Vodafone 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Vodafone Group Plc

Annual Report

For the year ended 31 March 2004

Table of contents

-

Page 1

Vodafone Group Plc Annual Report For the year ended 31 March 2004 -

Page 2

Vodafone Group Plc Annual Report & Accounts 2004 200 Our aim is to Delight our customers -

Page 3

... Legal Proceedings Operating and Financial Review and Prospects Non-GAAP Information The Board of Directors and the Group Executive Committee Directors' Report Corporate Governance Board's Report to Shareholders on Directors' Remuneration Employees Corporate Social Responsibility and Environmental... -

Page 4

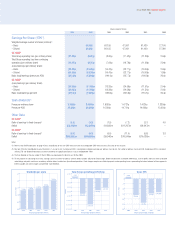

...£1, the Noon Buying Rate on 31 March 2004. At/year ended 31 March 2004 $m 2004 £m 2003 £m 2002 £m 2001 £m 2000 £m Consolidated Profit and Loss Account Data UK GAAP Group turnover Of which in respect of: continuing operations discontinued operations Total Group operating (loss)/profit Of which... -

Page 5

... the interest element of these payments, interest payable and similar charges and preferred share dividends. Dividends per share 2.5 (2,000) 0 (2,000) 1.6929p pence per share 1.5 £ millions 1.3350p 1.4020p 2.0315p 2.0 Total Group operating profit/(loss) £798 5 2.00p 0 Basic EPS (5) (£4,230... -

Page 6

... the enhancement of products and services such as Vodafone live!â„¢, the advance in technology - 3G - and the investment in assets where positive returns may be clearly identified. A progressive dividend policy and our share buy back programme are means by which value is returned to shareholders. In... -

Page 7

... can operate to global standards - that way our customers get the best from our services wherever they go. Another significant force impacting our business is competition. We face different competitors across our markets, but we have a tremendous advantage. Vodafone can draw from resources across... -

Page 8

... to drive demand and attract even higher market share in the 3G world. Another competitive advantage is our leadership position on cost and time to market. From network services to sales, and marketing to customer care and billing, we have many varied systems in use across the business. With strong... -

Page 9

... Times Stock Exchange 100 index, or FTSE 100, and the eleventh largest company in the world based on market capitalisation at that date. The Company is a public limited company incorporated in England and Wales under registered number 1833679. Its registered office is Vodafone House, The Connection... -

Page 10

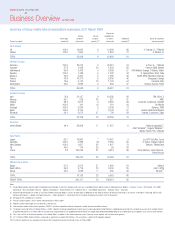

... (5) prepaid (%) Names of competitor (6) network operators Country by region (1) UK & Ireland UK Ireland TOTAL Northern Europe Germany Hungary Netherlands Sweden Belgium France Poland Switzerland TOTAL Southern Europe Italy Albania Greece Malta Portugal Spain Romania TOTAL Americas United States... -

Page 11

... related network infrastructure: Country by region Licence type Licence expiration date Network type Date of commencement of commercial service UK & Ireland UK Ireland Northern Europe Germany Hungary Netherlands Sweden Southern Europe Italy Albania Greece Malta Portugal Spain Asia Pacific Japan... -

Page 12

... a prepaid pricing scheme, a customer pays in advance, or "tops up", in order to gain access to mobile network services. The take-up of these models in the markets in which the Group operates varies significantly, from Japan and the US, where the vast majority of customers are on contract plans, to... -

Page 13

...10 controlled markets by 25 May 2004. Vodafone live!â„¢ with 3G Vodafone is the first mobile operator to bring 3G technology to both business and consumer markets across a number of European countries. Vodafone's 3G consumer service was launched in Europe on 4 May 2004 when Vodafone live!â„¢ with 3G... -

Page 14

... in Italy, Greece and the UK, has focused more on the user experience during the year, with customers invited to try out service offerings such as Vodafone live!â„¢. Local Internet sites offer products and services online and local sales forces are in place to discuss terms with business customers... -

Page 15

... technologies. The work of Group R&D is delivered through four main programmes concerned with radio, IP networks, service enablement and business support. In addition, Group R&D provides leadership for funding research into health and safety aspects of mobile telecommunications, technical support... -

Page 16

... to issue its final decisions on its market reviews during 2004. Mobile Number Portability, which allows customers to switch network provider whilst retaining their existing mobile telephone number, was implemented in July 2003. Northern Europe Germany Germany is expected to enact national law... -

Page 17

...LRIC-based average mobile termination rate are scheduled for July 2004. Southern Europe Italy Italy enacted national law implementing the new EU Framework in September 2003. The NRA has commenced its market reviews, which are expected to be completed during 2004. Americas United States The Federal... -

Page 18

...services. Cegetel is France's second largest fixed line telephony operator and offers a wide range of fixed line telephone services to residential and business customers as well as special corporate services ranging from network and customer relations management to Internet-Intranet hosting services... -

