Vodafone 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

37

Italy

Vodafone Italy’s turnover increase was driven almost entirely by a 16% growth in

service revenues (11% when measured in local currency). In addition, equipment sales

also increased 36% as the benefits from increased handset prices more than offset

the lower gross customer additions. The increase in service revenues was generated

by the continued growth in the customer base, improved customer retention and

increased ARPU, as the effect of higher usage levels more than offset the voluntary

reduction in termination rates. The increase in blended ARPU reflected growth in

contract ARPU and growth in prepaid ARPU from 1297 to 1298 for the same period.

Data revenues increased 50% largely as a result of increases in SMS messaging.

Churn decreased primarily as a result of commercial offers and incentives focused on

customer loyalty.

The improvement in total Group operating profit, before goodwill amortisation and

exceptional items, was principally driven by the growth in turnover, as described

above, and the continued focus on controlling acquisition and retention costs.

Other Southern Europe

The increase in results in the Group’s other interests was driven by growth in

Vodafone Spain and Vodafone Greece, which saw turnover increase by 21% and 35%,

respectively, (16% and 29%, respectively, when measured in local currency) as a

result of growth in the customer base, with venture customer numbers in controlled

operations increasing by 15% since 31 March 2002, and improved ARPU. The

Southern Europe Region also experienced higher roaming revenues and significant

growth in data revenues from increased SMS activity during the financial year ended

31 March 2003.

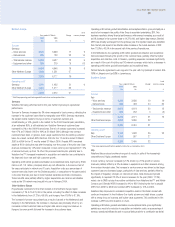

Americas

Local

Years ended 31 March Change currency change

2003 2002

£m £m % %

Turnover

Verizon Wireless ––––

Other Americas 5 12 (58)

5 12 (58)

Operating profit*

Verizon Wireless 1,270 1,332 (5) 5

Other Americas (51) (15) –

1,219 1,317 (7)

* Total Group operating profit before goodwill amortisation and exceptional items

The Americas Region predominantly comprises the Group’s interests in Verizon

Wireless and Grupo Iusacell, both of which are accounted for using equity accounting.

Accordingly, the turnover from these operations are not included in the Group’s

statutory profit and loss account.

The results of the Americas Region, which largely reflect the Group’s interest in

Verizon Wireless, were adversely affected by the relative strength of sterling against

the US dollar.

Verizon Wireless

In Verizon Wireless, total Group operating profit, before goodwill amortisation and

exceptional items, decreased as a result of foreign exchange movements. When

measured in local currency, total Group operating profit, before goodwill amortisation

and exceptional items, increased 5%, driven by customer growth and improved usage,

particularly in data revenues, which increased by 106% over the comparable period to

£136 million. ARPU increased due to a focus on selling plans with higher access price

points, also reflected in an increase in acquisition and retention costs.

Other Americas

The total Group operating loss, before goodwill amortisation and exceptional items, for

the other interests of the Group in the Americas Region, increased due to the

deterioration in the financial performance of Grupo Iusacell.

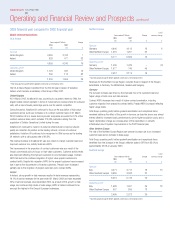

Asia Pacific

Local

Years ended 31 March Change currency change

2003 2002

£m £m % %

Turnover

Japan 7,539 3,323 127 132

Other Asia Pacific 825 749 10

8,364 4,072 105

Operating profit*

Japan 1,310 523 150 152

Other Asia Pacific 111 66 68

1,421 589 141

* Total Group operating profit before goodwill amortisation and exceptional items

The results of the Asia Pacific Region increased mainly from the full year inclusion of

Vodafone Japan, which became a subsidiary of the Group on 11 October 2001.

Japan

Vodafone Japan continued to produce the highest ARPU in the Group and, although

voice ARPU declined as expected, data and content revenues continued to improve.

This increase was largely driven by the increase in J-Sky (now rebranded Vodafone

live!™) web usage and content revenue, together with the continued success of

Vodafone Japan’s other data offerings, “Sha-mail”and “Movie Sha-mail”.

Vodafone Japan’s total Group operating profit, before goodwill amortisation and

exceptional items, increased as a result of the stake changes and the benefits of

increased turnover and corporate efficiency initiatives. Average acquisition and

retention costs reduced as a result of lower customer acquisition subsidies and more

cost efficient purchasing. However, the increase in total Group operating profit, before

goodwill amortisation and exceptional items, as a result of these measures was

partially offset by an increase in the depreciation charge as a result of the launch of

3G services.

Other Asia Pacific

The results of the Group’s other operations in the Asia Pacific Region improved

principally as a result of a focus on operational efficiencies in Vodafone Australia and

Vodafone New Zealand.

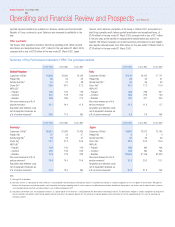

Middle East and Africa

2003 2002 Change

£m £m %

Turnover 290 306 (5)

Operating profit* 197 161 22

* Total Group operating profit before goodwill amortisation and exceptional items

In the Middle East and Africa Region, turnover, which represents the Group’s

operations in Egypt, decreased as a result of the continuing devaluation of the

Egyptian pound. When measured in local currency, turnover increased 17% for the

year ended 31 March 2003, largely attributable to growth in the customer base, which

increased over 31% to 2,263,000 at 31 March 2003.

Total Group operating profit, before goodwill amortisation and exceptional items,

increased largely as a result of the Group’s Egyptian subsidiary, which focused on cost

effectiveness to improve margins. The Group’s South African associate, Vodacom,