Vodafone 2004 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

87

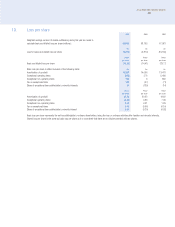

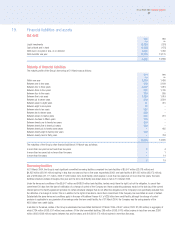

Other fixed asset investments

Group

£m

Cost:

1 April 2003 as restated 2,527

Exchange movements (295)

Additions 220

Disposals (373)

31 March 2004 2,079

£m

Amounts written off:

1 April 2003 1,363

Exchange movements (156)

Disposals (183)

Amounts written off during the year 6

31 March 2004 1,030

Net book value

31 March 2004 1,049

31 March 2003 as restated 1,164

Prior to the adoption by the Group of UITF 38, “Accounting for ESOP Trusts”, 18,950,434 shares in the Company held by the Vodafone Group Employee Trust, to

satisfy the potential award of shares under the Group’s Long Term Incentive Plan and Short Term Incentive Plan, and 7,189,316 shares in the Company, held by

the Group’s Australian and New Zealand businesses, in respect of an employee share option plan were held as fixed asset investments. In accordance with the

adoption of UITF 38, these shares have been reclassified as a deduction from shareholders’ funds. The cost to the Group of these shares was £41 million. In

addition, the 2,068,946 shares in the Company held by a Qualifying Employee Share Ownership Trust, which had £nil cost to the Group, have also been

reclassified.

Other fixed asset investments include 3.3% of China Mobile (Hong Kong) Limited of which is listed on the New York and Hong Kong Stock Exchanges. The

market value of this investment at 31 March 2004 was £1,047 million (2003: £806 million).

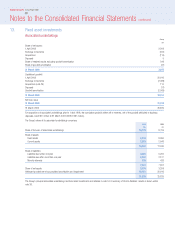

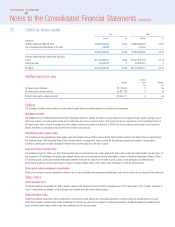

The Company’s fixed asset investments comprises investments in subsidiary undertakings as follows:

£m

Cost

1 April 2003 109,417

Additions 6,937

Disposals (5,415)

31 March 2004 110,939

£m

Amounts written off

1 April 2003 4,762

31 March 2004 4,762

Net book value

31 March 2004 106,177

31 March 2003 104,655