Page 19

...fixed line business was transferred to Japan Telecom Co., Ltd. All of these changes took effect from 1 August 2002. This created a telecommunications service group comprising two core businesses of mobile and fixed telecommunications, namely J-Phone Co., Ltd and Japan Telecom. The Group has sold its... -

Page 20

... Group Plc Annual Report 2004 18 Business Overview continued A recommended cash offer for all remaining shares in Vodafone Sweden not held by the Group was announced on 5 February 2003. As a result of shares bought in the offer and in the market, the Company increased its effective shareholding... -

Page 21

..., including pension and non-trading financial liabilities to be assumed on closing. On 29 September 2000, a payment of approximately a3.1 billion (£1.9 billion) plus interest was made to Mannesmann in exchange for the transfer of a 50% plus two shares stake in Atecs, which was completed on 17... -

Page 22

...cost structure and capital expenditure outlays; the ability of the Group to harmonise mobile platforms and any delays, impediments or other problems associated with the roll-out and scope of 3G technology and services and Vodafone live!â„¢ and other new or existing products, services or technologies... -

Page 23

... of demand for 3G services will justify the cost of setting up and providing 3G services. Failure or a delay in the completion of networks and the launch of new services, or increases in the associated costs, could have a material adverse effect on the Group's operations. Delays in the development... -

Page 24

... defendants and the timing of the Company's decision to write down the value of goodwill and certain impaired assets in the financial year ended 31 March 2002 violated Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder. The complaints sought, among other things... -

Page 25

... set out in the Accounting Standards Board's Statement, "Operating and Financial Review", which was issued in January 2003. The information in this regard is provided in this section or elsewhere in this Annual Report. Vodafone Group Plc is the world's leading mobile telecommunications company... -

Page 26

... Group Plc Annual Report 2004 24 Operating and Financial Review and Prospects continued movements by restating the current period's results as if they had been generated at the prior period's exchange rates. Management believes that these measures provide useful information to assist investors... -

Page 27

... services. Historically, changes in useful economic lives have not resulted in material changes to the Group's depreciation charge. Cost capitalisation Cost includes the total purchase price and labour costs associated with the Group's own employees to the extent that they are directly... -

Page 28

... in calculating the net present value of future cash flows from the Group's businesses including Management's expectations of growth in revenues, including those relating to the achievement the Group's strategy on data products and services; Changes in operating margin; Timing and quantum of... -

Page 29

... debts reflects management's estimate of losses arising from the failure or inability of the Group's customers to make required payments. The estimate is based on the ageing of customer accounts, customer credit worthiness and the Group's historical write-off experience. Changes to the allowance... -

Page 30

Vodafone Group Plc Annual Report 2004 28 Operating and Financial Review and Prospects continued Operating Results Group overview 2004 £m Years ended 31 March 2003 £m 2002 £m Turnover (1) Direct costs and operating expenses (1)(2) Depreciation and amortisation (1) Share of profit in joint ... -

Page 31

... (2003: £55 million) relating to potential interest charges arising on settlement of a number of outstanding tax issues, from £457 million for the prior year and was covered 28 times by operating cash flow plus dividends received from associated undertakings. The Group's share of the net interest... -

Page 32

...success of the Group's data product and service offerings, in particular, increased SMS usage in the Group's controlled networks. During the period, Vodafone live!â„¢ and the Mobile Connect Card were launched in most of the Group's European markets. The Group's main markets of Germany, Italy, the UK... -

Page 33

... profit of £60 million on the disposal of fixed assets, businesses and fixed asset investments, principally relating to the reduction in the Group's interest in Vodafone Greece from 55% to 51.9%, the disposal of the Group's interest in the Korean mobile operator, Shinsegi, offset by a net loss... -

Page 34

... of the United Kingdom and Ireland which now form their own region. The following results are presented in accordance with the new regional structure. Vodafone UK's share of mobile service revenue in the latest quarterly review by OFCOM, the new national UK regulator, for the quarter ended 30... -

Page 35

Annual Report 2004 Vodafone Group Plc 33 Northern Europe Years ended 31 March 2004 2003 £m £m Change % Local currency change % Turnover Germany - Voice services - Data services - Total service revenue - Equipment and other Other Northern Europe Operating profit, before goodwill amortisation ... -

Page 36

... of higher value contract customers migrating to competitors and the effect of new price plans and the increased prepaid customer base was felt. Vodafone Japan's market share, at 31 March 2004, was marginally lower, at 18.4%, than at 31 March 2003. Overall mobile penetration levels in Japan remain... -

Page 37

... Vodafone Global Standard W-CDMA network, compared with the range available through other operators using different 3G technologies amongst other factors, has limited Vodafone Japan's ability to compete effectively in the 3G market. Vodafone Japan held less than 1% of the customers in the 3G market... -

