Vodafone 2004 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2004 Vodafone Group Plc

103

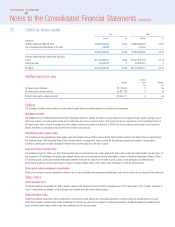

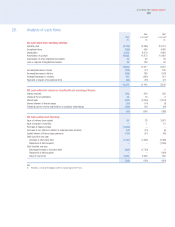

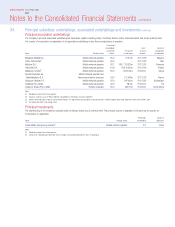

28. Analysis of cash flows

2003 2002

2004 as restated(1) as restated(1)

£m £m £m

Net cash inflow from operating activities

Operating loss (4,776) (5,295) (10,377)

Exceptional items (228) 496 4,486

Depreciation 4,362 3,979 2,880

Amortisation of goodwill 13,095 11,875 10,962

Amortisation of other intangible fixed assets 98 53 34

Loss on disposal of tangible fixed assets 89 109 46

12,640 11,217 8,031

(Increase)/decrease in stocks (102) (17) 125

(Increase)/decrease in debtors (293) 198 (242)

Increase/(decrease) in creditors 157 (233) 215

Payments in respect of exceptional items (85) (23) (27)

12,317 11,142 8,102

Net cash outflow for returns on investments and servicing of finance

Interest received 942 543 259

Dividends from investments 25 15 2

Interest paid (901) (1,004) (1,104)

Interest element of finance leases (10) (14) (9)

Dividends paid to minority shareholders in subsidiary undertakings (100) (91) (84)

(44) (551) (936)

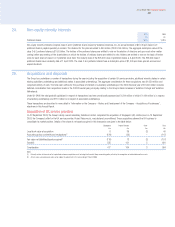

Net cash outflow from financing(1)

Issue of ordinary share capital 69 28 3,581

Issue of shares to minorities –112

Purchase of treasury shares (1,032) ––

Purchase of own shares in relation to employee share schemes (17) (14) (6)

Capital element of finance lease payments (115) (97) (46)

Debt due within one year:

Decrease in short-term debt (1,791) (1,366) (2,486)

Repayment of debt acquired –– (1,256)

Debt due after one year:

(Decrease)/increase in long-term debt (507) (1,700) 6

Repayment of debt acquired ––(991)

Issue of new bonds 2,693 2,998 505

(700) (150) (681)

Note:

(1) Restated as a result of the adoption of UITF 38 “Accounting for ESOP Trusts”.