Vodafone 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

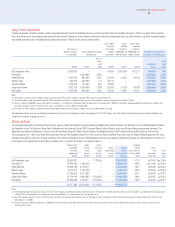

The Remuneration Committee reviews and sets the base award performance targets

on an annual basis, taking into account business strategy. The performance measures

for the 2004 financial year relate to EBITDA, free cash flow, ARPU, data as a

percentage of total service revenues, and customer satisfaction. The targets are not

disclosed, as they would give clear indication of the Company’s business targets,

which are commercially sensitive. For the 2005 financial year, the targets for data as a

percentage of service revenues and ARPU will be replaced with a total service

revenues target in order to provide clearer focus on total revenue growth.

The vesting of the enhancement award shares is dependent upon the achievement of

an EPS performance target. For the awards made in 2003, which will vest in July

2005, the performance target was that annual compound growth in EPS, before

goodwill amortisation and exceptional items, must exceed UK RPI growth by 5% per

annum over the performance period.

The STIP awards made in July 2001 vested in July 2003. Details of STIP awards are

given in the table on page 60.

The Group may, at its discretion, pay a cash sum of up to the value of the base award

in the event that an executive director declines the share award. In these

circumstances, the executive director will not be eligible to receive the enhancement

award or any cash alternative.

Long term incentives

Performance shares

Performance shares are awarded annually to executive directors. Vesting of the

performance shares depends upon the Company’s relative TSR performance. TSR

measures the change in value of a share and reinvested dividends over the period of

measurement. The Company’s TSR performance is compared to that of other

companies in the FTSE Global Telecommunications index over a three-year

performance period. The Vodafone Group Plc 1999 Long Term Stock Incentive Plan is

the vehicle for the provision of these incentive awards.

In 2003/04, the Chief Executive received an award of Performance shares with a face

value of two times base salary; the Chief Operating Officer and other executive

directors one and a half times their base salary.

Performance shares will vest only if the Company ranks in the top half of the ranking

table; maximum vesting will only occur if the Company is in the top 20%. Vesting is

also conditional on underlying improvement in the performance of the Company.

Awards will only vest to the extent that the performance condition has been satisfied

at the end of the three-year performance period. To the extent that the performance

target is not met, the awards will be forfeit. The following chart shows the basis on

which the performance shares will vest:

Performance Shares Vesting Schedule

0%

20%

40%

60%

80%

100%

0% 20% 40% 60% 80% 100%

% of Award Vesting

Relative TSR Percentile Rank

The constituents of the FTSE Global Telecommunications index as at July 2003,

(applicable to 2003 awards), excluding the Company, were:

Alltel Olivetti

AT&T Orange

AT&T Wireless Services Portugal Telecom

BCE Royal KPN

BellSouth SBC Communications

BT Group Singapore Telecommunications

China Mobile (Hong Kong) Sprint Corp-FON Group

China Unicom Swisscom

Deutsche Telekom Telecom Italia

France Telecom Telefonica

Japan Telecom Telia Sonera

KDDI Telstra Corp

Nextel Communications TIM

Nippon Telegraph & Telephone Verizon Communications

NTT DoCoMo

Previously disclosed performance share awards granted in 2000 vested in 2003.

Details are given in the table on page 61.

Share options

Share options are granted annually to executive directors.

The exercise of the options is subject to the achievement of a performance condition set

prior to grant. The Remuneration Committee determined that the most appropriate

performance measure for 2003/04 awards was real (in excess of UK RPI) growth in EPS,

before goodwill amortisation and exceptional items. One quarter of the option award will

vest for achievement of EPS growth of UK RPI + 5% p.a. rising to full vesting for

achievement of EPS growth of RPI + 15% p.a. over the performance period. In setting

this target the Remuneration Committee has taken the internal long range plan and

market expectations into account. The Committee’s advisers have confirmed that this

EPS target is amongst the most demanding of those set by large UK based companies.

The Remuneration Committee has decided that for 2004/05 grants, real EPS growth of

5-15% p.a. (over UK RPI) will be replaced with absolute EPS growth of 8-18% p.a. The

following chart illustrates the basis on which share options granted in 2003/04 will vest:

Options have a ten-year term and vesting will be after three years. For 2003 options

performance may be measured again after years four and five from a fixed base year.

The Committee, having considered this matter at length and taking into account the

evolving views of institutional investors, has decided to remove the performance

re-test at year four, but to retain the performance re-test at year five, for 2004/05

grants. The Committee believes that for this existing scheme, retaining the re-test with

a stretching performance target compounding from a fixed base year will continue to

incentivise performance over the longer term and this is in shareholders’ interests. The

re-test will be reviewed again in 2005.

Share Option Vesting Schedule

0%

20%

40%

60%

80%

100%

0% 5% 10% 15% 20%

% of Options Vesting

Annualised EPS Growth Above RPI

Vodafone Group Plc Annual Report 2004

56

Board’s Report to Shareholders on Directors’ Remuneration continued