Page 38

... Region benefited from the first full year inclusion of Vodafone Ireland, which became a subsidiary of the Group in May 2001. United Kingdom At 31 March 2003, Vodafone UK was, according to a quarterly review by Oftel, the largest mobile network operator in terms of mobile service revenue share for... -

Page 39

...higher roaming revenues and significant growth in data revenues from increased SMS activity during the financial year ended 31 March 2003. Americas Years ended 31 March 2003 2002 £m £m Change % Local currency change % Operating profit* Japan Other Asia Pacific 1,310 111 1,421 152 * Total Group... -

Page 40

..., as the benefits of management's transformation plan start to be realised. The Group's European non-mobile businesses, principally Arcor and Cegetel, also reported reduced losses, from £306 million for the year ended 31 March 2002 to £138 million for the year ended 31 March 2003. Summary of Key... -

Page 41

... dividend payment to be paid directly into a bank or building society account in the United Kingdom. In accordance with the Company's Articles of Association, the sterling: euro exchange rate will be determined by the Company shortly before the payment date. The Company will pay the ADS Depositary... -

Page 42

... tax issues, regulatory rulings, delays in development of new services and networks, inability to receive expected revenues from the introduction of new services, reduced dividends from associates and investments or dividend payments to minority shareholders. See "Risk Factors", above. The Group is... -

Page 43

.... The maximum share price payable for any share purchase is no greater than 105% of the average of the middle market closing price of the Company's share price on the London Stock Exchange for the five business days immediately preceding the day on which any shares were contracted to be purchased... -

Page 44

Vodafone Group Plc Annual Report 2004 42 Operating and Financial Review and Prospects continued Bonds The Group has a 115 billion Medium Term Note programme and a $12 billion US shelf programme, both of which are used to meet medium to long term funding requirements. At 31 March 2004, amounts of ... -

Page 45

... Greece's share price was 16.00 per share and the Company is in the process of de-listing its shares, following its tender offer and market purchases resulting in an increase of the Group's consolidated shareholding to 99.4%. On 27 November 2003, Vodafone Jersey Holdings Ltd was granted a call... -

Page 46

... provides a centralised service to the Group for funding, foreign exchange, interest rate management and counterparty risk management. Treasury operations are conducted within a framework of policies and guidelines authorised and reviewed annually by the Company's Board of directors, most recently... -

Page 47

Annual Report 2004 Vodafone Group Plc 45 Outlook For the year ending 31 March 2005 In the coming year, on an organic basis, the Group anticipates high single-digit average proportionate mobile customer growth, leading to growth in Group turnover in the 2005 financial year compared to the 2004 ... -

Page 48

...including brand, product development, content management, Partner Networks and global accounts. He is also responsible for the Group's operations in the UK & Ireland. Previously, he was Chief Executive, Northern Europe, Middle East & Africa Region. He was Managing Director of Vodafone UK until April... -

Page 49

... Officer of Telkom SA Limited, South Africa. He is also a non-executive director of National Australia Bank Limited. Alan Harper, Group Strategy Director, aged 47, joined Vodafone in 1995 as Group Commercial Director and he subsequently became Managing Director of Vodafone Limited, the UK network... -

Page 50

...Results and dividends The consolidated profit and loss account is set out on page 69 of this Annual Report. The directors have proposed a final dividend for the year of 1.0780 pence per ordinary share, payable on 6 August 2004 to shareholders on the register of members at close of business on 4 June... -

Page 51

... 2004 Vodafone Group Plc 49 Directors' interests in the shares of the Company The "Board's Report to Shareholders on Directors' Remuneration" details the directors' interests in the shares of the Company. Major shareholders The Bank of New York, as custodian of the Company's American Depositary... -

Page 52

... to its associate companies (where Vodafone holds a minority stake) and to its business partners and suppliers. The Company's ordinary shares are listed in the United Kingdom on the London Stock Exchange. As such, the Company is required to make a disclosure statement concerning its application of... -

Page 53

... services, new global products and services, brand development, technology and other cost and revenue synergies within the Group's regions. The Group Policy Committee, which meets six times each year, is chaired by the Chief Executive. The Financial Director and the Group Chief Operating Officer... -

Page 54

Vodafone Group Plc Annual Report 2004 52 Corporate Governance continued associated with social, environmental and ethical impacts is also discussed under "Corporate Social Responsibility and Environmental Issues". Control structure The Board sets the policy on internal control that is implemented... -

Page 55

... of that review reported to the Board. Internal Audit The Committee engaged in discussion and review of the Group Audit department's audit plan for the year, together with its resource requirements. Private meetings were held with the Group Audit Director. Risk Management and Internal Control The... -

