Vodafone 2004 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

127

Subject to the finalisation of a proposed SEC rule on first time adoption of IFRS, it is currently expected that one year of IFRS comparative information for the

year ending 31 March 2005 will be provided in the year of first adoption. Interim results for the six-month period ending 30 September 2005 will be presented

under IFRS together with restated information for the six months ending 30 September 2004.

The Group has established a project team to evaluate and monitor developments in IFRS and to manage and co-ordinate the implementation of IFRS across the Group.

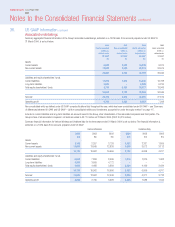

Current principal differences between IFRS and UK GAAP

On 31 March 2004, the International Accounting Standards Board (“IASB”) completed the set of standards that are mandatory for EU listed companies adopting

IFRS for the first time. Following the completion of this process, the Group has provisionally identified the major differences between IFRS and the Group’s

UK GAAP accounting policies, which are summarised below.

While the following disclosure is intended to highlight those differences expected to result in significant changes to the results and financial position reported

under UK GAAP, this summary is not intended to be a complete list of differences between the two accounting bases applicable to the Group. In addition, further

significant differences may arise from accounting standards and pronouncements that the IASB could issue in the future and which the Group may elect to early

adopt in the its first IFRS accounts. As noted below, the Group is also still considering the impact of the IASB’s recently issued standards on business

combinations, intangible assets and impairment. Finally, the Group is considering which, if any, of the optional transitional provisions within IFRS 1 “First-time

adoption of International Financial Reporting Standards” to adopt which may impact substantially the Group’s reported results.

Scope of Consolidation

Under UK GAAP, the Group currently accounts for its 76.8% interest in Vodafone Italy as a subsidiary undertaking. As a result of the significant participating

rights held by the largest minority shareholder, it is currently anticipated that the adoption of IAS 27, “Consolidated and Separate Financial Statements”, and

IAS 28, “Accounting for Investments in Associates”, will result in Vodafone Italy being accounted for as an associated undertaking.

Financial Instruments

Under UK GAAP, financial instruments are generally measured at cost with gains and losses being deferred until the underlying transaction occurs. IAS 39

“Financial Instruments: Recognition and Measurement”requires certain financial instruments to be measured at fair value and is expected to introduce certain

additional volatility into the Group’s profit and loss account.

The primary impact of the implementation of IAS 32, “Financial Instruments: Disclosure and Presentation”, is anticipated to be the reclassification of the Group’s

non-equity minority interests to liabilities. As discussed in “Quantitative and Qualitative Disclosures About Market Risk – Funding and liquidity”, the Group’s

internal debt protection ratios define net debt to include redeemable preference shares and financial guarantees.

Share based payments

UK GAAP requires that the charge for employee share schemes should be based on the intrinsic value at grant date. As a result, no expense is recognised for a

number of share based payment transactions such as the grant of share options to employees at market value. IFRS 2, “Share-based Payment”, will require the

Group to recognise an expense for certain share based transactions granted after 7 November 2002, equal to the fair value of the share or share option at the

date of the grant over the vesting period.

Pensions and other retirement benefits

For defined benefit pension schemes, the requirements of IAS 19, “Employee Benefits”, are similar to those of FRS 17 under UK GAAP, though IAS 19 permits

the deferral of actuarial gains and losses in certain circumstances which is not permitted under FRS 17. The IASB is currently considering revisions to IAS 19,

which would substantially align the accounting for defined benefit schemes to the requirements of FRS 17. The Group currently applies the provisions of

SSAP 24.

Deferred taxes

IAS 12, “Income Taxes”, requires accounting for deferred tax on temporary differences, which is wider in scope than existing UK GAAP accounting principles in

relation to deferred taxation. The Group is currently considering IAS 12 together with the tax accounting impact of a number of other recently introduced

international accounting standards.

Other matters

Business combinations and intangible assets

IFRS 3: “Business Combinations”, IAS 36: “Impairment of Assets”and IAS 38: “Intangible Assets”were issued by the IASB on 31 March 2004. These standards

are of particular significance to the Group given both the nature of its operations and the nature and scale of the intangible assets currently recognised under

UK GAAP. While the Group is currently considering the impact of these standards, the most significant impact is likely to be the requirement for goodwill not to

be amortised.

Revenue recognition

The Group does not currently anticipate any significant difference between the Group’s current UK GAAP revenue recognition policies and those required to be

adopted to comply with IAS 18: “Revenue”.