Vodafone 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

35

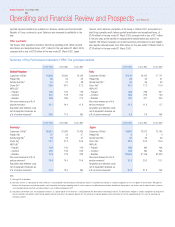

compared with the other markets in which the Group operates, increasing over the

year from 64% to 68% at 31 March 2004. 20% of Japanese mobile users were

connected to 3G network services at 31 March 2004, compared with 9% at 31 March

2003. The lack of suitable 3G handsets available for the Vodafone Global Standard

W-CDMA network, compared with the range available through other operators using

different 3G technologies amongst other factors, has limited Vodafone Japan’s ability

to compete effectively in the 3G market. Vodafone Japan held less than 1% of the

customers in the 3G market at 31 March 2004. To counteract these competitive

pressures, Vodafone Japan implemented measures in October 2003 including new

price plans, additional investment in the upgrade of existing customers and improved

loyalty schemes, and introduced a new range of 2.5G handsets.

Operating profit before goodwill amortisation and exceptional items fell as expected,

particularly in the second half of the financial year, due to higher retention costs

reflecting a high volume of upgrades, increased marketing spend, higher network

operating costs, an increase in provisions for slow moving handsets and a higher

depreciation charge due to launch of the 3G network in December 2002.

The Group is developing a full range of 3G handsets which are expected to be

available in the quarter leading up to Christmas 2004 and are expected to put

Vodafone Japan in a better competitive position. However, until these handsets are

introduced the necessary focus on retention and upgrades is expected to keep

margins depressed. A plan is in place to improve Vodafone Japan’s performance and

competitive position, focusing on cost reductions through leveraging the Group’s

global scale and scope, improving the efficiency of the distribution structure,

enhancing customer propositions, including new product offerings, and focusing on

business customers and refining the organisational structure to ensure Vodafone

Japan is more agile and commercially driven.

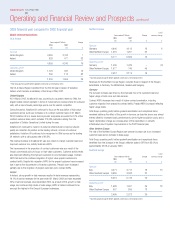

Other Asia Pacific

Proportionate customers for the Group’s other operations in the Asia Pacific region

increased by 14% during the year, including the Group’s share of China Mobile’s

customers, which is accounted for as an investment.

The increase in turnover was driven primarily by Vodafone New Zealand, resulting

from a larger customer base and higher equipment revenues. Vodafone Australia also

experienced turnover growth despite intense competitor activity. The operating profit of

both Vodafone New Zealand and Vodafone Australia improved, due largely to the cost

savings from operational efficiencies.

Vodafone Fiji increased its customer base by 25% and the operating profit improved.

China Mobile, in which the Group has a 3.27% stake, increased its customer base by

21% to 150,256,000 in the year ended 31 March 2004. ARPU continued to fall with

the increase in low usage customers. Dividends totalling £25 million were received

from China Mobile during the year.

The Group disposed of its interest in its Indian associate, RPG Cellular Services Ltd,

during the year.

In November 2003, a Partner Network Agreement was announced with M1 in

Singapore, the first Vodafone partner in this region.

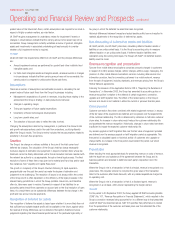

Middle East and Africa

Years ended 31 March Change

2004 2003

£m £m %

Turnover 297 290 2

Operating profit* 273 197 39

* Total Group operating profit before goodwill amortisation and exceptional items

The Group’s operations in the Middle East and Africa region comprise Vodafone Egypt

and the Group’s associated companies in South Africa (Vodacom) and Kenya

(Safaricom). In addition, the Group has two Partner Network Agreements with MTC,

covering Kuwait and Bahrain.

Vodafone Egypt experienced turnover growth of 41% when measured in local

currency, driven mainly by strong customer growth, improved contract ARPU and

increased roaming revenue. Operating profit before goodwill amortisation and

exceptional items improved, principally as a result of increased roaming and

operational efficiencies. The reported results were, however, affected by the continued

weakness of the Egyptian Pound against Sterling.

The Group has reached a preliminary understanding with Telecom Egypt for the

proposed disposal of a 16.9% stake in Vodafone Egypt, which would reduce its stake

to 50.1%. In December 2003, Vodafone Egypt was listed on the Cairo and Alexandria

Stock Exchange.

The Group’s associated undertakings in the region reported improved operating

performance in the year, primarily as a result of strong customer growth of 24% in

Vodacom and 77% in Safaricom.

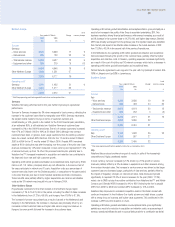

Other operations

Years ended 31 March Change

2004 2003

£m £m %

Turnover

Europe 947 854 11

Asia Pacific 897 1,979 (55)

1,844 2,833 (35)

Operating profit/(loss)*

Europe (59) (138) (57)

Asia Pacific 79 149 (47)

20 11 82

* Total Group operating profit before goodwill amortisation and exceptional items

Europe

The Group’s other operations in Europe comprise interests in fixed line

telecommunications businesses in Germany (Arcor) and France (Cegetel), and

Vodafone Information Systems, an IT and data services business based in Germany.

In local currency, Arcor’s turnover increased by 5%. Excluding the results of the

Telematik business which was disposed of in June 2002, turnover increased by 16%,

primarily due to customer and usage growth, partially offset by tariff decreases caused

by the competitive market. The fixed line market leader continues to drive this

intensive competition, although Arcor strengthened its position as the main competitor

during the year, increasing its contract voice customers by 11%. The number of

customers of Arcor’s ISDN service, Direct Access, increased by 98% to 389,000 at

31 March 2004. This revenue growth and further cost control measures resulted in a

significantly improved operating loss and positive cash flow.

Cegetel has the second largest residential customer base in France. The Group

increased its stake in Cegetel from 15% to 30% in the second half of the previous

financial year. Following the reorganisation of the Cegetel-SFR group structure in

December 2003, the Group’s effective interest in the Cegetel fixed line business,

whose business was enlarged through the merger with Télécom Développement,

became 28.5%.

Asia Pacific

The Group’s 66.7% controlled entity Vodafone Holdings K.K. (formerly Japan Telecom

Holdings Co., Ltd.) completed the disposal of its 100% interest in Japan Telecom in

November 2003. Receipts resulting from this transaction are ¥257.9 billion

(£1.4 billion), comprising ¥178.9 billion (£1.0 billion) of cash, ¥32.5 billion

(£0.2 billion) of transferable redeemable preferred equity and ¥46.5 billion

(£0.2 billion) withholding tax recoverable, which is expected to be received in the

2005 financial year. The Group ceased consolidating the results of Japan Telecom

from 1 October 2003.