Page 56

... be benchmarked against the relevant market. Vodafone is one of the largest companies in Europe and is a global business; Vodafone's policy will be to provide executive directors with remuneration generally at levels that are competitive with the largest companies in Europe. A high proportion of the... -

Page 57

... Review and Prospects". Share Options Performance shares Relative Total Shareholder Return (TSR) The Policy principles are cascaded, where appropriate, to employees in all subsidiary companies. Base salaries and short-term incentives are benchmarked against relevant peer companies in each market... -

Page 58

... Group Plc Annual Report 2004 56 Board's Report to Shareholders on Directors' Remuneration continued The Remuneration Committee reviews and sets the base award performance targets on an annual basis, taking into account business strategy. The performance measures for the 2004 financial year relate... -

Page 59

... average of the market values for the immediately preceding month in respect of Vittorio Colao, who is domiciled in Italy). Therefore, scheme participants only benefit if the share price increases and vesting conditions are achieved. The Vodafone Group Plc 1999 Long Term Stock Incentive Plan is the... -

Page 60

... plans and benefits that are consistent with the terms of such plans. Details of the contract terms of the executive directors follow: Contract start date Unexpired term* Notice period Arun Sarin Peter Bamford Vittorio Colao Thomas Geitner Julian Horn-Smith Ken Hydon * until normal retirement... -

Page 61

...base share awards under the Vodafone Group Short Term Incentive Plan applicable to the year ended 31 March 2004. These awards are in relation to the performance achievements above targets in EBITDA, before exceptional items, ARPU, free cash flow, data as a percentage of service revenues and customer... -

Page 62

Vodafone Group Plc Annual Report 2004 60 Board's Report to Shareholders on Directors' Remuneration continued Pensions Pension benefits earned by the directors in the year to 31 March 2004 were: Change in transfer value over year less member contributions £'000 Change in accrued benefit in excess ... -

Page 63

... Plan and Vodafone Group Plc 1999 Long Term Stock Incentive Plan, and dividends on those shares paid under the terms of the Company's scrip dividend scheme and dividend reinvestment plan, are shown below. Long Term Incentive shares that vested and were sold or transferred during the year ended... -

Page 64

Vodafone Group Plc Annual Report 2004 62 Board's Report to Shareholders on Directors' Remuneration continued The aggregate number of options granted during the year to the Company's senior management, other than executive directors, is 11,058,407. The weighted average exercise price of the options... -

Page 65

... year end was 128.75p, its highest closing price in the year having been 149.5p and its lowest closing price having been 112.5p. Beneficial interests The directors' beneficial interests in the ordinary shares of the Company, which includes interests in the Vodafone Group Profit Sharing Scheme and... -

Page 66

Vodafone Group Plc Annual Report 2004 64 Employees Vodafone is committed to investing in world class people development to build a unified global team working efficiently across boundaries. Employee involvement The Board of director's aim is that employees understand the Company's strategy and ... -

Page 67

... completed and is reported in the CSR report. In addition to the Group report, operating companies in Italy, Greece, the Netherlands and Ireland have produced their own CSR publications tailored to specific audiences in those markets. Environmental Issues The Group continues to monitor and manage... -

Page 68

Vodafone Group Plc Annual Report 2004 66 Statement of Directors' Responsibilities United Kingdom company law requires the directors to prepare financial statements for each financial year which give a true and fair view of the state of affairs of the Company and the Group as at the end of the ... -

Page 69

... Independent Auditors' Report to the Members of the Company We have audited the consolidated financial statements of Vodafone Group Plc for the year ended 31 March 2004, which comprise the consolidated and Company balance sheets at 31 March 2004 and 2003, the consolidated profit and loss accounts... -

Page 70

Vodafone Group Plc Annual Report 2004 68 Consolidated Financial Statements Index to the Consolidated Financial Statements Consolidated Profit and Loss Accounts for the years ended 31 March Balance Sheets at 31 March Consolidated Cash Flows for the years ended 31 March Consolidated Statements of ... -

Page 71

Annual Report 2004 Vodafone Group Plc 69 Consolidated Profit and Loss Accounts For the years ended 31 March Note 2004 $m 2004 £m 2003 £m 2002 £m Total Group turnover: Group and share of joint ventures and associated undertakings - Continuing operations - Discontinued operations Less: Share of ... -

Page 72

...17 18 21 243,070 (23,874) (7,723) 211,473 Capital and reserves Called up share capital Share premium account Merger reserve Capital reserve Own shares held Other reserve Profit and loss account Total equity shareholders' funds Equity minority interests Non-equity minority interests 22 23 23 23... -

Page 73

... resources and financing Management of liquid resources Net cash outflow from financing Issue of ordinary share capital Increase/(decrease) in debt Issue of shares to minorities Purchase of treasury shares Purchase of own shares in relation to employee share schemes Increase in cash in the year... -

