideration paid was

£391 million.

Under compulsory acquisition procedures, on 15 March 2004, Vodafone Holdings

Sweden AB obtained advanced access to an aggregate of 2,377,774 shares in

Vodafone Sweden, giving the Group ownership of and title to these shares. An arbitral

tribunal in Sweden is currently determining the purchase price for the shares and a

decision is expected in autumn 2004.

On 31 March 2004, the Group increased its effective interest in Vodafone Sweden to

100% by the purchase of 1,320,000 shares which were held in treasury by Vodafone

Sweden for a total consideration of SEK62 million (£4 million).

Vodafone Sweden’s shares have been de-listed from the O-list, Attract 40, of the

Stockholm Exchange. The last day of trading for Vodafone Sweden’s shares was

28 March 2003.

Vodafone Netherlands

On 27 November 2002, the Group purchased for cash an additional 7.6% interest in

Vodafone Netherlands, increasing the Group’s interest from 70% to 77.6%.

In January 2003, the Company entered into discussions with the board of Vodafone

Netherlands concerning a possible tender offer to acquire the remaining shares of

Vodafone Netherlands not held by the Group. A cash offer for these shares was

announced on 12 February 2003 and was declared unconditional on 28 March 2003.

Following a post-closing acceptance period, the Company, as a result of the offer and

market purchases, increased its overall effective interest in Vodafone Netherlands to

97.2% at 31 March 2003. The total aggregate cash consideration paid in the 2003

financial year was £486 million, with a further £110 million paid in April 2003. As a

result of private transactions, the Group has increased its effective interest in Vodafone

Netherlands to 99.9% at 31 March 2004. The Group has exercised its rights under

Dutch law and initiated compulsory acquisition procedures in order to acquire the

remaining shares, completion of which is expected during the first half of the 2005

financial year. Following these procedures Vodafone Netherlands will become a wholly

owned subsidiary of the Group. Vodafone Netherlands’ shares have been de-listed

from the Euronext Amsterdam Stock Exchange.

Vodafone Portugal

During September 2002, the Group increased its effective interest in its then listed

subsidiary Vodafone Portugal to 61.4% through market purchases.

In January 2003, the Company entered into discussions with the board of Vodafone

Portugal concerning a possible tender offer to acquire, for cash, all remaining shares

not held by the Group. The offer was announced on 28 February 2003. Following

completion of the offer, the Company’s effective interest in Vodafone Portugal

increased to approximately 94.4% as a result of shares purchased in the offer and in

the market. The total aggregate cash consideration paid in the 2003 financial year

was £184 million, with a further £336 million paid in April 2003. Having achieved an

effective interest of greater than 90%, the Company implemented compulsory

acquisition procedures to acquire the remaining shares, which became effective on

21 May 2003 for further consideration of £74 million, as a result of which Vodafone

Portugal became a wholly owned subsidiary of the Group. De-listing of the shares

occurred on 22 May 2003.

Vodafone Greece

On 27 November 2002, the Group announced an agreement to acquire from France

Telecom S.A. (“FT”) its 10.85% interest in Vodafone Greece for £216 million in cash.

The transaction completed on 3 December 2002 and increased the Group’s effective

shareholding in Vodafone Greece from 51.88% to 62.73%. In addition, the Company