Vodafone 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

27

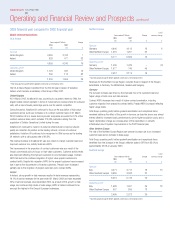

Deferring connection revenues and associated costs over the estimated life of the

customer relationship, using the methodology required under SAB 101, resulted in the

Group’s revenues for the 2003 and 2002 financial years being reduced by £1,760

million and £1,044 million, respectively. Profits are materially unaffected by this

adjustment as a broadly equal amount of costs are also deferred.

For all new contracts entered into from 1 October 2003, the Group has adopted the

requirements of Emerging Issue Task Force (“EITF”) Issue 00-21, “Accounting for

Revenue Arrangements with Multiple Deliverables”. The adoption of EITF 00-21

substantially aligns the Group’s US GAAP revenue recognition policy with UK GAAP.

As contracts entered into before 1 October 2003 are accounted for in accordance

with SAB 101, the related deferred connection revenues, and related costs, will

continue to be recognised over the remaining life of the customer relationship. For the

2004 financial year, the Group’s revenue under US GAAP increased by £188 million as

a result of following the methodology under SAB 101 for the first six months and EITF

00-21 for the remainder of the year. At 31 March 2004, deferred revenue accounted

for in accordance with SAB 101 amounted to £3,737 million.

Allowance for bad and doubtful debts

The allowance for bad and doubtful debts reflects management’s estimate of losses

arising from the failure or inability of the Group’s customers to make required

payments. The estimate is based on the ageing of customer accounts, customer credit

worthiness and the Group’s historical write-off experience.

Changes to the allowance may be required if the financial condition of the Group’s

customers was to improve or deteriorate. An improvement in financial condition may

result in lower actual write-offs.

Historically, changes to the estimate of losses have not been material to the Group’s

financial position and results.