Page 74

... Total Equity Shareholders' Funds For the years ended 31 March 2004 $m 2004 £m 2003 as restated £m 2002 as restated £m Loss for the financial year Equity dividends Currency translation New share capital subscribed, net of issue costs Goodwill transferred to the profit and loss account in respect... -

Page 75

... billing cycle date to the end of each period accrued and unearned turnover from services provided in periods after each accounting period deferred. Revenue from the sale of prepaid credit is deferred until such time as the customer uses the airtime, or the credit expires. Other turnover from mobile... -

Page 76

... year ended 31 March 1998, goodwill is capitalised and held as a foreign currency denominated asset, where applicable. Goodwill is amortised on a straight line basis over its estimated useful economic life. For acquired network businesses, whose operations are governed by fixed term licences... -

Page 77

... in the balance sheet and the Group's share of the turnover of the joint venture is disclosed in the profit and loss account. Other investments, held as fixed assets, comprise equity shareholdings and other interests. They are stated at cost less provision for any impairment. Dividend income is... -

Page 78

...UK & Ireland £m Northern Europe £m Southern Europe £m Americas £m Asia Pacific £m Total £m Europe £m Asia Pacific £m Total Group £m Year ended 31 March 2004 Group turnover Operating profit/(loss) Share of operating profit/(loss) in associated undertakings Total Group operating loss... -

Page 79

...Vodafone Group Plc 77 Mobile telecommunications Middle East & Africa £m Other operations UK & Ireland £m Northern Europe £m Southern Europe £m Americas £m Asia Pacific £m Total £m Europe £m Asia Pacific £m Total Group £m Year ended 31 March 2003 Group turnover Operating profit... -

Page 80

... for the Group's share of exceptional items of its associated undertakings and joint ventures, which principally comprise £102 million of, principally, asset write-downs in Vodafone Japan and £115 million of reorganisation costs in Verizon Wireless and Vizzavi. 5. Operating loss 2004 Continuing... -

Page 81

... profit and loss account Capitalised or charged to share premium account 10 2 12 2004 £m 13 7 20 2003 £m UK companies Overseas companies 4 8 12 4 16 20 In addition to the above, the Group's associated companies paid fees totalling £8 million to Deloitte and Touche LLP during the year ended... -

Page 82

... cash of AOL Europe shares by Cegetel Group S.A. The profit on disposal of fixed asset investments for the year ended 31 March 2002 relates to a profit on disposal of the Group's 11.7% interest in the Korean mobile operator, Shinsegi. The profit on disposal of businesses for the year ended 31 March... -

Page 83

... differences Excess tax depreciation over book depreciation Short term timing differences Deferred tax on overseas earnings Losses carried forward utilised/current year losses for which no credit taken Prior year adjustments Non taxable profits/non deductible losses International corporate tax rate... -

Page 84

... book depreciation Short term timing differences Losses carried forward utilised/current year losses for which no credit taken Prior year adjustments Net (over)/under charge relating to international associated undertakings Non taxable profits/non deductible losses International corporate tax rate... -

Page 85

Annual Report 2004 Vodafone Group Plc 83 10. Loss per share 2004 2003 2002 Weighted average number of shares outstanding during the year and used to calculate basic and diluted loss per share (millions): 68,096 £m 68,155 £m 67,961 £m Loss for basic and diluted loss per share (9,015) ... -

Page 86

... year ended 31 March 2008. Revenue growth is forecast from a combination of new customers and enhanced customer propositions. Data revenue is expected to increase significantly to 2009 but grow at more modest rates to 2014. Voice ARPU is forecast to benefit in the longer term from new services and... -

Page 87

Annual Report 2004 Vodafone Group Plc 85 12. Tangible fixed assets Land and buildings £m Equipment, fixtures and fittings £m Network infrastructure £m Total £m Cost: 1 April 2003 Exchange movements Acquisitions Additions Disposals Japan Telecom disposal Reclassifications 31 March 2004 ... -

Page 88

Vodafone Group Plc Annual Report 2004 86 Notes to the Consolidated Financial Statements continued 13. Fixed asset investments Associated undertakings Group £m Share of net assets: 1 April 2003 Exchange movements Acquisitions Disposals Share of retained results excluding goodwill amortisation ... -

Page 89

...shares in the Company held by a Qualifying Employee Share Ownership Trust, which had £nil cost to the Group, have also been reclassified. Other fixed asset investments include 3.3% of China Mobile (Hong Kong) Limited of which is listed on the New York and Hong Kong Stock Exchanges. The market value... -

Page 90

... for resale Stocks are reported net of allowances for obsolescence, an analysis of which is as follows: 2004 £m 458 365 2002 £m 2003 £m Opening balance at 1 April Exchange adjustments Amounts charged/(credited) to the profit and loss account Acquisitions Assets written off Closing balance at... -

