Vodafone 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc Annual Report 2004

42

Operating and Financial Review and Prospects continued

Bonds

The Group has a 115 billion Medium Term Note programme and a $12 billion US shelf

programme, both of which are used to meet medium to long term funding

requirements. At 31 March 2004, amounts of 19.2 billion and $nil, respectively, were

in issue from these programmes.

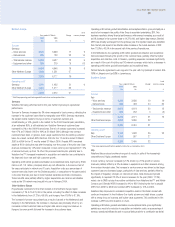

The following table provides a summary of the Group’s bond issues, each of which

have been undertaken since 1 April 2003 for general corporate purposes, including

working capital.

Bond issues during 2004 financial year

10 April 2003

$500m 5.375% bond with maturity 30 January 2015

a500m 5.125% bond with maturity 10 April 2015

a250m 4.625% bond with maturity 31 January 2008

4 June 2003

£150m 6.25% bond with maturity 10 July 2008

a750m 5.0% bond with maturity 4 June 2018

26 June 2003

$500m 4.625% bond with maturity 15 July 2018

22 September 2003

$1,000m 5.0% bond with maturity 16 December 2013

4 December 2003

£250m 5.625% bond with maturity 4 December 2025

On 22 April 2003, Vodafone Americas, Inc. cancelled the following bonds after

repurchase by tender:

Bond buy backs in the 2004 financial year

$137.8m of $200m 6.35% bond with maturity 2005

$182.3m of $400m 7.50% bond with maturity 2006

$249.8m of $500m 6.65% bond with maturity 2008

DEM 308.4m of DEM 400m bond with maturity 2008

With respect to the US dollar bonds, a total cash payment of $658 million was made

to acquire 68.9%, 45.6% and 50.0% of the 2005, 2006 and 2008 issues

respectively. The DEM bond repurchase resulted in a total cash payment of 1175

million to acquire 77.1% of the issue.

As at 31 March 2004, the Group had a total of £12,428 million of capital market debt

in issue.

Committed facilities

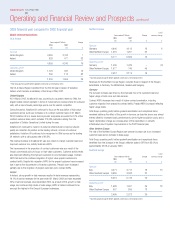

The following table summarises the committed bank facilities currently available to the

Group.

Committed Bank Facilities Amounts drawn

Under the terms and conditions of the $10.4 billion bank facilities, lenders have the

right, but not the obligation, to cancel their commitments and have outstanding

advances repaid no sooner than 30 days after notification of a change of control of

the Company. The facility agreements provide for certain structural changes that do

not affect the obligations of the Company to be specifically excluded from the

definition of a change of control. This is in addition to the rights of lenders to cancel

their commitment if the Company has committed an event of default.

Substantially the same terms and conditions apply in the case of Vodafone Finance

K.K.’s ¥225 billion term credit facility, although the change of control provision is

applicable to any guarantor of borrowings under the term credit facility. As of

31 March 2004, the Company was the sole guarantor.

In addition, Vodafone Japan has fully drawn bilateral facilities totalling ¥12.1 billion

(£63 million). These bilateral bank facilities expire at various dates up to January 2007.

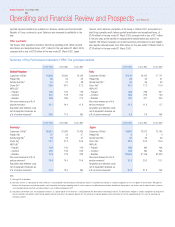

Furthermore, certain of the Group’s subsidiary undertakings are funded by external

facilities which are non-recourse to any member of the Group other than the borrower,

due to the level of country risk involved. These facilities may only be used to fund their

operations. Vodafone Egypt has a partly drawn syndicated bank facility of EGP 2.0

billion (£176 million) that fully expires in September 2007, Vodafone Hungary has a

partly drawn syndicated bank facility of a350 million (£234 million), drawn in or

swapped into Hungarian forints, that fully expires in December 2008 and Vodafone

Albania has committed facilities of 185 million (£57 million) that expire at various

dates up to and including October 2012.

In aggregate, the Group has committed facilities of approximately £7,366 million, of

which £5,793 million was undrawn at 31 March 2004.

The Group believes that it has sufficient funding for its expected working capital

requirements. Further details regarding the maturity, currency and interest rates of the

Group’s gross borrowings at 31 March 2004 are included in note 19 to the

Consolidated Financial Statements.

Financial assets and liabilities

Details of the Group’s treasury management and policies are set out below in

“Quantitative and Qualitative Disclosures About Market Risk”. Analyses of financial

assets and liabilities, including the maturity profile of debt, currency and interest rate

structure, are included in notes 18 and 19 to the Consolidated Financial Statements.

No drawings have been made against this facility.

The facility supports the Group’s commercial

paper programmes and may be used for general

corporate purposes including acquisitions.

26 June 2003

$4.9 billion Revolving Credit Facility,

maturing 26 June 2006.

No drawings have been made against this facility.

The facility supports the Group’s commercial

paper programmes and may be used to fund

working capital requirements.

26 June 2003

$5.5 billion 364-day Revolving

Credit Facility, maturing 25 June

2004 with an option to extend for

one year.

The facility was drawn down in full on 15 October

2002. The facility is available for general

corporate purposes, although amounts drawn

must be on-lent to Vodafone Group Plc.

29 November 2001

¥225 billion term credit facility,

maturing 15 January 2007, entered

into by Vodafone Finance K.K.