Page 91

... account of £287 million for the deferred purchase of 48,935,625 shares in Vodafone Portugal. This was released for payment on 4 April 2003. 17. Creditors: amounts falling due within one year Group 2004 £m 2003 £m 2004 £m Company 2003 £m Bank overdrafts Bank loans and other loans Commercial... -

Page 92

Vodafone Group Plc Annual Report 2004 90 Notes to the Consolidated Financial Statements continued 18. Creditors: amounts falling due after more than one year continued Other loans falling due after more than one year primarily comprise bond issues by the Company, or its subsidiaries, analysed as ... -

Page 93

Annual Report 2004 Vodafone Group Plc 91 19. Financial liabilities and assets Net debt 2004 £m 2003 £m Liquid investments Cash at bank and in hand Debt due in one year or less, or on demand Debt due after one year (4,381) (1,409) 2,054 12,224 8,488 (291) (475) 1,430 13,175 13,839 Maturity ... -

Page 94

Vodafone Group Plc Annual Report 2004 92 Notes to the Consolidated Financial Statements continued 19. Financial liabilities and assets continued Financial liabilities and assets The Group uses short term foreign exchange instruments for managing both liquidity and the currency mix of Group net ... -

Page 95

Annual Report 2004 Vodafone Group Plc 93 Financial assets Non-interest bearing assets Floating rate financial assets(1) £m Fixed rate financial assets £m Other non-interest bearing financial assets £m Currency Total £m Equity investments(2) £m At 31 March 2004: Sterling Euro US dollar ... -

Page 96

... foreign currency rates prevailing at the year end. Foreign exchange contracts, interest rate swaps and futures - The Group enters into foreign exchange contracts, interest rate swaps and futures in order to manage its foreign currency and interest rate exposure. The book values stated above exclude... -

Page 97

Annual Report 2004 Vodafone Group Plc 95 21. Provisions for liabilities and charges Deferred taxation £m Post employment benefits £m Other provisions £m Total £m 1 April 2003 Exchange movements Disposals Profit and loss account Utilised in the year - payments Other 31 March 2004 3,032 (157)... -

Page 98

... shares listed on the London Stock Exchange, or ADSs for US employees. Share option plans belonging to subsidiaries Share option schemes are also operated by certain of the Group's subsidiary and associated undertakings, under which options are only issued to key personnel. Share Plans Share... -

Page 99

... measured over a three year period. The awards are granted under the Vodafone Group Long Term Incentive Plan and under the Vodafone Group Plc 1999 Long Term Stock Incentive Plan referred to above. Under these plans, the maximum aggregate number of ordinary shares which may be issued in respect of... -

Page 100

... companies are in respect of an employee share option plan. Treasury shares are held in relation to the share purchase programme described in "Operating and Financial Review and Prospects - Liquidity and Capital Resources". Details of all shares purchased in the year are shown below: Average price... -

Page 101

... issued by Vodafone Americas, Inc. An annual dividend of $51.43 per class D & E preferred share is payable quarterly in arrears. The dividend for the year amounted to £50 million (2003: £55 million). The aggregate redemption value of the class D & E preferred shares is $1.65 billion. The holders... -

Page 102

..., management also believe that by obtaining 100% ownership in these companies, it can more closely align their respective businesses to the Group's businesses. Consideration £m Fair value net assets acquired(1) £m Goodwill capitalised £m Vodafone Egypt Vodafone Greece Vodafone Hungary Vodafone... -

Page 103

...of these network infrastructure assets are not included in the Group's balance sheet. Capital and other commitments 2004 £m 2003 £m Tangible and intangible fixed asset expenditure contracted for but not provided 866 1,014 In addition to the commitments above, the Group has a number of further... -

Page 104

... principally comprise commitments to support disposed entities. In addition to the amounts disclosed above, the Group has guaranteed financial indebtedness and issued performance bonds for £53 million (2003: £125 million) in respect of businesses which have been sold and for which counter... -

Page 105

... shares Purchase of own shares in relation to employee share schemes Capital element of finance lease payments Debt due within one year: Decrease in short-term debt Repayment of debt acquired Debt due after one year: (Decrease)/increase in long-term debt Repayment of debt acquired Issue of new... -

Page 106

Vodafone Group Plc Annual Report 2004 104 Notes to the Consolidated Financial Statements continued 29. Analysis of net debt 1 April 2003 £m Cash flow £m Acquisitions and disposals (excluding cash and overdrafts) £m Other non-cash changes and exchange movements £m 31 March 2004 £m Liquid ... -

Page 107

Annual Report 2004 Vodafone Group Plc 105 31. Employees An analysis of the average number of employees by category of activity is shown below. Of total average employees, 17% were based in the United Kingdom (2003: 15%, 2002: 16%). 2004 Number 2003 Number 2002 Number By activity: Operations ... -

Page 108

... Group's reported pension costs and balance sheet position are likely to change. United Kingdom The majority of the UK employees are members of the Vodafone Group Pension Scheme (the "main scheme"). This is a tax approved scheme, the assets of which are held in a separate trustee-administered fund... -

Page 109

... the year ended 31 March 2004, the total amount charged to the profit and loss account in respect of all the Group's pensions plans was £79 million (2003: £95 million, 2002: £64 million), as analysed below: 2004 £m 2003 £m 2002 £m Defined benefit schemes: United Kingdom Germany Japan Other... -

Page 110

... gains and losses: Actual return less expected return on pension scheme assets Experience (gains) and losses arising on the scheme liabilities Changes in assumptions underlying the present value of the plan liabilities Actuarial (gains)/losses on assets and liabilities Exchange rate movements Total... -

Page 111

... the above principal defined benefit schemes is reported at the beginning of this note. The deficits reported under FRS 17 reflect the different assumptions for valuing assets and liabilities compared with SSAP 24. The funding policy for the German and UK schemes is reviewed on a systematic basis in... -

Page 112

... relate to the disposal of the Japan Telecom fixed line business. Group net assets and profit and loss account reserves Under SSAP 24 (as adopted) 2004 £m 2003 (as restated)(1) £m Under FRS 17 (for information only) 2004 £m 2003 (as restated)(1) £m Net assets excluding pension scheme assets... -

Page 113

... Mobile network operator Mobile network operator Mobile network operator Mobile network operator Global products and services provider Germany Sweden Albania USA Germany Egypt Spain Netherlands Germany Spain Japan Hungary Netherlands Luxembourg Ireland Japan Netherlands England Malta Australia New... -

Page 114

... Principal activity Percentage shareholding(1) Country of registration China Mobile (Hong Kong) Limited(2) Notes: (1) Rounded to nearest tenth of one percent. (2) Listed on the Hong Kong and New York stock exchanges and incorporated under the laws of Hong Kong. Mobile network operator 3.3 China -

Page 115

... officer, nor any associate of any director or any other executive officer, was indebted to the Company. On 3 February 2004, as part of the public offer described in "Business Overview - History and Development of the Company", the Group purchased Julian Horn-Smith's 18,000 shares in Vodafone Greece... -

Page 116

Vodafone Group Plc Annual Report 2004 114 Notes to the Consolidated Financial Statements continued 36. US GAAP information Index Page Reconciliations to US GAAP Net loss for the years ended 31 March Shareholders' equity at 31 March Total assets at 31 March Comprehensive (loss)/income for the years... -

Page 117

... in the segment "Other operations - Asia Pacific". The pre-tax loss, including the loss on sale, was £515 million for the year ended 31 March 2004 (2003: income of £133 million; 2002: loss of £428 million). Change in accounting principle for 2002 relates to the Group's transitional adjustment in... -

Page 118

Vodafone Group Plc Annual Report 2004 116 Notes to the Consolidated Financial Statements continued 36. US GAAP information continued Comprehensive (loss)/income for the years ended 31 March Reference 2004 $m 2004 £m 2003 £m 2002 £m Total recognised losses relating to the year in accordance ... -

Page 119

... permit the Group's share of turnover of associated undertakings to be disclosed on the face of the consolidated income statement. Equity accounting for Vodafone Italy and Vodafone Spain under US GAAP results in the Group operating loss, Group net interest payable, Group taxation payable and equity... -

Page 120

...that the related network service is launched. Capitalised interest costs are amortised over the estimated useful lives of the related assets. (g) Income taxes Under UK GAAP, deferred tax is provided in full on timing differences that result in an obligation at the balance sheet date to pay more tax... -

Page 121

...2004 Vodafone Group Plc 119 Stock based compensation - Under UK GAAP, options granted over the Company's ordinary shares are accounted for using the intrinsic value method, with the difference between the fair value of shares at grant date and the exercise price charged to the profit and loss over... -

Page 122

...in anticipation of sterling denominated shareholder returns via share purchases and dividends. This allows debt to be serviced in proportion to anticipated cash flows and therefore provides a partial hedge against profit and loss account translation exposure, as interest costs will be denominated in... -

Page 123

... fluctuations in foreign exchange rates. Year ending 31 March £m 2005 2006 2007 2008 2009 16,054 15,194 14,918 14,794 14,708 The following pro forma information presents the impact of results under US GAAP, had the Group accounted for its goodwill and identifiable intangible assets under SFAS No... -

Page 124

... and Vodafone Italy for the three years ended 31 March 2004 is set out below. The financial information is extracted on a 100% basis from accounts prepared under UK GAAP. Verizon Wireless 2004 £m Assets Current assets Non-current assets 2,142 13,033 15,175 Liabilities and equity shareholders' funds... -

Page 125

...of US GAAP reporting, the Group accounts for stock based compensation in accordance with APB 25. The Group also adopts the disclosure only provisions of SFAS No. 148. The Company currently uses a number of share plans to grant options and share awards to its directors and employees described in Note... -

Page 126

... note 32. Analyses of the net pension cost, plan assets, obligations and funded status for the major defined benefit plans in the UK, Germany and Japan, prepared under US GAAP, are provided below. The investment policy and strategy of the main scheme in the UK is set by the Trustees and reflects the... -

Page 127

... Group Plc 125 UK 2004 £m 2003 £m 2002 £m 2004 £m Germany 2003 £m 2002 £m 2004 £m Japan 2003 £m 2002 £m Change in plans' assets Fair value of assets at 1 April Actual return/(loss) on plans' assets Employer's contributions Members' contributions Benefits paid (estimated) Exchange... -

Page 128

... the Group's net assets and equity shareholders' funds under UK GAAP at 31 March 2004 by £728 million (2003: £612 million). US Standards SFAS No. 143, "Accounting for Asset Retirement Obligations" In June 2001, the FASB issued SFAS No. 143. SFAS No. 143 is effective for financial years beginning... -

Page 129

... Market Risk - Funding and liquidity", the Group's internal debt protection ratios define net debt to include redeemable preference shares and financial guarantees. Share based payments UK GAAP requires that the charge for employee share schemes should be based on the intrinsic value at grant date... -

Page 130

... write to: The Bank of New York Shareholder Relations Department Global BuyDIRECT P.O. Box 1958 Newark New Jersey 07101-1958 USA For calls from outside the US, call +1 (610) 312 5315. Please note that this number is not toll-free. Online Shareholder Services www.vodafone.com/investor/ • Register... -

Page 131

... date. Calculate dividend payments. Use interactive tools to value your holding and chart Vodafone ordinary share price changes against indices. Mackintosh Foundation, 46 Grosvenor Street, London W1K 3HN (telephone: +44 (0) 20 7337 0501). The Unclaimed Assets Register The Company participates... -

Page 132

...,000 7% cumulative fixed rate shares of £1.00 each. Markets Ordinary shares of Vodafone Group Plc are traded on the London Stock Exchange and, in the form of ADSs, on the New York Stock Exchange. In addition, the Company's ordinary shares were listed on the Frankfurt Stock Exchange until 23 March... -

Page 133

... or an officer or is otherwise interested, provided that the director (together with any connected person) is not interested in 1% or more of any class of the company's equity share capital or the voting rights available to its shareholders, (e) relating to the arrangement of any employee benefit in... -

Page 134

... the creation or issue of new shares ranking equally with or subsequent to that class of shares in sharing in profits or assets of the Company or by a redemption or repurchase of the shares by the Company. Limitations on voting and shareholding There are no limitations imposed by English law or the... -

Page 135

...shares or ADSs in the Company as capital assets (for US and UK tax purposes). This section does not, however, cover the tax consequences for members of certain classes of holders subject to special rules and holders that, directly or indirectly, hold 10 per cent or more of the Company's voting stock... -

Page 136

... SDRT is generally payable on an unconditional agreement to transfer shares in the Company in registered form at 0.5% of the amount or value of the consideration for the transfer, but is repayable if, within six years of the date of the agreement, an instrument transferring the shares is executed or... -

Page 137

... Contact Details Registered Office Vodafone House The Connection Newbury Berkshire RG14 2FN England Telephone: +44 (0) 1635 33251 Fax: +44 (0) 1635 45713 Group Corporate Affairs Tim Brown Telephone: Fax: Group Corporate Affairs Director +44 (0) 1635 673310 +44 (0) 1635 682890 Investor Relations... -

Page 138

...Balance sheet Corporate Social Responsibility and Environmental Issues - Environmental Issues Operating and Financial Review and Prospects - Operating Results Operating and Financial Review and Prospects - Liquidity and Capital Resources Business Overview - Global Services - Research and Development... -

Page 139

Annual Report 2004 Vodafone Group Plc 137 Item 10 Form 20-F caption Additional Information 10A Share capital 10B Memorandum and articles of association 10C Material contracts 10D Exchange controls 10E Taxation 10F Dividends and paying agents 10G Statement by experts 10H Documents on Display 10I ... -

Page 140

Vodafone Group Plc Annual Report 2004 138 Notes -

Page 141

...Report package to a minimum. We have therefore given careful consideration to the production process. The paper used was manufactured in the UK at mills with ISO4001 accreditation. It is 75% recycled from de-inked post consumer waste. This document was printed by Butler and Tanner, a company...Howe Plc -

Page 142

Vodafone Group Plc Vodafone House The Connection Newbury Berkshire RG14 2FN England Registered in England No. 1833679 Tel: +44 (0) 1635 33251 Fax: +44 (0) 1635 45713 www.vodafone.com Printed in the United Kingdom